SMC Investment and Trading JSC (Stock Code: SMC) has announced that December 16th will be the final registration date for a written shareholder vote in 2025. The purpose is to streamline and reorganize the company’s governance structure, aligning it with the company’s scale, enhancing operational efficiency, increasing flexibility, and meeting the company’s development goals.

The process is scheduled to take place from December 17th to December 31st, 2025, at the company’s headquarters in Thạnh Mỹ Tây Ward, Ho Chi Minh City.

Specifically, the Board of Directors has agreed to seek shareholder approval for the removal of three board members serving the 2021-2025 term: Mr. Fujitsuka Masahiko (Japanese nationality), Mr. Vu Anh Nguyen, and Mr. Nguyen Huu Kinh Luan. Additionally, one member of the Supervisory Board, Mr. Nguyen Quang Trung, will also be removed. All these members have submitted their resignations.

Simultaneously, SMC Investment and Trading JSC has approved amendments to the company’s charter, designating the Chairman of the Board of Directors and the CEO as the legal representatives of the company.

Previously, at an extraordinary shareholders’ meeting in late October, SMC removed two board members, Mr. Hua Vu and Ms. Nguyen Thi Ngoc Loan, and elected three new board members: Mr. Pham Hoang Anh (new Chairman of the Board), Mr. Hoang Trung Dung, and Mr. Nguyen Ngoc Anh Duy. SMC also appointed two new members to the Supervisory Board: Mr. Nguyen Quang Trung and Ms. Thai Thi Van Anh.

In related news, Mr. Pham Hoang Anh, Chairman of the Board of SMC, has registered to purchase 1 million SMC shares to increase his ownership stake.

If the transaction is successful, Mr. Pham Hoang Anh’s ownership will increase from 0% to 1.36% of SMC’s capital. The transaction is expected to be executed via order matching from November 5th, 2025, to December 4th, 2025.

For Q3 2025, SMC reported net revenue of over 1,571 billion VND, a 31% decrease compared to the same period last year. Operating below cost resulted in a gross loss of nearly 2.2 billion VND, a significant reversal from the 10.3 billion VND profit in the same period last year.

After deducting taxes and fees, SMC reported a net loss of nearly 78 billion VND, an improvement from the 82 billion VND net loss in the same period last year.

For the first nine months of 2025, SMC generated net revenue of over 5,369 billion VND, a 20% decrease compared to the first nine months of 2024; the net loss after tax was nearly 159 billion VND, while the same period last year still reported a net profit of nearly 7 billion VND.

SMC was once Vietnam’s leading steel trading company, achieving a record net revenue of 21,000 billion VND and a net profit of 901 billion VND in 2021. However, since 2022, business results have declined sharply due to falling steel prices and difficulties in recovering debts from customers in the construction and real estate sectors.

In the market, SMC shares are currently under warning, trading at around 13,550 VND per share.

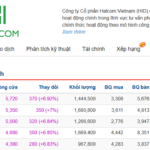

HOSE Demands Explanation from HID as Stock Hits Upper Limit for Five Consecutive Sessions

The Ho Chi Minh City Stock Exchange (HOSE) has requested Halcom Vietnam JSC (HOSE: HID) to clarify the reasons behind the consecutive ceiling price increases of HID shares over five sessions from November 11 to 17.

FPT Allocates VND 1.7 Trillion for Interim Dividend Payout in December

FPT is set to distribute over 1.7 trillion VND in dividend advances for 2025 to its shareholders on December 12th.

ABBANK: Vũ Văn Tiền Reappointed as Chairman, Phạm Duy Hiếu Steps Down as CEO

On November 14, 2025, the Board of Directors of An Binh Commercial Joint Stock Bank (ABBANK) issued resolutions to adjust key leadership positions within the Board and the bank’s Executive Committee. These strategic changes aim to strengthen governance foundations and accelerate operational efficiency.