A Series of “Buy” Recommendations Fueled by Strong Q3 Results and IPO Success

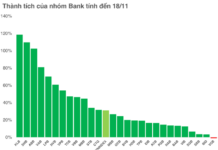

Recent updates on Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) have led multiple securities firms to raise their target prices and issue “Buy” or “Outperform” recommendations. This optimism stems from the revaluation following the IPO of VPBank Securities Company (VPBankS) and the robust Q3 2025 financial performance.

On November 12th, VPBankS completed a record-breaking IPO for a Vietnamese securities company. Raising nearly VND 12,713 billion, the company’s equity reached nearly VND 33,000 billion (excluding Q4 profits), propelling it to the top 2 in the securities industry.

MB Securities (MBS) assigned an “Outperform” rating to VPB, with a target price of VND 42,400 per share. The VPBankS IPO raised VND 12,713 billion for the subsidiary, enhancing its competitiveness as the stock market rebounds. Analysts also highlight the synergy within the group and the strategic partnership with SMBC as key drivers for VPBank’s competitive edge.

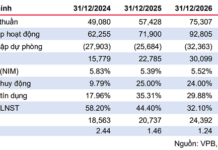

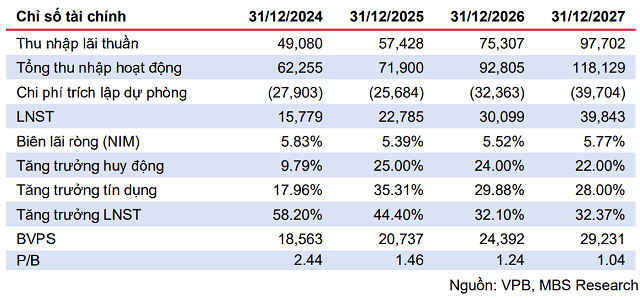

Anticipating greater contributions from subsidiaries to VPBank’s performance, MBS revised its 2025 and 2026 after-tax profit forecasts to VND 22,785 billion and VND 30,099 billion, up 44.4% and 32.1% year-on-year, respectively. The bank’s book value per share is projected to reach VND 24,392 by 2026, corresponding to a P/B ratio of 1.24 post the VPBankS IPO.

VPBank’s Business Performance Forecast. (Image: MBS).

|

Similarly, Maybank Securities upgraded its recommendation for VPB from “Hold” to “Buy,” setting a target price of VND 40,600 per share. Analysts cite the strong profit growth in the first three quarters, the VPBankS IPO, and potential strategic share issuance as key catalysts for VPB.

ACB Securities (ACBS) also issued an “Outperform” recommendation and raised its target price for VPB, driven by the revaluation potential from the VPBankS IPO. ACBS expects the IPO to value VPBankS at nearly VND 64,000 billion, adding VND 30,577 billion to VPB’s market capitalization, or VND 3,854 per share.

Echoing this sentiment, DSC Securities views the VPBankS IPO as a “catalyst for bank valuation.” Analysts note that the IPO pricing is reasonable compared to industry averages and aligns with favorable market conditions.

Beyond the VPBankS IPO, VPBank’s Q3 2025 pre-tax profit of VND 9,166 billion, up 77% year-on-year, and nine-month cumulative profit of VND 20,396 billion, up 47%, exceeded many analysts’ expectations. Securities firms also commend the bank’s strong credit growth, improved asset quality, and sustained net interest margin (NIM).

The Strategic Role of the IPO in VPBank’s Ecosystem

VPBank’s leadership sees the VPBankS IPO as a strategic milestone in achieving its goal of becoming a leading financial group. At the Q3 investor meeting, Ms. Lưu Thị Thảo, Deputy CEO and Senior Executive Director, emphasized the IPO’s “strategic role for VPBankS and the broader ecosystem.”

VPB Shares Rated “Outperform” Post VPBankS IPO

|

Under its 2022-2026 strategy, VPBank aims to become Vietnam’s leading financial group with regional influence. Within this framework, VPBankS provides investment banking and asset management solutions across all customer segments in the ecosystem.

“Backed by VPBank and SMBC, VPBankS has achieved impressive scale and efficiency, building a strong market reputation,” shared Ms. Thảo. “The IPO is expected to increase VPBankS’s charter capital to nearly VND 20,000 billion, providing a solid foundation to fulfill its mission.”

“The IPO is not just a milestone for VPBankS. Capital strategy is essential for achieving VPBank’s goals. Transactions at FE CREDIT, VPBank, and the recent VPBankS IPO have strengthened the bank’s capital base, enabling it to seize opportunities and realize its 2022-2026 strategic objectives,” she added.

Additionally, VPBank’s leadership confirmed the sustainability of VPBankS’s growth in the first nine months of 2025. According to Ms. Thảo, the initial business plan was developed in September 2024 amid financial market volatility. With improved conditions in 2025, VPBankS capitalized on opportunities to boost profits.

As a result, the company reported a nine-month profit of VND 3,260 billion and revised its 2025 profit target to VND 4,450 billion. For 2026-2030, VPBankS aims for a 32% annual compound growth in pre-tax profit, reaching VND 17,520 billion by 2030.

Ms. Thảo noted that despite being a late entrant, VPBankS possesses unique, hard-to-replicate advantages, including the VPBank-SMBC ecosystem, international capital mobilization capabilities, advanced technology, and governance. Notably, VPBank serves over 30 million customers, including 1 million affluent clients, providing VPBankS with a significant edge in developing asset management and investment banking services.

– 14:21 19/11/2025

Unleashing VPBank’s Growth Momentum: The Power of a Distinctive, Expanded Ecosystem Synergy

In an increasingly competitive banking sector, VPBank stands out as a notable case study, thanks to its comprehensive and dynamic financial ecosystem. Beyond mere expansion, the strategic synergy among its member units has forged a closed-loop value chain, where each component seamlessly complements and amplifies the others.

VPBankS Set to Raise Up to 1 Trillion VND Through Bond Issuance

VPBank Securities JSC (VPBankS) is set to raise up to VND 1,000 billion through the issuance of VPX32501 bonds in November 2025. This strategic move aims to restructure the company’s existing loan obligations.