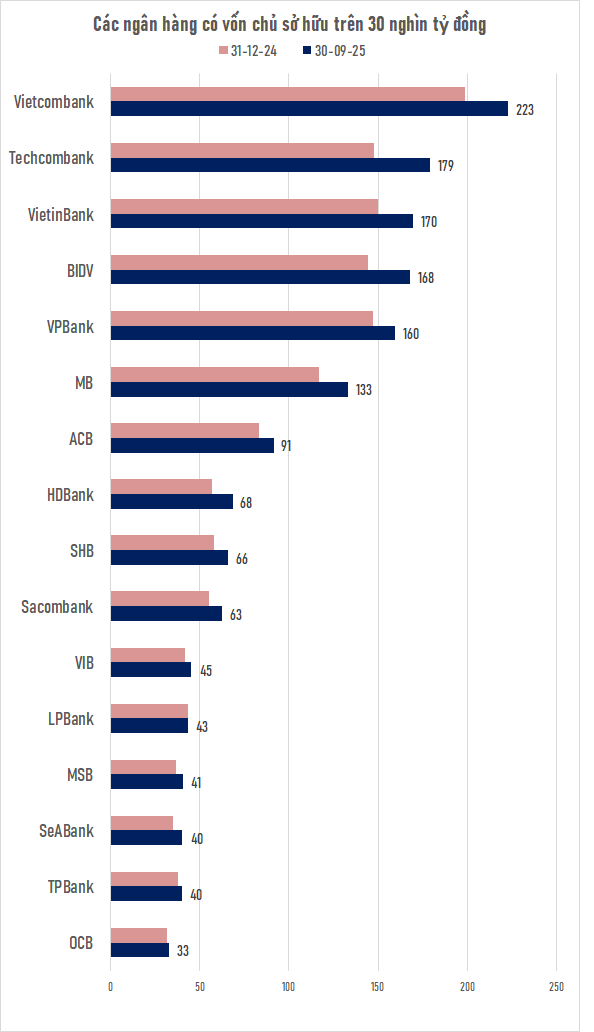

According to recent statistics, by the end of September 2025, the total equity capital of 27 banks listed on the stock exchange reached nearly VND 1,700 trillion, marking an increase of over VND 191 trillion compared to the beginning of the year, equivalent to a 12.7% growth. The disparity within the system is widening, as leading banks are outpacing smaller ones in terms of growth.

Currently, the “elite club” of banks with equity capital exceeding VND 150 trillion includes six prominent names. By the end of Q3 2025, Vietcombank (VCB) led with VND 222.7 trillion, followed by Techcombank (TCB) at VND 179.4 trillion, BIDV at VND 168 trillion, VietinBank (CTG) at VND 170 trillion, and VPBank at VND 160 trillion.

When converted to the current USD exchange rate, Vietcombank’s equity capital stands at approximately USD 8.4 billion, while TCB, BIDV, CTG, and VPB range between USD 6–6.7 billion. This group of banks has surpassed the VND 150 trillion milestone, creating a significant gap with the rest of the market.

Just below this leading group is MB, with equity capital exceeding VND 133 trillion, equivalent to around USD 5 billion. No other bank has yet reached the VND 100 trillion threshold, and it may take several years for any to do so.

Beyond these banks, the group with equity capital above VND 60 trillion includes ACB, SHB, Sacombank (STB), and HDBank (HDB). ACB currently stands at over VND 91 trillion, nearing the top tier; SHB and STB are around VND 60–66 trillion; and HDBank is at over VND 68 trillion. This group has maintained steady capital growth over the past two years, with each bank adding between VND 15 trillion and VND 25 trillion.

Meanwhile, many banks still have equity capital below VND 10 trillion. Banks like VietABank and VietBank are around VND 8–9 trillion; PGB is at approximately VND 6 trillion; and SGB is just over VND 4 trillion. This group has seen the most modest growth, typically increasing by only a few dozen to a few hundred billion per quarter. The gap between the smallest and largest banks is now over 50 times.

Equity capital is a critical metric for assessing a bank’s financial strength. A robust capital base strengthens a bank’s position, ensures operational safety, and provides a foundation for expansion and future business strategies. In recent years, banks have increasingly retained profits and bolstered equity capital by issuing stock dividends to increase their chartered capital.

PDR’s Q3 Net Profit Surges 68%, Cash Flow Turns Positive

The Q3/2025 consolidated financial report of Phat Dat Real Estate Development Corporation (HOSE: PDR) paints a positive financial picture, highlighting robust revenue growth, improved profitability, and a return to positive operating cash flow.

Impressive Growth Reported by Trucking Companies, Surpassing Annual Targets Ahead of Schedule

Vietnam Machinery Development Investment Corporation (VIMID – Stock Code: VVS) has released its Q3/2025 financial report, showcasing a remarkable 103% year-on-year growth in cumulative net revenue and a 173.7% surge in pre-tax accounting profit. This outstanding performance has enabled VIMID to surpass its 2025 targets in less than nine months.

SHB Reports 36% Surge in Pre-Tax Profit for Q1-Q3, Bolstering Financial Strength

Saigon-Hanoi Commercial Joint Stock Bank (SHB) continues its robust growth trajectory, reporting a pre-tax profit of VND 12,307 billion for the first nine months of 2025. This impressive figure marks a 36% year-on-year increase and represents 85% of the bank’s annual target.