Asset Management Continues to Thrive: A Breakdown of Q3 2025 Performance

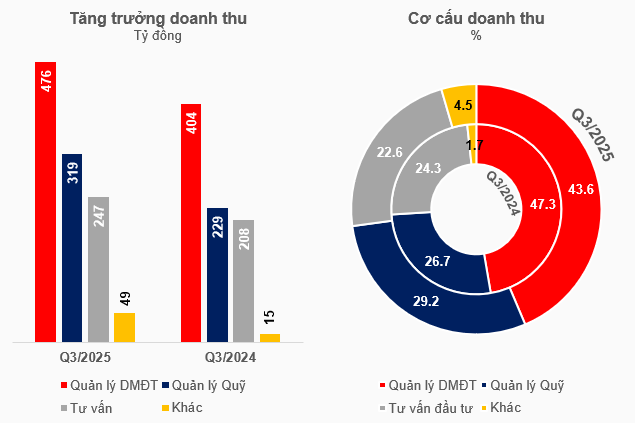

In Q3 2025, Vietnam’s asset management industry (AMI) generated nearly VND 1.1 trillion in revenue, with portfolio management (trust) contributing 44%, fund management 29%, consulting 23%, and other sources making up the remaining 5%.

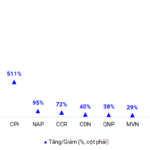

Overall industry revenue surged 28% year-over-year, driven by a 40% increase in fund management, 19% in consulting, 18% in trust, and a remarkable 237% growth in other segments.

Trust and fund management remain the primary drivers of the industry’s success, both in terms of contribution and growth. This is a natural outcome given the vibrant stock market conditions.

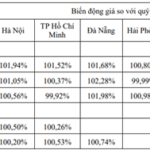

During the quarter, the VN-Index climbed 286 points (21%), surpassing 1,600 for the first time. Average daily trading value reached VND 39.5 trillion, a significant improvement from Q2’s VND 22 trillion and Q1’s VND 16.4 trillion.

Source: Author’s compilation

|

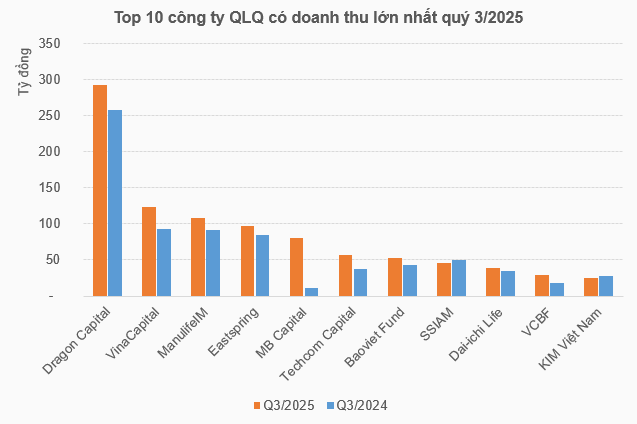

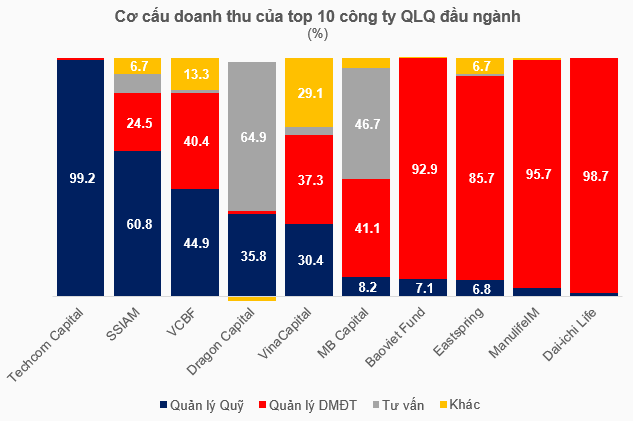

Among the top 10 companies by revenue (accounting for 85% of the industry), there’s a clear divergence in revenue sources. While Techcom Capital and SSIAM rely heavily on fund management, DFVN, ManulifeIM, EIFMC, and Baoviet Fund leverage substantial trust funds from their parent insurance companies.

VCBF, VinaCapital, and MB Capital have a more balanced revenue structure. Notably, Dragon Capital derives 65% of its revenue from investment consulting, making it the industry leader with Q3 revenue of nearly VND 293 billion (up 13% YoY).

Other top performers include VinaCapital (VND 123 billion, +32%) and ManulifeIM (VND 108 billion, +18%).

Source: Author’s compilation

|

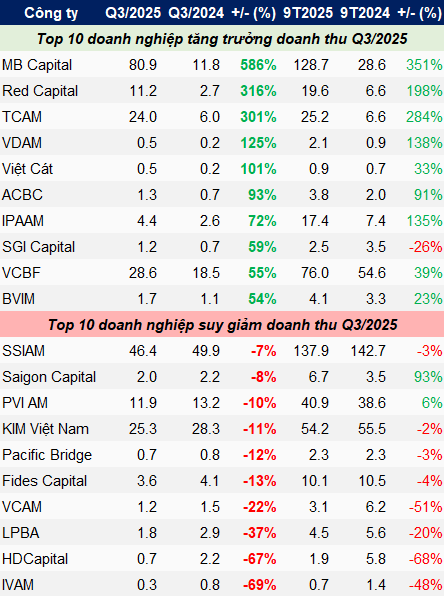

In terms of growth, 30 companies outperformed their Q3 2024 figures, with five experiencing multi-fold increases. MB Capital led with a 6.9x surge to VND 81 billion, followed by Red Capital (4.2x), TCAM (4x), and others.

Twelve companies saw revenue declines, but the most significant drops were among smaller players like IVAM (-69%), HDCapital (-67%), LPBA (-37%), and VCAM (-22%). Larger firms like SSIAM (-7%) and KIM Vietnam (-11%) experienced more moderate decreases.

Source: Author’s compilation

|

Q3 Net Profit Nearly Matches First Two Quarters Combined

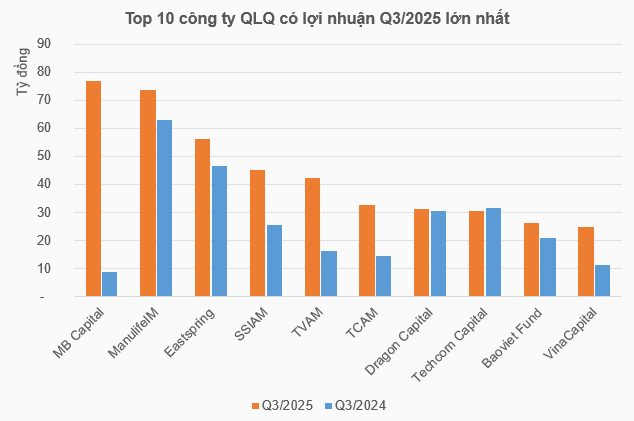

The industry’s positive momentum translated into a Q3 net profit of VND 569 billion, up 87% YoY. This brings the 9-month total to over VND 1.2 trillion, a 24% increase. Remarkably, Q3 profit alone accounts for 85% of the first two quarters combined.

MB Capital topped the chart with a Q3 net profit of nearly VND 77 billion, a staggering 9x increase from the same period last year. This growth was fueled by both core operations (trust and consulting) and higher financial investment gains.

While impressive, MB Capital’s growth was outpaced by ACB Capital (26x), IPAAM (17x), Red Capital (16x), and BVIM (13x), all of which grew from relatively low bases.

Source: Author’s compilation

|

Overall, 26 companies reported higher Q3 net profits, mirroring the revenue trend. Four companies experienced declines, but these were primarily smaller firms with thin margins like PCAM, Pacific Bridge, and Saigon Capital. Techcom Capital saw a modest 3% decrease to VND 30 billion.

Source: Author’s compilation

|

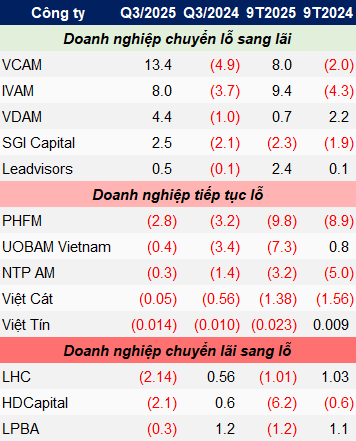

Several companies switched profit statuses. VCAM, IVAM, and VDAM moved from losses to profits, while LPBA, HDCapital, and LHC shifted from profits to losses. PHFM, UOBAM Vietnam, and NTP AM remained in the red.

Source: Author’s compilation

|

In summary, while the asset management industry exhibits varying performance levels, the overall picture is positive, with many major players contributing to a bright outlook.

– 10:00 18/11/2025

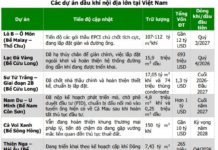

Vanguard’s Investment Allocation Plans Following Vietnam’s Market Upgrade: Brokerage Insights

Following Vietnam’s market upgrade, ACBS anticipates that ETFs tracking the aforementioned indices will allocate their portfolios to the Vietnamese market in accordance with their respective weightings.