One of the rare “purple shades” on HoSE during the November 18th session was the stock of ANV, Nam Viet Corporation (Navico). By the end of the session, ANV surged to its ceiling price of VND 30,800 per share, with a significant influx of capital and over 6.6 million units traded. Since its low point around seven months ago, ANV’s market price has increased by 2.5 times, marking an impressive recovery.

Earlier, in early April, ANV experienced a sharp decline with four consecutive floor sessions following the “tariff shock.” However, the stock quickly rebounded strongly.

During that period, Mr. Doan Toi, CEO and Vice Chairman of Nam Viet’s Board of Directors, personally intervened to support the stock price by registering to purchase 3 million ANV shares from April 11 to May 10, 2025, to increase his ownership stake. In a letter to shareholders, Mr. Doan Toi described this as a “battle” to support the stock, affirming that if the market continued to decline, he would keep buying until ANV could no longer fall further.

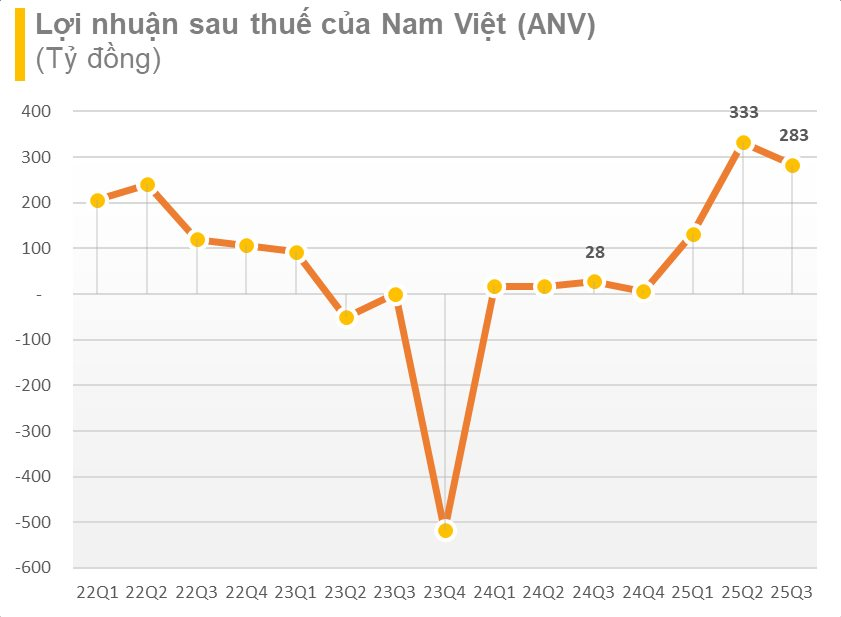

The driving force behind this price surge is Nam Viet’s impressive business performance.

In Q3/2025, Navico recorded net revenue of over VND 2,000 billion, a 49% increase compared to the same period in 2024. The company’s gross profit reached VND 487 billion, up 282% year-on-year. The gross profit margin nearly doubled, from 12.87% in Q3/2024 to 24.37% in Q3/2025.

Pre-tax profit in Q3 reached VND 343 billion, a ninefold increase, equivalent to 826% compared to the same period last year.

In the first nine months of the year, Navico’s cumulative net revenue reached VND 4,833 billion, a 36% increase year-on-year. Net profit after tax was nearly VND 748 billion, almost 18 times higher than the same period last year.

Explaining the reasons for the high profit growth, Navico attributed it to the favorable market conditions that supported the company’s production and business activities.

New Growth Momentum from Pangasius

According to a report by Phu Hung Securities (PHS), the pangasius segment has higher profit potential than catfish due to lower farming costs and FOB prices to the US reaching up to USD 5/kg (compared to USD 2.5-3.4/kg for catfish).

From a market perspective, the US is the largest consumer of pangasius products. The 55% tariff imposed by the US on Chinese pangasius (which accounted for 72% of pangasius imports into the US in 2024) has created a supply gap that ANV is well-positioned to fill.

ANV aims to maintain a revenue ratio of catfish to pangasius at 7:3 or 6:4, with catfish remaining the core segment, but the primary growth driver will be pangasius.

To meet demand, ANV is converting a 600-hectare farming area in Binh Phu, its largest farming region, to pangasius, with 70% of the ponds already converted. The company also plans to increase its processing capacity to 1,000 tons/day.

ANV’s competitive advantage lies in its raw material self-sufficiency. The cost of farming pangasius for ANV is only VND 23,000-24,000/kg, significantly lower than the market price of VND 28,000-29,000/kg. Meanwhile, the selling price in the US reaches USD 4.02/kg (equivalent to approximately VND 104,500/kg), significantly improving profit margins.

Phu Hung Securities also noted that ANV is continuously expanding its market reach. In addition to securing orders from major US retailers like Walmart, Costco, Kroger, and Meiji, on July 5, 2025, ANV signed a cooperation agreement with AV09 Comercio Exporter Ltda, one of Brazil’s largest food importers, becoming the first Vietnamese enterprise to officially export pangasius to Brazil.

Oil & Gas Stock Surges 40% to One-Year High as Brokerages Forecast 44% CAGR Growth for 2026-2028

The positive growth in business results during Q3 2025 has been a key driver supporting the stock price performance.

Big Group Holdings: Unlocking 2025 Profits with Three Revolutionary Business Strategies to Boost Stock Valuation

By the end of 2025, Big Group Holdings JSC (UPCoM: BIG) is set to expand its three strategic pillars through its subsidiaries: Big Expo, Big Hotel, and Big Bro. This growth trajectory is projected to drive consolidated revenue above 500 billion VND and post-tax profit exceeding 20 billion VND. These positive developments have fueled a steady rise in BIG’s stock price over recent weeks.

Who Spent Over $56 Million to Acquire 24.5% Stake in Postal Insurance?

Over three consecutive trading sessions from November 6th to 10th, the market witnessed the transfer of 29.5 million shares of Post and Telecommunication Joint Stock Insurance Corporation (HNX: PTI) via negotiated transactions. This volume represents 24.5% of PTI’s outstanding shares, with a total value nearing VND 1,328 billion. The average negotiated price stood at approximately VND 45,000 per share.