In the first nine months of 2025, Vietnam’s banking sector witnessed improvements across various metrics, notably in credit growth. However, the overall picture presents considerations such as slower capital mobilization, rising deposit interest rates, and narrowing net interest margins (NIM). These trends have shaped the banking system’s performance in the first three quarters and are expected to persist into the final months of the year.

Industry-wide Profitability Grows Despite NIM Pressure

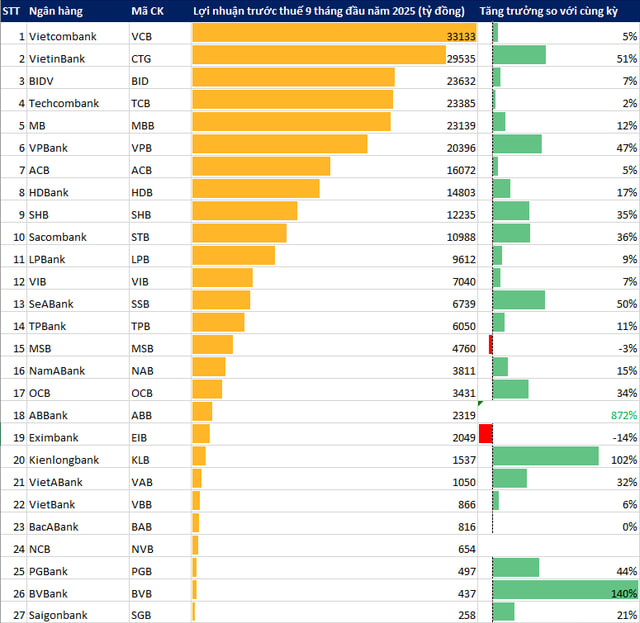

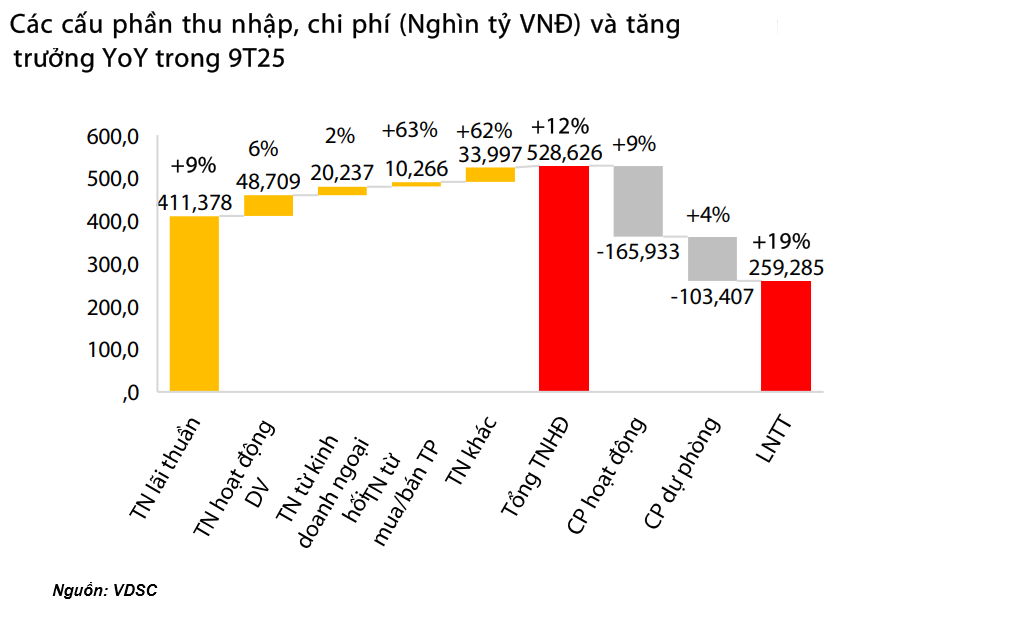

According to data from 27 listed banks, total pre-tax profits for the first nine months reached nearly VND 260 trillion, up 19% year-on-year, fulfilling 74% of the annual target.

Growth was observed across all bank categories. State-owned banks grew by an average of 18%; large private banks (MBB, VPB, TCB, ACB) by 14%; and medium to small-sized banks by 24%.

Among state-owned banks, Vietcombank maintained its top position with a pre-tax profit of VND 33.133 trillion, up 5%. VietinBank saw the strongest growth at 51%, reaching VND 29.535 trillion, securing second place industry-wide.

In the large private bank segment, Techcombank led with pre-tax profits of VND 23.385 trillion. VPBank accelerated significantly, reporting a 47% profit increase, surpassing VND 20 trillion for the first time.

Overall, 25 out of 27 banks reported positive profit growth in the first nine months, with some banks like ABBank, Kienlongbank, and BVBank seeing profits multiply compared to the same period in 2024.

Profit growth was accompanied by a 12% increase in total operating income, exceeding VND 528 trillion. Net interest income remained the primary revenue source at VND 411 trillion, accounting for 78% of total operating income, up 9% year-on-year. Non-interest income also grew: service fees by 6%, foreign exchange by 2%, and bond trading and other income by over 60%.

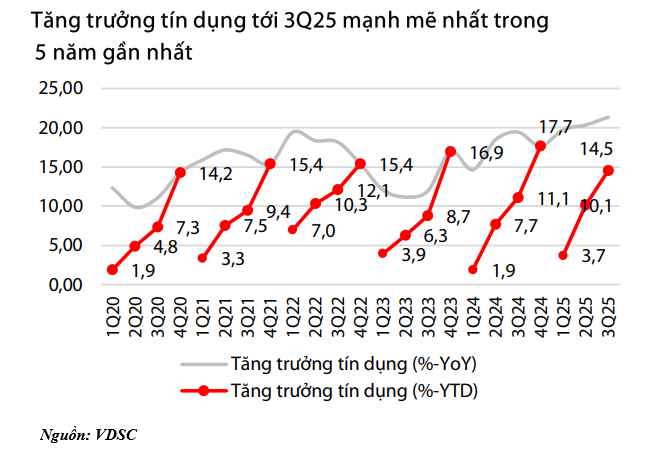

By the end of Q3, credit growth among listed banks reached 14.5% year-to-date, the highest in five years. Credit growth disparities between banks narrowed compared to the first half as many approached their credit limits. VPBank led with 29.1% credit growth, while VietinBank topped state-owned banks at 15.6%.

Notably, medium to long-term credit grew faster than short-term credit, indicating a shift in portfolio structure and reflecting recovering investment demand.

However, high credit growth pressured capital mobilization. By Q3, deposits grew only 11.4%, significantly lower than credit growth. The deposit-credit growth gap turned negative at 3.1 percentage points, straining system liquidity. The CASA ratio also fell to 21.9% due to business sentiment regarding e-invoice regulations and shifts to gold, USD, and digital assets.

To secure funding, banks raised deposit rates. Average deposit rates increased by 0.15 percentage points in Q3 and 0.4 percentage points year-to-date. State-owned banks raised rates slightly by 0.05 percentage points, while large and medium-sized banks increased them more significantly, by 0.20–0.25 percentage points. Interbank transactions surged to over VND 480 trillion in Q3, reflecting localized liquidity needs.

Slower mobilization and rising funding costs directly impacted NIM. In Q3, industry NIM fell 0.1 percentage points to 3.0%, the lowest since Q1 2025. Interest-earning asset yields dropped 0.05 percentage points due to rising net NPLs, while funding costs increased 0.05 percentage points due to higher deposit rates. The four-quarter moving average NIM fell 0.35 percentage points to 3.15%, the lowest since 2018.

However, several private banks saw NIM recovery, notably Sacombank, VPBank, OCB, MB, and VIB, supported by strong credit growth and high retail lending ratios. Sacombank benefited additionally from interest income recognition on restructured loans related to Phong Phu Industrial Park.

Conversely, state-owned banks (Vietcombank, BIDV, VietinBank) maintained NIM at 2%–2.6% due to low lending rates despite rising funding costs.

NIM pressure is expected to persist in Q4 as cyclical capital demand rises and input rates show limited decline potential.

Asset Quality Shows Mild Improvement – NPL Ratio Falls but Group 2 Loans Warrant Attention

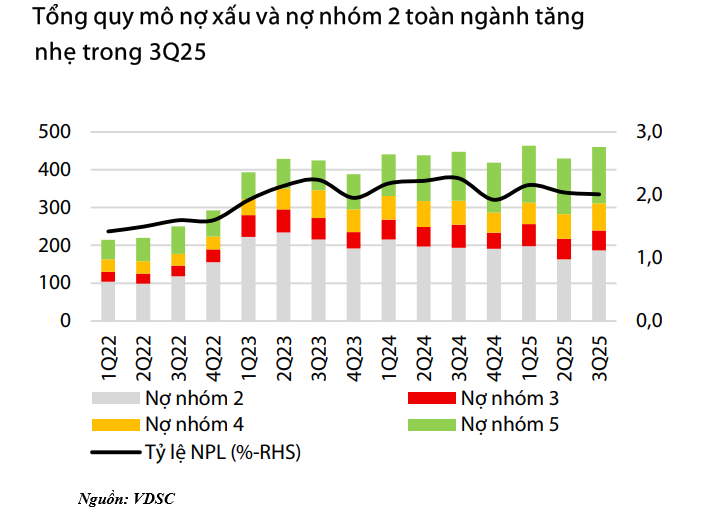

While credit activity and profits showed positive signs, asset quality signals were mixed. Total on-balance-sheet NPLs increased by VND 44 trillion to VND 274 trillion in the first nine months. Rapid credit expansion lowered the system-wide NPL ratio to 2.01%.

Loan loss provisions increased by only VND 23 trillion, reducing the NPL coverage ratio (LLR) to 84% from 2024 year-end, though recovering slightly from 79.8% in Q2 2025.

Individually, CTG, TCB, ACB, and STB improved asset quality through enhanced NPL recovery and provisioning. Conversely, MBB, VPB, and SHB saw NPL increases, largely technical or industry-specific.

A key concern is Group 2 loans, an early warning sign before NPL classification. In Q3, net Group 2 loans surged by over VND 50 trillion, reversing the Q2 decline. Causes include rising repayment pressure from higher deposit rates, maturing restructured loans, and risks in real estate, trade, and construction.

The Group 2 loan increase indicates credit quality requires close monitoring, especially with deposit rates showing no decline and sustained funding cost pressure. Without timely intervention, some Group 2 loans may become NPLs in Q4 2025 or early 2026, impacting provisioning costs and bank performance.

Overall, the first nine months of 2025 marked strong banking sector acceleration, with positive signs like rapid credit growth, improved profits, and many banks returning to growth after a cautious 2024. However, challenges remain, including unsustainable liquidity, narrowing NIM, and rising Group 2 loans – factors that will shape bank prospects in Q4 and beyond.

The growth race is thus shifting from credit volume and profits to risk management, capital balancing, and macroeconomic resilience. Banks with strong retail foundations and capital positions will maintain advantages, while those facing funding cost pressures or unstable asset quality will encounter challenges ahead.

Credit Growth in Ho Chi Minh City and Dong Nai Surges 10.37% Over 10 Months

By the end of October 2025, the total credit outstanding in Ho Chi Minh City and Dong Nai Province reached nearly 5.53 quadrillion VND, marking a 1.19% increase from the previous month and a 10.37% surge compared to the end of the previous year.

Masan Consumer: Surging Growth Hand in Hand with Sustainable Development

In the fiercely competitive fast-moving consumer goods (FMCG) sector, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) stands out as a rare gem in Vietnam’s market. The company not only sustains profitability at the highest levels in the region but has also been recognized by S&P Global as one of the world’s leading sustainable FMCG enterprises.

Empowering Financial Growth: Banks Secure Capital Flow for Economic Development

Credit recovery is soaring and is projected to sustain robust growth, fueled by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is pivotal in achieving the ambitious GDP growth target of 8% by 2025. The banking sector continues to strengthen its financial capabilities, solidifying a robust foundation to support its growth strategies and meet the economy’s capital needs.