Mr. Nguyen Xuan Quang, Chairman of the Board of Directors at Nam Long Investment Corporation (stock code: NLG, HoSE), recently reported the execution and transfer of stock purchase rights.

Specifically, the Chairman exercised 18.06 million out of 33.45 million NLG stock purchase rights, equivalent to purchasing 4.6 million newly issued shares. The transaction was completed between November 6 and 11, 2025.

At a price of VND 25,000 per share, Mr. Quang invested approximately VND 117.44 billion. Following the transaction, his holdings increased from 33.45 million to 38.15 million shares.

Mr. Nguyen Xuan Quang, Chairman of Nam Long’s Board of Directors

Additionally, Mr. Quang transferred 15.38 million purchase rights, equivalent to 4 million shares, to his two sons between November 6 and 10, 2025.

Mr. Nguyen Hiep received 6.15 million rights (1.6 million shares) from his father and exercised 3.35 million rights, acquiring 872,599 new shares. His total holdings now stand at 5.8 million NLG shares.

Mr. Nguyen Nam received 9.23 million rights (2.4 million shares) and exercised 2.68 million rights, acquiring 697,816 new shares. His holdings increased to 5.78 million shares.

Previously, Thai Binh Investment Corporation transferred 16.96 million NLG purchase rights from October 27 to November 7, 2025, through a securities company.

By executing this transaction, Thai Binh Investment will not participate in Nam Long’s offering, maintaining its 16.96 million shares. These rights equate to 4.4 million new shares.

Mr. Nguyen Duc Thuan, Chairman of Thai Binh Investment, also serves on Nam Long’s Board of Directors.

Nam Long is offering nearly 100.12 million shares to existing shareholders at VND 25,000 per share through a rights issue.

The rights ratio is 100:26, allowing shareholders to purchase 26 new shares for every 100 held. Upon completion, Nam Long’s charter capital will rise from VND 3,851 billion to VND 4,852 billion.

In the first nine months of 2025, Nam Long reported net revenue of VND 3,941 billion, a 4.8-fold increase year-on-year. Net profit after tax reached VND 441 billion, an 8.1-fold increase. Parent company shareholders’ net profit was VND 354 billion, 23 times higher than the previous year.

For 2025, Nam Long targets VND 6,794 billion in revenue and VND 701 billion in net profit. As of Q3, the company has achieved 58% of its revenue target and 50.5% of its profit goal.

As of September 30, 2025, total assets decreased by 6.4% to VND 28,387 billion. Inventory accounts for VND 17,852 billion, or 62.9% of total assets.

Liabilities total VND 14,020 billion, down 11% year-on-year, including VND 1,442 billion in short-term debt and VND 5,550 billion in long-term debt.

KIS Securities Finalizes Plan to Inject Hundreds of Billions into Proprietary Trading and Margin Lending

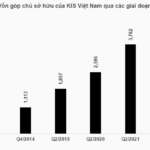

KIS Vietnam Securities Corporation (KIS Vietnam) has successfully obtained written approval from shareholders between November 5th and 15th. The outcome confirms the adjustment of certain details within the plan to offer over 78.9 million shares, as initially approved during the Extraordinary General Meeting of Shareholders on October 15th.

Securities Firm Re-Enters Capital Raising Game: Boosts Share Issuance to 950 Million, Targeting Nearly VND 11 Trillion in Chartered Capital

Previously, the company announced a resolution to halt the implementation of its plan to offer and sell shares to existing shareholders for the purpose of increasing its chartered capital.