Illustrative Image

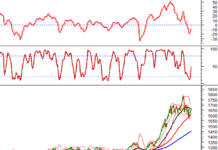

Russian crude oil exports to India plummeted in November as Indian refineries grew cautious amid new U.S. sanctions targeting major Moscow-based energy firms. This shift threatens to disrupt the robust energy trade between the two nations, which has flourished in recent times.

Data from Kpler reveals that from November 1 to 17, Russia’s average daily crude shipments to India stood at 672,000 barrels, a staggering 66% drop from October’s 1.88 million barrels per day. Overall, Russia’s total oil exports to all destinations fell by 28% year-on-year to 2.78 million barrels daily.

The primary driver behind this decline is the U.S. sanctions imposed on Rosneft and Lukoil, Russia’s top crude exporters, which collectively handle around 3 million barrels daily, with roughly one-third destined for India. Several Indian refineries have publicly declared they will avoid transactions with sanctioned entities.

Notably, nearly half of Russian oil tankers now operate without declaring their destinations, indicating exporters are navigating monitored or restricted routes to evade scrutiny.

The practice of ship-to-ship transfers in “non-traditional” locations, such as off Mumbai’s coast—far from the usual transfer hubs near the Strait of Singapore—is becoming more frequent. This reflects increasingly complex logistics aimed at sustaining operations despite tightening Western sanctions.

Beyond India, exports to China and Turkey—two other key Russian markets—also saw sharp declines last month. Shipments to China dropped 47% to 624,000 barrels daily, while Turkey’s imports fell 87% to 43,000 barrels daily. In October, these three markets collectively accounted for nearly 90% of Russia’s oil exports.

Given the month-long transit time for Russian oil to reach India, November’s shipments will only arrive in December, after the November 21 deadline for the U.S. to review certain sanctions exemptions.

To meet this deadline, Indian refineries accelerated processing of pre-contracted shipments while slashing new orders, causing Russia’s oil imports into India from November 1–17 to surge 16% above October’s average, briefly returning to 1.88 million barrels daily.

However, analysts predict this short-term spike will soon reverse. Sumit Ritolia, a refining analyst at Kpler, forecasts a significant drop in Russian oil flows to India in December and January as refineries adopt more cautious strategies.

Specifically, they are prioritizing deals with non-sanctioned traders, using blended products, and leveraging intricate logistics to minimize exposure to the U.S. Office of Foreign Assets Control (OFAC).

Experts warn that if sanctions persist or intensify, the global oil market—particularly in Asia—could witness a profound reshaping of trade flows. As one of the world’s largest crude importers, India may be compelled to diversify its supply sources further, with the U.S. emerging as a strategic alternative.

VinFast Limo Green Debuts in India: Locally Assembled, Launch Expected Next Year

VinFast Limo Green, set to debut in India next year, may be locally assembled, marking a significant step in the brand’s expansion strategy.

Russia’s Oil Exports Surge as Deadline for U.S. Sanctions Looms

Imports of Russian oil into India are surging, marking a significant shift in global energy dynamics. This trend underscores India’s strategic diversification of its energy sources, leveraging cost-effective alternatives amidst geopolitical tensions. As a result, Russia has emerged as a pivotal supplier, reshaping trade patterns and reinforcing India’s energy security.