This marks a significant advancement in the comprehensive partnership strategy between Techcombank and Techcom Life, showcasing their rapid execution and commitment to delivering on their promises shortly after Techcom Life’s launch in September. This collaboration aims to provide customers with a transparent, modern, and seamless insurance experience, catering to their needs at every life stage.

The synergy between Techcombank’s leading digital banking capabilities in Vietnam and Techcom Life’s innovative insurance solutions is expected to introduce a modern, customer-centric insurance approach. By placing customers at the heart of their services, they aim to enhance transparency and seamlessness, ultimately improving the quality of life and empowering millions of Vietnamese families to take control of their future.

Mr. Jens Lottner, CEO of Techcombank, shared: “The distribution of life insurance products is a crucial next step in our comprehensive partnership roadmap, aiming to create a holistic financial ecosystem. We strive to establish a ‘one-stop financial experience’ where customers can fulfill their insurance, savings, and investment needs within a single, seamlessly operated ecosystem powered by cutting-edge technology and data. This integration expands access to modern financial-insurance solutions, contributing to a sustainable insurance market development.”

Leveraging technological prowess, innovative thinking, and market insights, Techcom Life offers tailored, modern insurance solutions designed to meet the unique needs of Vietnamese individuals. With the vision of “Rebuilding the insurance industry, empowering future autonomy,” Techcom Life ensures customers are protected against risks, enabling them to confidently build their financial future and enhance their quality of life.

Mr. Mukesh Pilania, Chairman of Techcom Life’s Board of Directors, stated: “Today’s customers seek more than just insurance products; they desire a comprehensive experience where protection solutions are paired with value-added services and a seamless journey from awareness to lifelong engagement. Powered by technology, Techcom Life not only deeply understands individual needs but also delivers personalized experiences, ensuring customers can confidently shape their future.”

Techcom Life’s value proposition is reflected in its diversified distribution channels and deep integration of technology and data throughout the customer journey. Products and services will be directly integrated into Techcombank’s digital banking platform, enabling customers to easily manage policies, benefits, and insurance participation with just a few clicks. By leveraging big data, behavioral analytics, and AI, Techcom Life personalizes solutions to align with individual financial and health needs, fostering enduring relationships built on trust and tangible value.

Starting December, Techcom Life’s protection solutions will be available at select Techcombank branches in Ho Chi Minh City and Hanoi, with a nationwide rollout planned for January 2026.

ABOUT TECHCOMBANK

Techcombank (listed on the Ho Chi Minh City Stock Exchange (HoSE) under the ticker TCB) is one of Vietnam’s largest joint-stock banks and a leading financial institution in Asia. With a vision to “Transform finance, Elevate life’s value,” Techcombank focuses on customer-centric strategies, offering diverse financial solutions and banking services to approximately 17 million individual and corporate clients. Through its extensive branch network and market-leading digital banking services, Techcombank leverages ecosystem partnerships across key economic sectors to differentiate itself in one of the world’s fastest-growing economies.

Techcombank is rated AA- by FiinRatings, Ba3 by Moody’s, and BB by S&P, placing it among Vietnam’s highest-rated joint-stock banks.

ABOUT TECHCOM LIFE

Techcom Life Insurance Joint Stock Company, established by Techcombank and other shareholders, provides life and health insurance solutions to Vietnamese individuals and families. Techcom Life aims to pioneer a new generation of modern, transparent, and customer-friendly life insurance products. Operating under the vision of “Rebuilding the insurance industry, Empowering future autonomy” and the mission to “Shape insurance experiences, driving continuous growth for individuals, families, and businesses,” Techcom Life focuses on three core needs: health protection, financial stability, and quality of life enhancement. This approach contributes to the sustainable development of Vietnam’s life insurance sector and improves the lives of Vietnamese people.

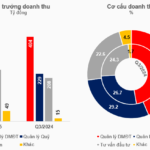

Unlocking Unprecedented Profits: The Rise of Fund Management

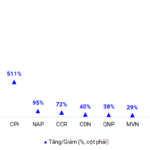

In Q3 2025, over 40 asset management companies operating in Vietnam’s stock market painted a vibrant picture of growth. Combined revenues surged to nearly VND 1.1 trillion, while net profits soared to approximately VND 570 billion, marking impressive year-over-year increases of 27% and 87%, respectively.