Ho Chi Minh City (HCMC) is entering a new phase post-merger, with the central real estate market continuing to lead, especially in the luxury apartment segment. The selection of Thu Thiem for the development of the International Financial Center (IFC) is generating expectations for a new growth cycle. This also provides a foundation for wealthy investors to continue directing their capital towards high-end projects in the core urban area, where scarcity, legal clarity, and profitability are key concerns for this demographic.

At the HCMC Core Real Estate Forum on November 18, Assoc. Prof. Dr. Tran Dinh Thien noted that the city currently possesses a rare developmental structure, with three major centers operating simultaneously, forming a megacity. This advantage positions HCMC to lead the national real estate market for years to come.

Speakers at the HCMC Core Real Estate Forum on November 18

|

According to Dinh Minh Tuan, Director of Batdongsan.com.vn’s Southern Region, the establishment of the IFC in Thu Thiem could lead to three scenarios. First, Thu Thiem will operate alongside the existing Central Business District (CBD) in District 1 and District 3. The old CBD will retain its current commercial, service, and financial functions, while the new area will focus on international fintech and technology.

Second, the new center will gradually dominate, while the old area transitions to a cultural and historical hub. In the most ambitious scenario, Thu Thiem could become a global connectivity center, attracting high-quality businesses and residents.

In this context, wealthy investors are selecting luxury apartments based on specific criteria to own property in this area.

The allure of central real estate for the wealthy

According to Nguyen Thai Binh, CEO of Dong Tay Land, high-end property buyers prioritize three factors: scarcity, transparent legal frameworks, and tangible investment returns. These criteria shape the wealthy’s perspective on central assets, where land is increasingly limited and ownership opportunities are shrinking over time. This is why many buyers are willing to pay a premium, provided the project’s legal status is complete and liquidity is assured.

“During a project viewing, a client chose to purchase an apartment in the city center for 85 billion VND instead of buying 10 suburban properties for the same amount, as they prioritized profitability and high liquidity. They preferred one high-value, exploitable central property over ten potentially unrentable suburban ones,” Mr. Binh illustrated.

Echoing this sentiment, Vu Quoc Viet Nam, Deputy CEO of Marketing and Sales at Dat Xanh Group, noted that central areas cannot expand, so property values will appreciate over time.

Additionally, the new CBD, including Thu Thiem, An Phu, and Nam Rach Chiec, is concentrated with infrastructure such as metro lines, highways, and the IFC. Once these infrastructures are completed, central real estate is expected to grow sustainably.

Furthermore, the shift of tenants and buyers from the South to the East, driven by the East’s superior rental rates, is enhancing investment returns and liquidity, attracting more investors.

However, Mr. Viet Nam cautioned that before investing, buyers should carefully examine the project’s legal status and request the developer provide state-mandated notices to ensure compliance and protect their interests. Property selection should also consider infrastructure. He believes that the new central areas in Thu Thiem and Nam Rach Chiec, which are meticulously planned from the outset, will see property values double or triple once infrastructure is complete.

Additionally, investors should evaluate the product-to-price ratio. “Professional investors should list criteria such as location, design, handover standards, amenities, brand, and construction contractor to assess this and avoid emotional investing,” Mr. Viet Nam advised.

Continued rise in luxury apartments

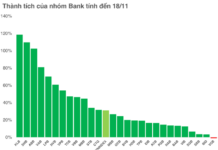

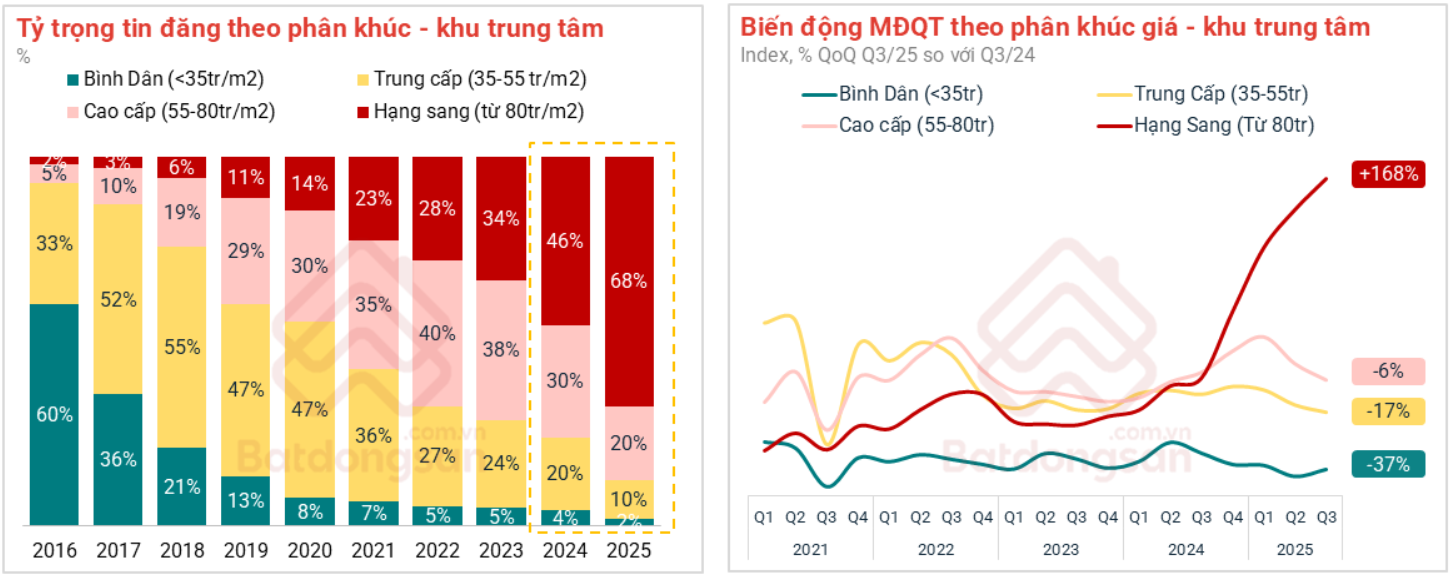

As HCMC develops into a multi-centered city, the central real estate market remains highly attractive, particularly for apartments. Data from Batdongsan.com.vn shows that in the first 10 months of 2025, despite accounting for only 28% of the supply, central apartments attracted 45% of market interest, significantly outperforming other property types.

Among these, the luxury apartment segment (starting at 80 million VND/m²) in the city center is experiencing strong growth in both supply and interest. In Q3/2025, interest in this segment surged by 168% year-on-year.

|

Interest in the luxury segment in Q3/2025 increased by 168%

Source: Batdongsan.com.vn

|

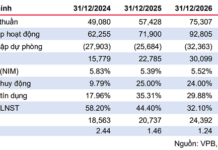

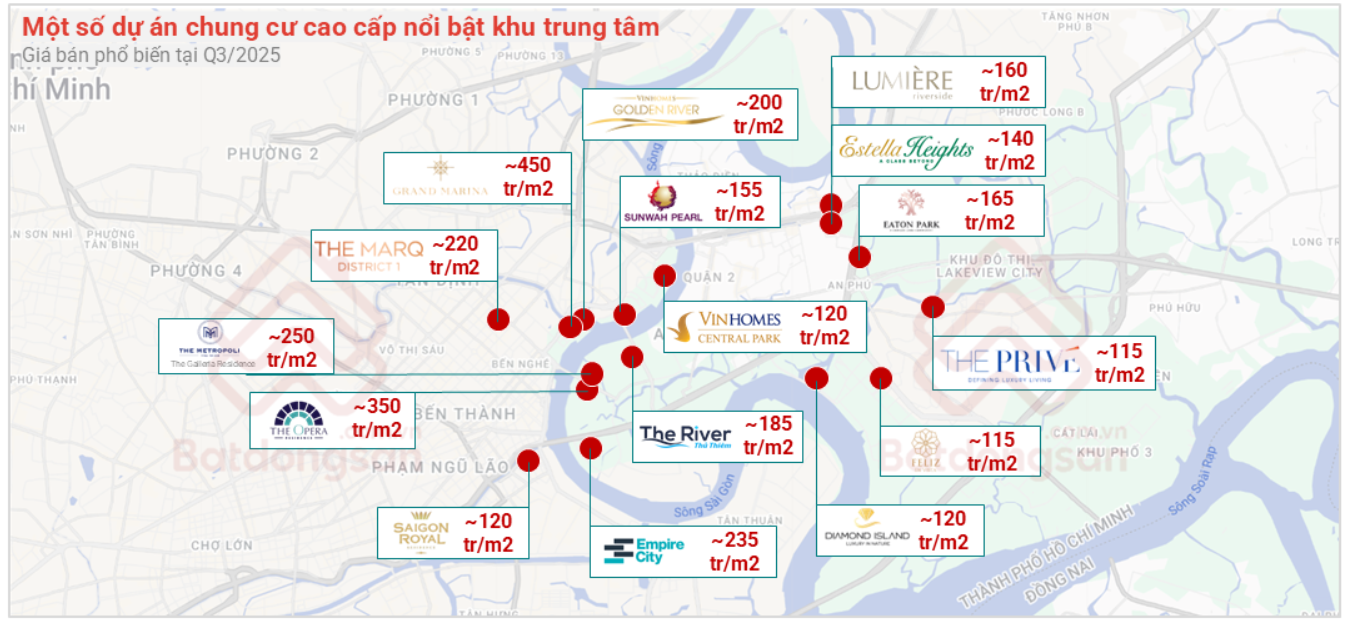

The market has seen several luxury apartment projects set new price benchmarks. In the old District 1, some secondary projects reached approximately 413 million VND/m², while District 2 saw prices around 314 million VND/m². Other projects typically ranged from 101 to 182 million VND/m². Apartment prices are rising due to strong real demand and high prices in the single-family home segment, which are beyond many buyers’ budgets.

|

Listed prices for luxury apartments in central HCMC

Source: Batdongsan.com.vn

|

In the growth landscape of HCMC’s central real estate, the Nam Rach Chiec urban area (formerly An Phu ward) is attracting attention from investors and residents. Batdongsan.com.vn data shows that interest in An Phu’s real estate in Q3/2025 increased by nearly 10% compared to the previous quarter. Adjacent to Thu Thiem and directly connected to Mai Chi Tho and Song Hanh highways, as well as the HCMC-Long Thanh-Dau Giay expressway, this area is home to numerous luxury projects.

Batdongsan.com.vn data also reveals that from 2015 to 2025, central HCMC real estate prices rose sharply across all segments, though unevenly. Land plots led with a 384% increase (from 25 to 121 million VND/m²), followed by apartments at 197% (from 31 to 92 million VND/m²), single-family homes at 168% (from 56 to 150 million VND/m²), and townhouses at 134% (from 92 to 215 million VND/m²).

The rapid rise in land and single-family home prices is putting financial pressure on central buyers, driving a shift towards high-rise apartments, which offer more reasonable investments while still meeting living standards, amenities, security, and connectivity.

From a long-term perspective, Nguyen Quoc Anh, Deputy CEO of Batdongsan.com.vn, believes that Thu Thiem could become a counterbalance to the economic and financial center within 5-10 years as infrastructure and financing mature. The emergence of a multi-centered network will transform urban operations, sustaining demand for high-quality housing.

Expert: HCMC is poised for growth similar to Seoul

– 14:42 19/11/2025

International Financial Center Poised to Spark New Surge in Ho Chi Minh City’s Central Real Estate Value

According to Prof. Dr. Trần Đình Thiên, former Director of the Vietnam Institute of Economics, the development of an International Financial Center (IFC) in Ho Chi Minh City is not merely an economic project but must be regarded as the city’s new “nucleus of accumulated energy.”

Good News for Residents of Old and Grade D Apartments in Ho Chi Minh City

Unveiling the architectural and planning benchmarks for 19 aging apartment complexes in Ho Chi Minh City has been a highly anticipated development for both residents and businesses alike.