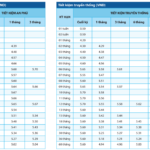

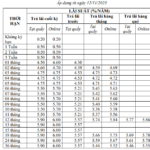

Nam A Commercial Joint Stock Bank (Nam A Bank) has recently increased deposit interest rates across all terms, with the highest increase reaching up to 0.85% per annum. This marks the first time in over seven months that the bank has raised savings interest rates.

According to the updated online savings interest rate table for individual customers, the one-month term rate has been significantly adjusted upward by 0.8 percentage points, now standing at 4.6% per annum. The two-month term saw an even more substantial increase of 0.85 percentage points, while terms ranging from 3 to 5 months received an additional 0.75 percentage points. As a result, interest rates for terms from 2 to 5 months have all been raised to 4.75% per annum—the ceiling rate set by the State Bank of Vietnam for terms under 6 months.

Source: Nam A Bank

Longer-term rates have also been adjusted. The six-month term rate increased by 0.8 percentage points, bringing the online savings interest rate for this term to 5.7% per annum. For terms ranging from 7 to 11 months, the new rates are set at 5.6% per annum, following a 0.5 percentage point increase for 7–8 month terms and a 0.4 percentage point increase for 9–11 month terms.

Long-term deposit rates were also revised upward. Specifically, the 12–13 month and 14–17 month terms both saw an increase of 0.2 percentage points, reaching 5.7% per annum and 5.8% per annum, respectively. Meanwhile, the 24–36 month term experienced a slight increase of 0.1 percentage points, now at 5.9% per annum.

Skyrocketing Savings Rates: A New Bank Disrupts the Market

Interest rates for terms ranging from 2 to 5 months at this bank have been increased to 4.75% per annum, the maximum rate permitted by the State Bank of Vietnam for deposits under 6 months.

Institutions – Infrastructure – Human Resources: The Three Pillars Driving Ho Chi Minh City’s Development from 2025 to 2030

To implement the resolutions of the 1st Party Congress of Ho Chi Minh City, the City Party Committee has developed an action program comprising 10 task groups and 3 breakthrough priority programs.