Mastering the Art of Booking in Real Estate

Booking in real estate refers to the process of reserving or expressing interest in a property before its official launch. During booking, buyers typically deposit a certain amount (known as the booking fee), as required by the developer, to secure priority in selecting prime locations or desired units.

Recently, the launch of a real estate project in Thu Duc (formerly part of Ho Chi Minh City) has stirred up the brokerage community. The project, featuring two 36-story blocks with a total of 845 units, is currently undergoing pile testing, with the foundation yet to be constructed. Surprisingly, it has already garnered nearly 1,500 bookings. However, on the launch day, brokers were left perplexed as they couldn’t secure units for their clients. The reason? The developer was hoarding inventory.

Developers have altered the rules, inadvertently skewing the market in their favor, creating a supply-demand gap, and artificially inflating demand (Illustrative image).

Similarly, a villa and townhouse project in District 9 (formerly part of Ho Chi Minh City) left brokers frustrated. After investing in advertising and finding buyers, they faced delays as the developer released units in small batches. Brokers were left scrambling, frantically calling each other to share available units.

Adding to the complexity, developers and brokers often employ tactics during sales events to attract buyers. A common strategy is hiring actors to pose as buyers. These actors arrive with cash, create a sense of urgency, and compete for units, fostering a frenzied atmosphere. Genuine buyers, fearing they’ll miss out, rush to place deposits.

Another tactic involves electronic booking boards at sales events perpetually showing “overloaded” status. Units often have multiple bookings, and vacancies are swiftly filled, further intensifying the perceived demand.

Recently, the practice of marking units as “sold out” during property launches has become rampant. While sales events often report 90-99% sell-out rates, investigations by Tien Phong’s reporters reveal a different story. Many units, previously declared “sold out,” are still being marketed by brokers, accompanied by attractive discounts and high commissions for distributors.

“If this model isn’t regulated, genuine homebuyers will never secure properties at their desired prices. They’ll always be latecomers, forced to pay premiums for units they should have accessed fairly. It’s time for the market to embrace transparency, fairness, and integrity,” said Mr. Phan Dinh Phuc, CEO of Seenee.

At a large-scale project in District 9 with tens of thousands of units delivered years ago, a recent influx of Northern real estate investors has led to long queues for ownership transfer procedures. Brokers and buyers alike are exasperated, as developers process only 5-7 applications per session, causing significant delays.

Distorting the Market

In a conversation with Tien Phong, Mr. Phan Dinh Phuc, CEO of Seenee—a firm specializing in real estate project evaluations—highlighted that developers, in their pursuit of financial optimization and revenue maximization, have shifted focus from collaborative partnerships with brokers and buyers to self-serving strategies.

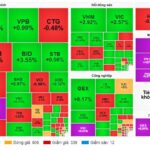

Many bookings are not from genuine buyers but are artificially created (Illustrative image).

For instance, recent sales events have been deliberately structured as overnight marathons, with exclusive pricing during these periods. This creates a scarcity mindset, pressuring buyers into hasty decisions.

“Recent events demonstrate that brokers and buyers are mere tools for developers to maximize profits and ensure their security,” Phuc noted.

Historically, bookings were transparent. Brokers would secure bookings, submit buyer details and payments to developers for confirmation, reflecting genuine market interest. However, this process has evolved.

Phuc explained that developers now allocate inventory based on booking numbers, not genuine buyer interest. This shift has created a supply-demand imbalance, artificially inflating demand and distorting market prices.

He detailed how developers no longer require buyer details with bookings, accepting only payments or allowing single individuals to hold multiple bookings. This system enables artificial demand creation within projects.

“The current booking model distorts the real estate market, creating artificial scarcity and driving prices upward. With 500 units and 5,500 bookings, developers face no sales pressure, exploiting this for profit,” Phuc stated.

This model also serves as a short-term, interest-free capital source for developers, who may hold buyer funds for 3-6 months, even in foreign-invested projects.

Over the past year, developers have leveraged this system to elevate property prices. Initial teaser rates are significantly lower than final selling prices—e.g., 49 million VND/m² teased, sold at 69 million VND/m²; 100 million VND/m² teased, sold at 160 million VND/m².

The current booking model distorts the real estate market, creating artificial scarcity and driving prices upward (Illustrative image).

“Today’s brokers need not only skills but also capital. Securing inventory requires billions in booking fees,” Phuc remarked.

Developers further exploit this model in subsequent sales phases. For instance, releasing only 500 of 1,000 units in phase one, then increasing prices in later phases.

This approach allows developers to control prices from the primary market, enabling brokers to withhold units and resell at premiums. This closed-loop system artificially inflates prices, benefiting developers at the expense of market integrity.