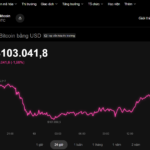

Bitcoin (BTC) continues its downward trend after losing the crucial psychological support level of $100,000 last weekend. The world’s largest cryptocurrency further plummeted below the $90,000 mark during the November 18 session.

Since the beginning of November, BTC has declined by approximately 17%. The current price is also 27% lower than its peak of $126,198 recorded earlier in October. As a result, Bitcoin’s market capitalization has shed over $600 billion.

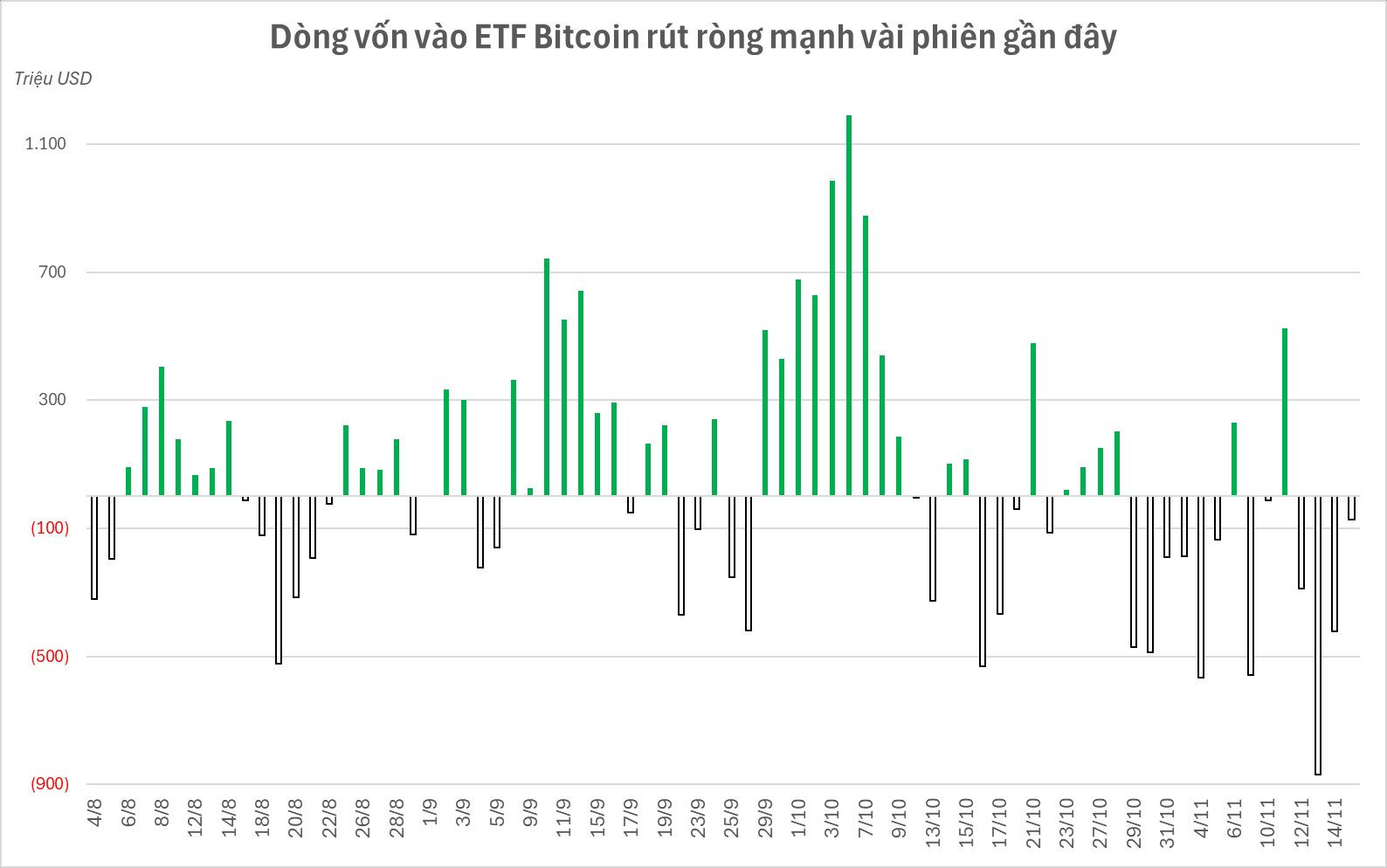

Amid widespread investor pessimism, selling pressure from market “whales” has further exacerbated Bitcoin’s decline. Notably, Bitcoin ETFs have seen consistent outflows over the past four sessions, from November 12 to 17.

Specifically, Bitcoin ETFs recorded outflows exceeding $1.65 billion, equivalent to nearly $1.7 billion worth of Bitcoin sold. The session on November 13 witnessed the most significant outflow, nearing $870 million.

Currently, global Bitcoin ETFs manage approximately $134 billion in assets, an increase of over $24 billion since the start of the year but a $27 billion drop from the October peak.

Bitcoin’s steep decline has triggered a broader sell-off across the cryptocurrency market, with Ethereum, Solana, and Dogecoin all experiencing significant drops.

In reality, Bitcoin’s sharp fall is closely tied to concerning economic signals from the U.S. The 43-day government shutdown has led to a severe lack of macroeconomic data, including CPI, PPI, and non-farm payroll reports, leaving investors without key indicators to assess monetary policy.

Nvidia’s recent earnings report highlights risks in tech speculation, with growing warnings of an AI bubble. Meanwhile, the Federal Reserve’s hints at a potential rate cut in December have amplified macroeconomic risks, putting speculative assets like cryptocurrencies under pressure.

Industry experts advise individual investors to avoid trying to predict short-term volatility. Instead, they recommend dollar-cost averaging or systematic investment plans, focusing on understanding the fundamentals of Bitcoin and Ethereum networks rather than trading based on news.

According to Tim Sun, an analyst at HashKey, long-term investors should await macroeconomic signals rather than technical indicators. Bitcoin’s upward momentum hinges on a sustained easing of global liquidity conditions.

Bitcoin Plummets Below $90,000 as Experts Warn of Further Decline

Bitcoin plummeted below the $90,000 mark on November 18th, hitting its lowest point in seven months and erasing all year-to-date gains. This sharp decline raises questions about whether the sell-off is a routine market shakeout or the beginning of a more prolonged downturn.

Today’s Crypto Market, November 13: Bitcoin Plunges as Mysterious Asset Surges

Bitcoin is experiencing a downturn amidst a bullish U.S. stock market, creating a stark contrast in investor sentiment and market dynamics.