Global Trade Fragmentation Benefits Vietnam

Global Trade Fragmentation, Vietnam Continues to Benefit

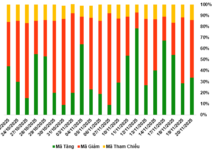

As 2025 draws to a close, there are many positive signs. The US-China trade tensions have eased, and the US tariffs on Vietnamese exports have dropped to 20%. Globally, international trade flows are diversifying: China’s exports are shifting from North America to Latin America, Europe, and Africa, while goods from Southeast Asia, including Vietnam, continue to increase their presence in the North American market.

Global Trade Map

FDI into Manufacturing

How will these new trends impact Vietnam’s exports? The answer varies by region:

- The US will remain Vietnam’s largest export market, with stable demand helping importers maintain orders as tariff risks decrease.

- Latin America is increasing imports of consumer electronics primarily from China, but Vietnam could become a supplementary supplier.

- As Europe increases purchases from Asia, Vietnam can capitalize by meeting EU regulations and origin requirements.

- Africa and the Middle East are increasing imports of agricultural and food products from Vietnam, offering opportunities for businesses that meet Halal standards.

- The intra-Asia region (ASEAN, South Korea, Japan) maintains stable demand with the advantage of shorter delivery times.

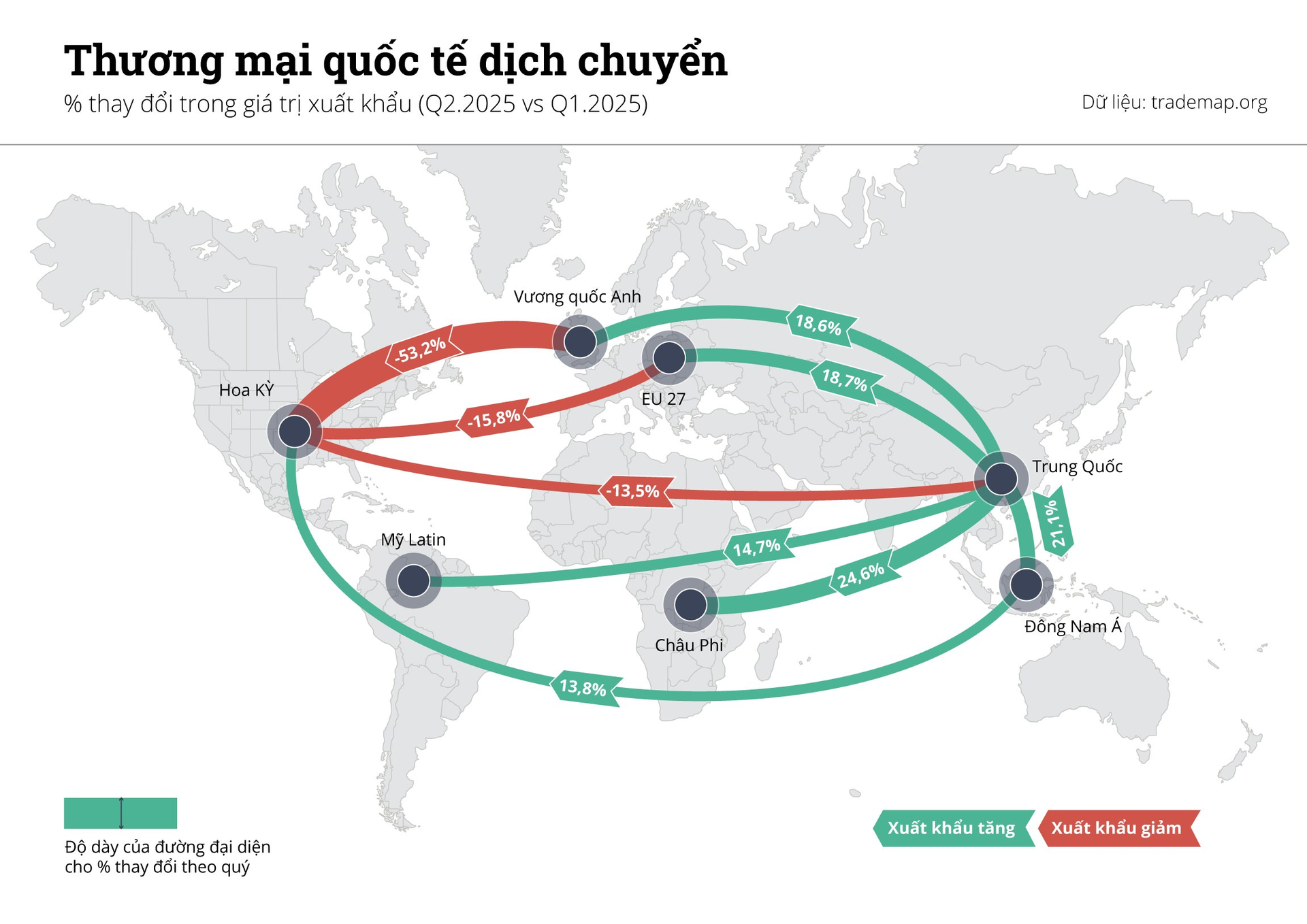

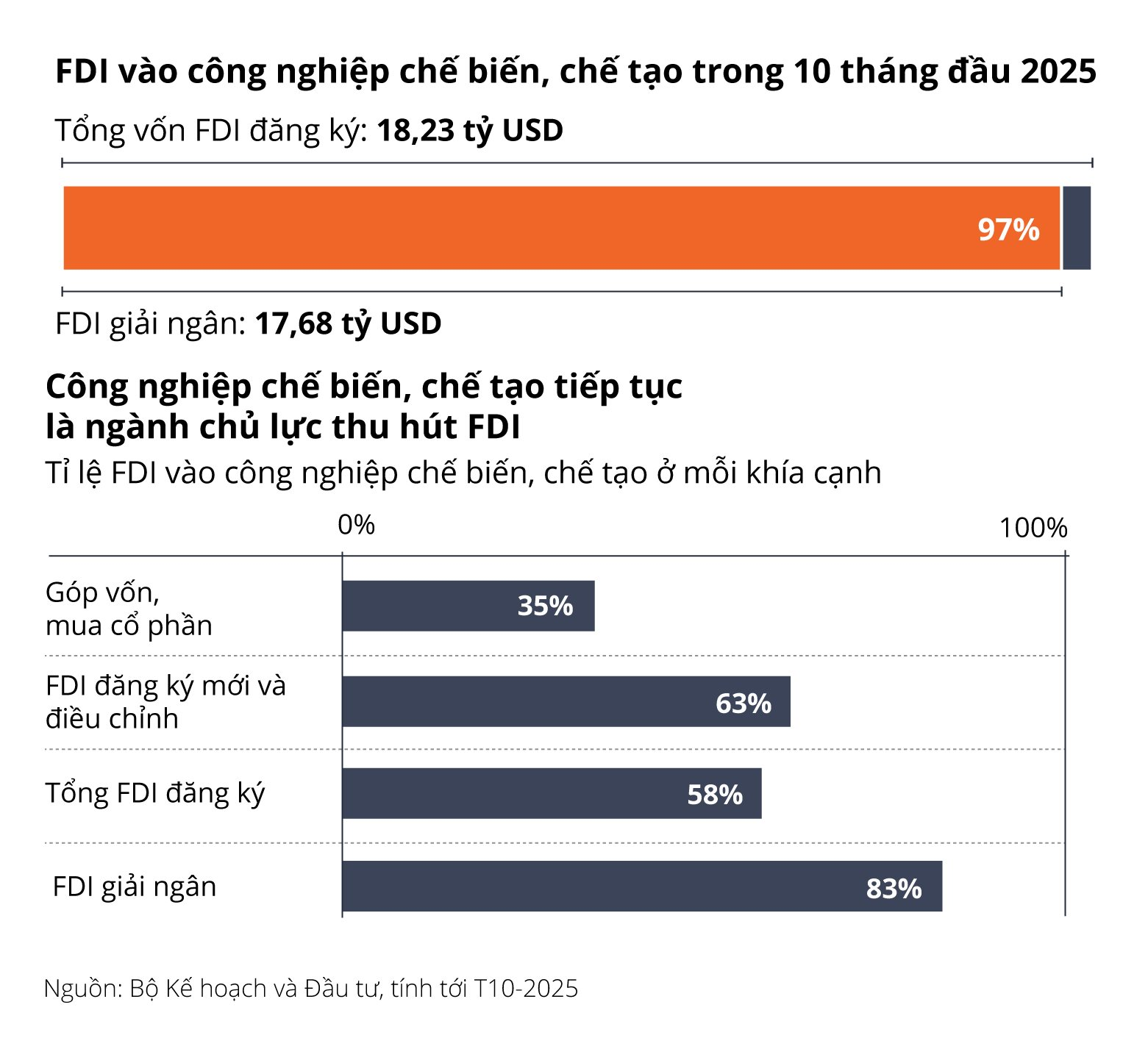

Domestically, legal and planning changes post-merger create new development spaces, increase transparency, and encourage green investment. The 10-month export turnover reached $391 billion, up 16.2% year-on-year, reflecting stable FDI flows, particularly in manufacturing. This remains a magnet for FDI despite global volatility, affirming Vietnam’s production capabilities and the position of its goods, providing a solid foundation for industrial real estate.

Where Does Vietnam’s Export Stand?

According to Bloomberg Economics’ Export Potential Index, Vietnam is a standout among emerging economies in replacing China. While ranking behind India and the US, Vietnam scores higher than Indonesia, Malaysia, and Thailand in labor costs and investment environment. Notably, Vietnam’s production capacity and energy are rated on par with China, a rare advantage in the region.

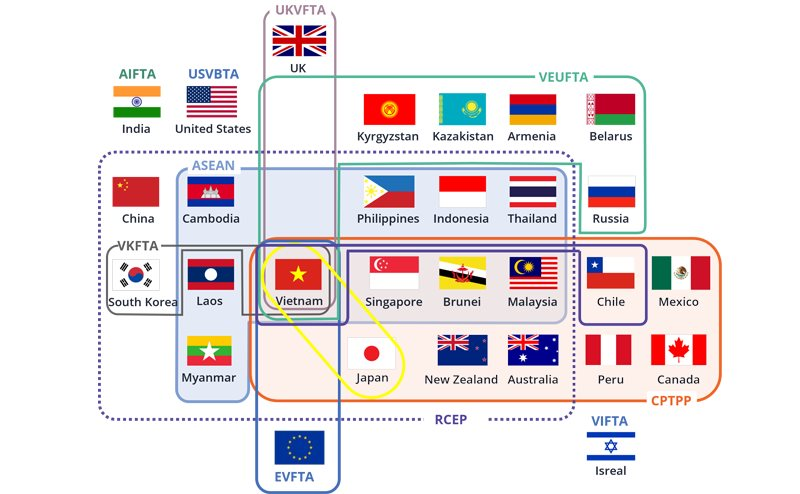

Another strength lies in its extensive integration policies. Vietnam’s network of 16 Free Trade Agreements (FTAs) covers 87% of the global economy, enabling “Made-in-Vietnam” goods to reach every continent.

Potential Candidates

Untitled

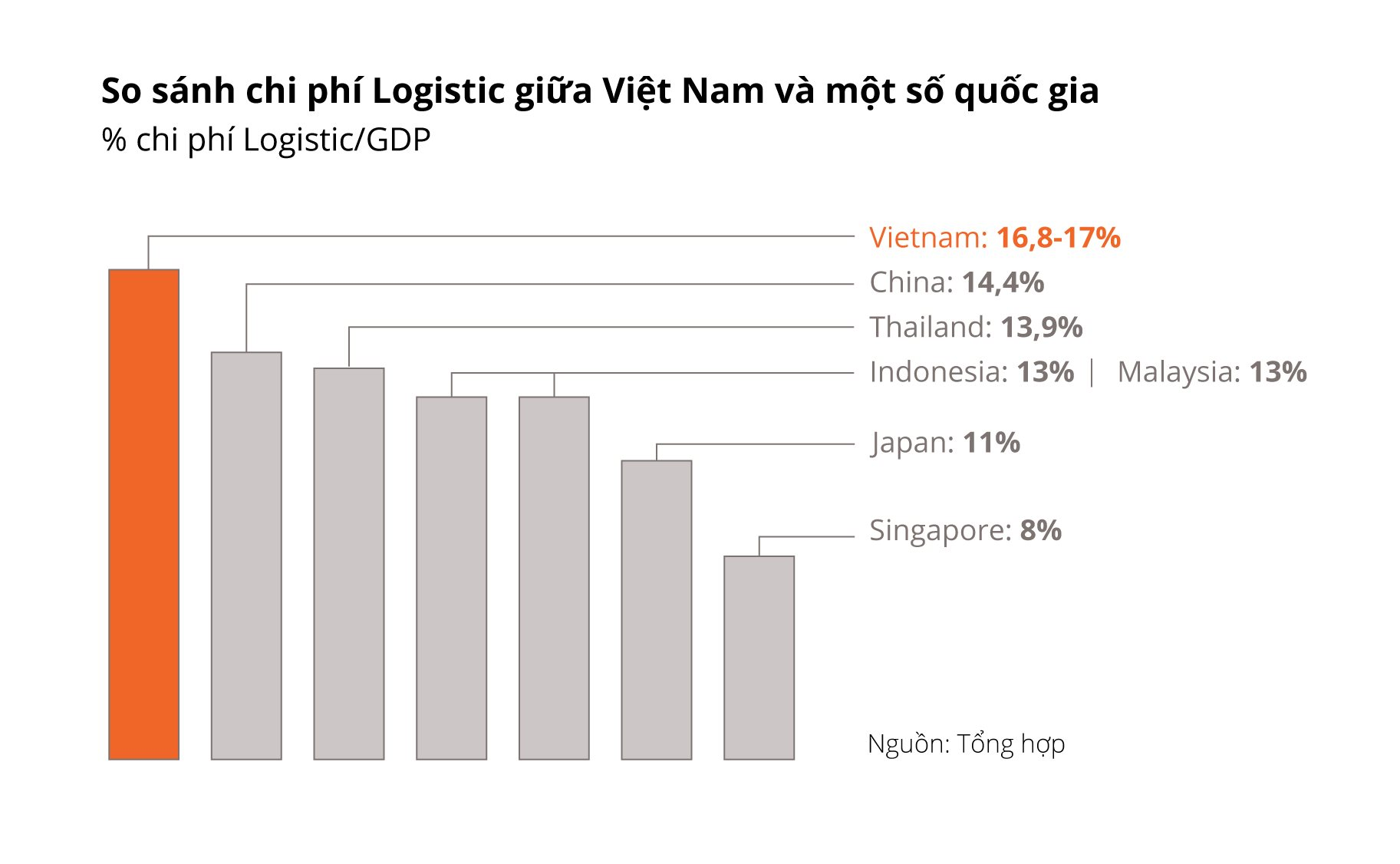

However, limitations remain, keeping Vietnam’s export value-added low. In 2023, Vietnam’s labor productivity was only 1/10th of Singapore’s and half of China’s. Logistics costs account for 16.8-17% of GDP, higher than regional peers, while the Logistics Performance Index (LPI) is only 3.3, 0.4 points behind China and ranking 43rd globally. Dependence on imported raw materials also hampers production autonomy: the auto industry imports 80% of components, and electronics localization is only 5-10%.

Logistics Cost

To advance further in the global value chain, Vietnam must focus on four areas: improving workforce quality, boosting inter-regional infrastructure investment (through public funds and PPP models), increasing raw material supply autonomy, and ensuring energy security, with LNG projects needing legal clarity for faster, more effective implementation.

Industrial Real Estate Supply and Demand Forecast

Financial pressures and sustainability goals are pushing manufacturers to focus more on efficiency, flexibility, and speed to reduce cost risks and optimize operations. Mr. Vu Minh Chi, Director of Industrial Services at Avison Young, notes: “Beyond basics like location, rent, area, and incentives, investors now prioritize legal services, customs procedures, and origin certifications. The goal is to maximize support for tenants to quickly operationalize projects and strengthen production capabilities for multi-market exports.”

Ready-built facilities like factories, warehouses, and logistics real estate (cold storage, transshipment hubs, last-mile delivery centers) continue to see high demand. Logistics services are becoming more professional, offering everything from import-export and inspection to labeling, packaging, and customs clearance.

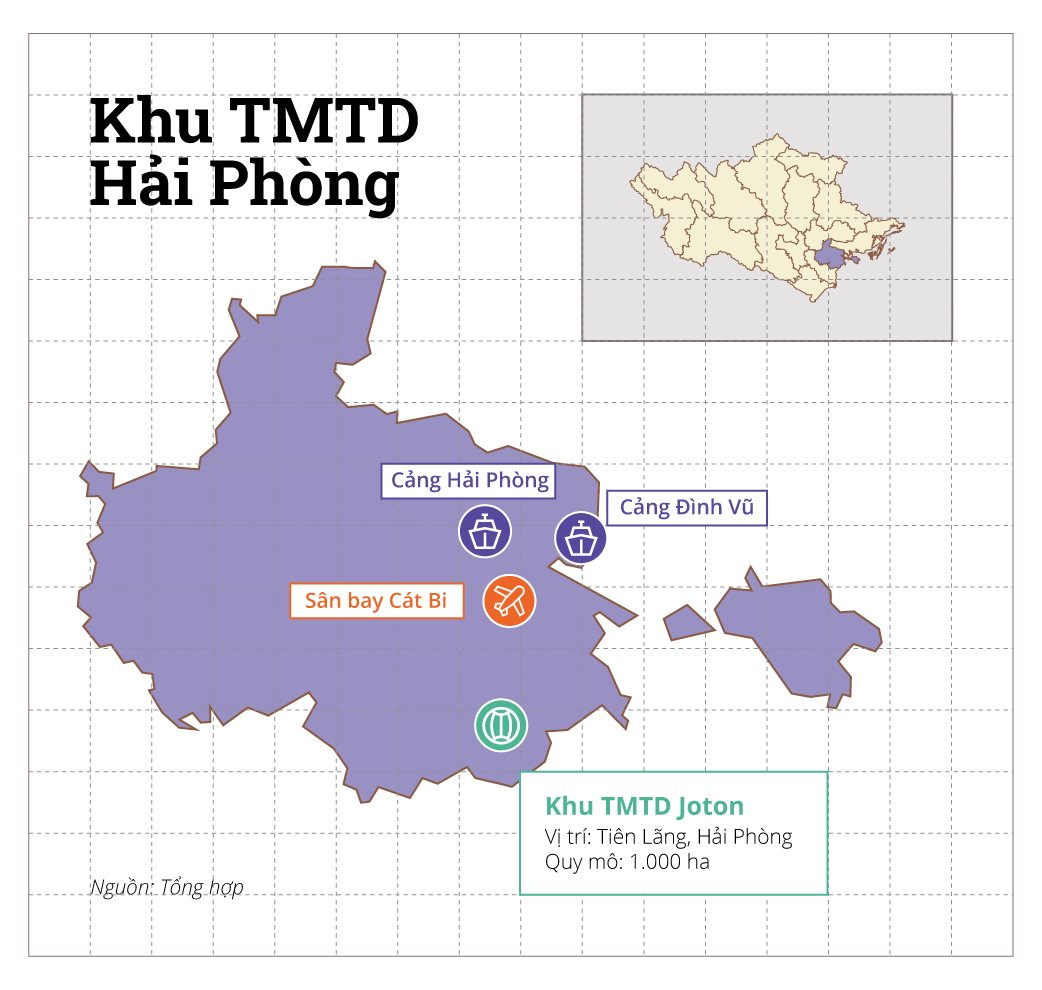

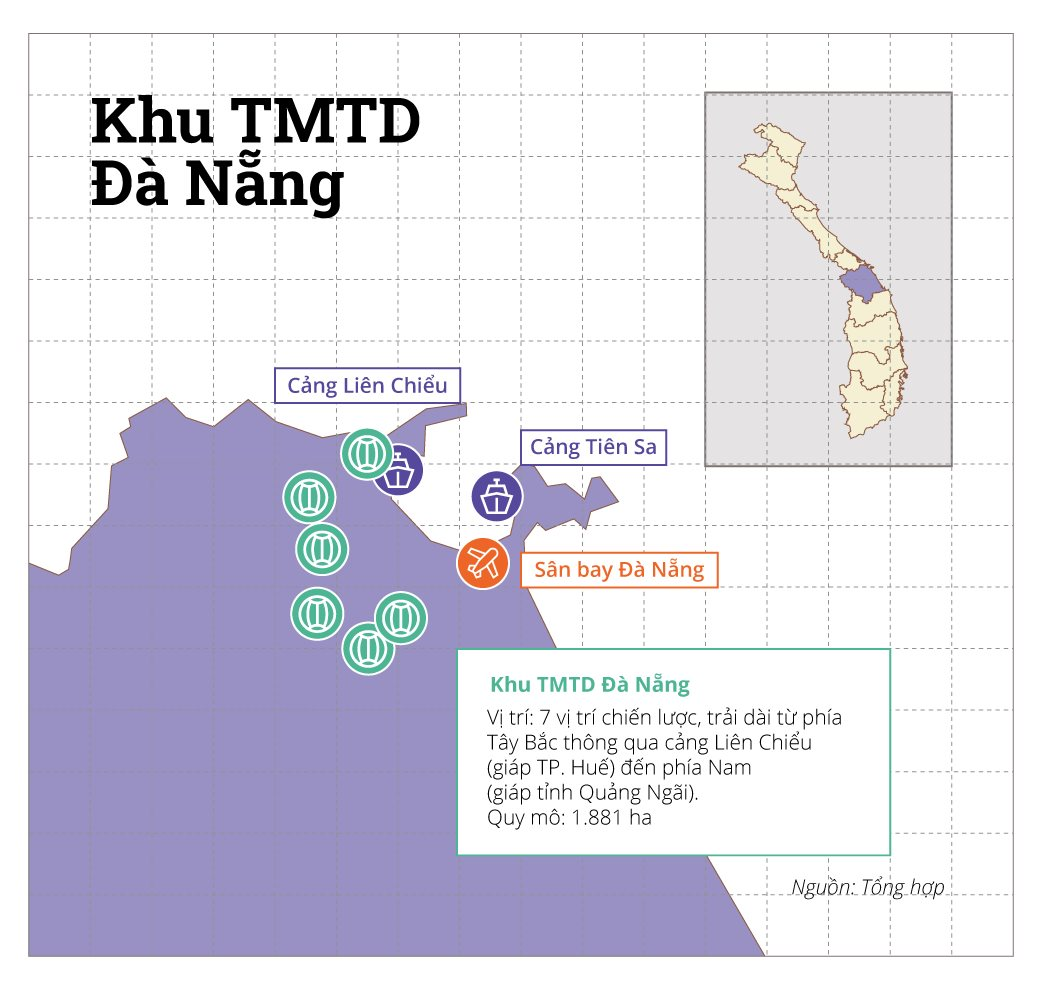

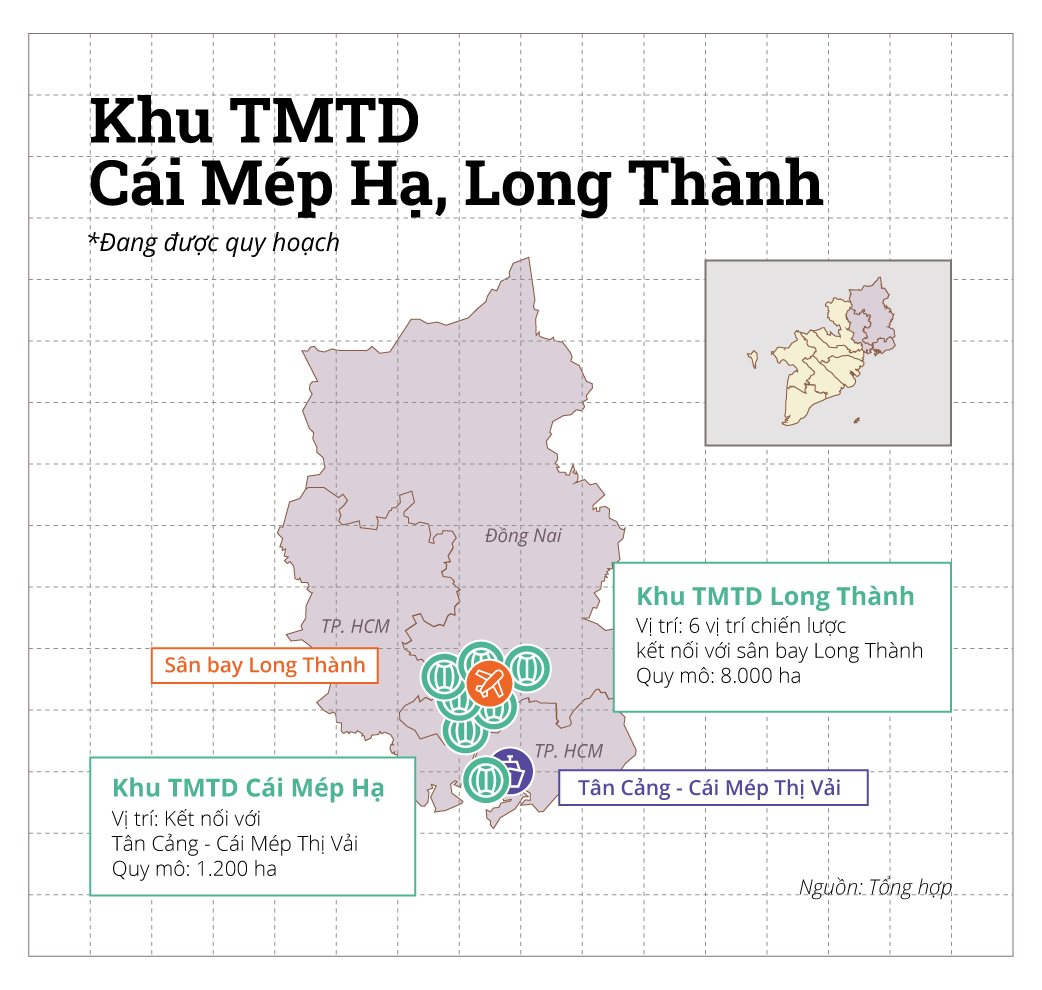

This growing demand for specialized services is driving industrial real estate supply from quantity to quality. Many developers now focus on providing tailored consulting services and developing green industrial parks, integrated logistics, and ESG-compliant models, rather than just basic infrastructure. Locations in Free Trade Zones (FTZs) near deep-sea ports or airports within 1-2 hours are top priorities for manufacturers.

Hai Phong FTZ

Da Nang FTZ

Cai Mep – Long Thanh FTZ

“Tier-1 markets will maintain their appeal, allowing developers to selectively attract high-tech tenants, who generate higher and more stable value. Meanwhile, tier-2 and tier-3 markets should balance green investment goals with existing infrastructure and workforce quality to increase occupancy. Investors increasingly prioritize environmental criteria, such as wastewater treatment systems, which significantly enhance asset value and capital attraction,” Mr. Chi adds.

Investment Map and New Competition Dynamics

“Boundary mergers and administrative restructuring have temporarily disrupted some decisions, prompting investors to reassess their investment maps. However, Vietnam is simplifying processes, aiming for a more dynamic, transparent trade, logistics, and investment market,” emphasizes David Jackson, Managing Director of Avison Young Vietnam. Staying aligned with planning, infrastructure, and development directions helps investors identify growth potential areas.

Specifically, infrastructure and energy project progress will significantly activate industrial real estate potential in those regions. For example, the Long Thanh Airport and Nhon Trach 3&4 LNG plants, expected to operate by 2026, will impact Dong Nai and the Southeast region. Industrial land rents in Dong Nai currently average $195-200/m²/term. Upon project completion, average rents in Dong Nai could exceed $200/m²/term.

However, Mr. David Jackson cautions: “Competition dynamics must shift as cost is no longer the primary FDI attraction.” The new 2026 land price schedule and the end of Corporate Income Tax incentives for industrial park tenants will change the rules. Instead, building trust and strengthening international cooperation through quality supply, value-added services, professionalism, and transparency is key. “Maintaining optimism while acting strategically is essential for stable and sustainable industrial real estate development,” Mr. Jackson concludes.

Veteran Bùi Xuân Tờ, 70, Develops $43 Million Industrial Park in Quảng Ninh

Veteran entrepreneur Bui Xuan To (70) is personally spearheading the implementation of the 1.057 trillion VND CCN Phuong Nam 2 project. The company led by Mr. To is also behind a series of other industrial real estate projects in Quang Ninh.