National Commercial Bank (NCB) has announced adjustments to its deposit interest rates effective November 17th. This marks the second consecutive month of rate increases by the bank.

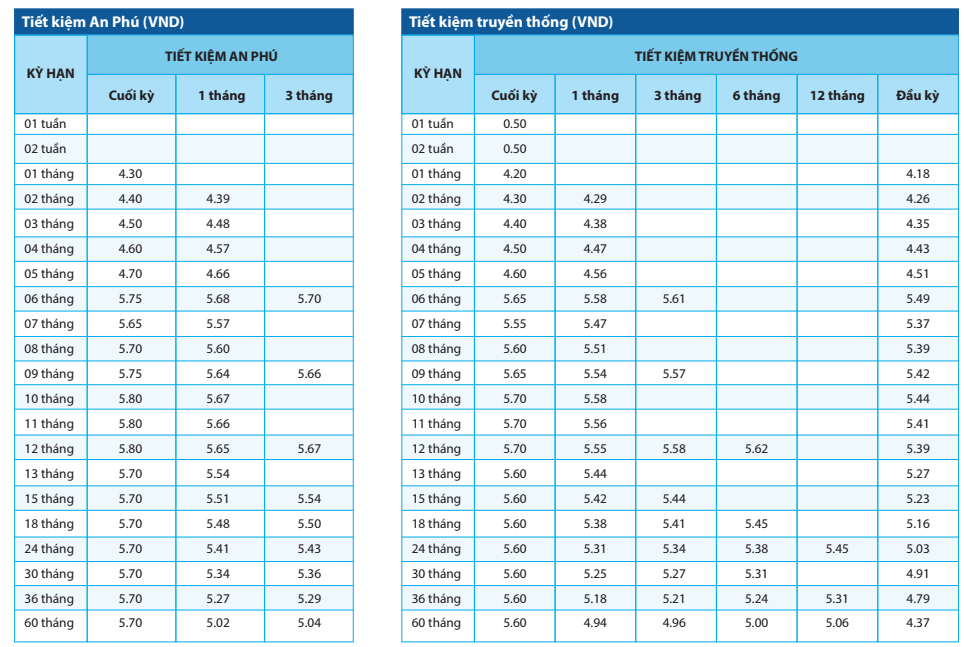

For the An Phú Savings product, which offers the highest interest rates, NCB has increased rates by 0.2 percentage points per annum for terms of 1–5 months, 0.3 percentage points for 6-month terms, 0.2 percentage points for 7–9 month terms, and an additional 0.1–0.15 percentage points for 10–12 month terms.

Source: NCB

Following these adjustments, NCB’s online savings interest rates for end-of-term payouts are as follows: 1 month at 4.3%/year, 2 months at 4.4%/year, 3 months at 4.5%/year, 4 months at 4.6%/year, 5 months at 4.7%/year, 6 months at 5.75%/year, 7 months at 5.65%/year, 8 months at 5.7%/year, 9 months at 5.75%/year, and 10–12 months at 5.8%/year.

The 5.8%/year rate for 10–12 month terms is currently the highest offered by NCB, while the bank maintains a 5.7%/year rate for longer terms of 13–60 months.

Thus, NCB’s 10–12 month deposit terms currently offer the highest interest rates. Notably, the 6-month term rate is even higher than the 60-month term rate.

Similar adjustments apply to the Traditional Savings product, though its listed rates are consistently 0.1 percentage points lower than those of the An Phú Savings product.

Top 5 Banks That Increased Savings Interest Rates Last Week

Last week, the market witnessed several banks adjusting their deposit interest rates upward, primarily for short-term tenures. Notably, one bank raised its deposit interest rate for terms under six months to the maximum limit of 4.75% per annum.

Breaking News: Two More Banks Hike Savings Interest Rates on November 11, 2025

Previously, numerous banks had already increased their savings interest rates in October and early November, including Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, Bac A Bank, BaoVietBank, and PVComBank.