The Ho Chi Minh City Stock Exchange (HOSE) has announced the launch of the Vietnam Shareholder Interest Enhanced Index (VNSHINE), a new benchmark designed to enhance shareholder value.

The VNSHINE index comprises a basket of stocks (ranging from 15 to 30) selected from the VNAllshare index, meeting specific criteria to ensure they align with shareholder interests.

The index is calculated based on market capitalization adjusted for free-float, with individual stock weightings capped. It is updated in real-time, with values published every 5 seconds on trading days.

To qualify for inclusion, stocks must be listed on HOSE before year T-3 and meet a minimum daily trading value of VND 10 billion. Additionally, they must have consistently paid cash dividends for three consecutive years prior to the review year (T-3, T-2, and T-1).

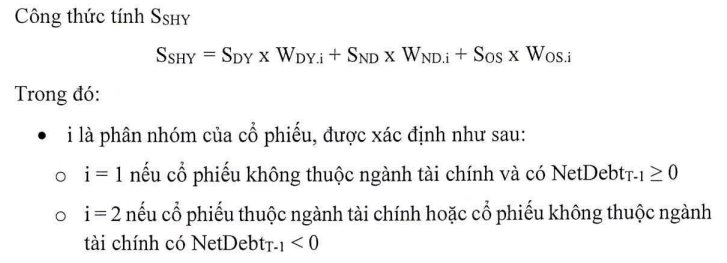

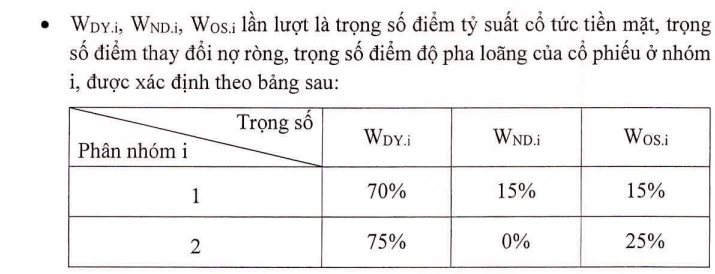

The selection process includes calculating the Shareholder Yield Score (S_SHY), which combines the Cash Dividend Yield Score (S_DY), Net Debt Change Score (S_ND), and Dilution Score (S_OS).

If 15 to 30 stocks meet all criteria, they are all included in the index. For 31 to 50 eligible stocks, priority is given to those in the previous index, with additional stocks selected based on free-float market capitalization (GTVH_f) and higher S_SHY scores.

For over 50 eligible stocks, the top 50 by S_SHY are considered, with priority given to previous index constituents and GTVH_f for the final 30 selections.

VNSHINE is the fourth new index launched by HOSE in 2025, following the Modern Industry and Technology Index (VNMITECH), Vietnam Growth 50 Index (VN50 Growth), and Vietnam Dividend Growth Index (VNDIVIDEND).

All these indices became effective on November 3, 2025.

VVS Approved for Listing on HoSE: Trucking Enterprise Unveils New Growth Prospects for Investors

The Ho Chi Minh Stock Exchange (HoSE) has officially approved the listing of 21,525,000 VVS shares from Vietnam Machinery Development Investment Joint Stock Company, with a par value of 10,000 VND per share. This milestone marks a strategic turning point, unlocking opportunities to attract significant capital inflows while solidifying the brand’s reputation and standing in both domestic and regional markets.

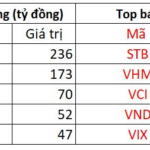

Foreign Block Continues Net Selling Spree, Offloading Nearly 1 Trillion VND as VN-Index Surges, with Heavy Dumping of a Banking Stock

Foreign investors’ trading activity remains a significant drawback, as they continued to offload substantial holdings across all three major exchanges.