Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, Stock Code: CTG, HoSE) has announced the public auction of SGP shares of Saigon Port Corporation (Saigon Port).

VietinBank intends to auction over 19.6 million SGP shares, equivalent to a 9.07% stake in Saigon Port’s charter capital.

With a starting price of VND 29,208 per share, VietinBank is expected to generate a minimum of nearly VND 573 billion if the SGP shares are successfully sold.

At the close of trading on November 18, 2025, SGP shares ended at VND 26,700 per share. Thus, VietinBank’s starting price is approximately 9.4% higher than the market price.

Illustrative image

Registration and deposit for the share purchase will be accepted from November 19, 2025, until 3:30 PM on December 15, 2025, at designated auction agents. Investors must submit their participation forms by 4:00 PM on December 18, 2025.

The SGP share auction by VietinBank is scheduled for 9:00 AM on December 22, 2025, at the Hanoi Stock Exchange (HNX), 2 Phan Chu Trinh, Cửa Nam Ward, Hanoi.

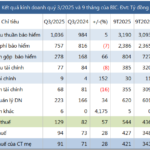

Regarding Saigon Port’s business performance, in the first nine months of 2025, the company achieved consolidated net revenue of over VND 868.2 billion, a 6.7% increase compared to the same period in 2024. After-tax profit reached nearly VND 387.8 billion, three times higher than the previous year.

For 2025, Saigon Port targets consolidated revenue of VND 1,428 billion and profit of VND 316 billion. By the end of Q3 2025, the company had completed 60.8% of its revenue target and 122.7% of its profit target.

As of September 30, 2025, Saigon Port’s total assets increased by 6.6% from the beginning of the year to over VND 6,138 billion. This includes cash and cash equivalents of over VND 580 billion (9.4% of total assets), investments held to maturity of over VND 548.1 billion, and long-term financial investments of over VND 1,503 billion (24.5% of total assets).

On the liabilities side, total debt stands at nearly VND 2,888.5 billion, a slight increase from the beginning of the year. Long-term payables account for VND 1,839 billion, or 63.7% of total debt.

“Upcoming Dividend Payout: A 35% Total Yield from a Consistently Reliable Dividend-Paying Enterprise”

Since its listing on the Hanoi Stock Exchange (HNX) in 2019, the company has consistently maintained a robust cash dividend policy, delivering payouts as reliable as clockwork, with rates soaring into the double digits annually.

VietinBank Targets 2025 Pre-Tax Profit of VND 32,500 Billion, Poised to Enter Gold Market

At the investor conference held on the afternoon of November 13, 2025, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG) forecasted a stable Net Interest Margin (NIM) with potential improvement by the end of 2026. Additionally, the bank identified emerging business segments, including the National Gold Trading Platform and digital assets, as key strategic focuses.