Vietnam International Commercial Joint Stock Bank (VIB) has recently increased deposit interest rates across all terms from 1 to 36 months. Previously, in late October, VIB raised the interest rate by 0.2%/year for deposits with terms of 3–5 months.

Accordingly, online savings interest rates for terms of 1–2 months and 6–36 months have both increased by 0.2%/year. Notably, the 3–5 month term saw a significant rise of 0.75%/year, the most substantial increase in this adjustment.

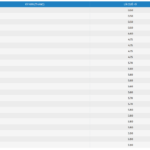

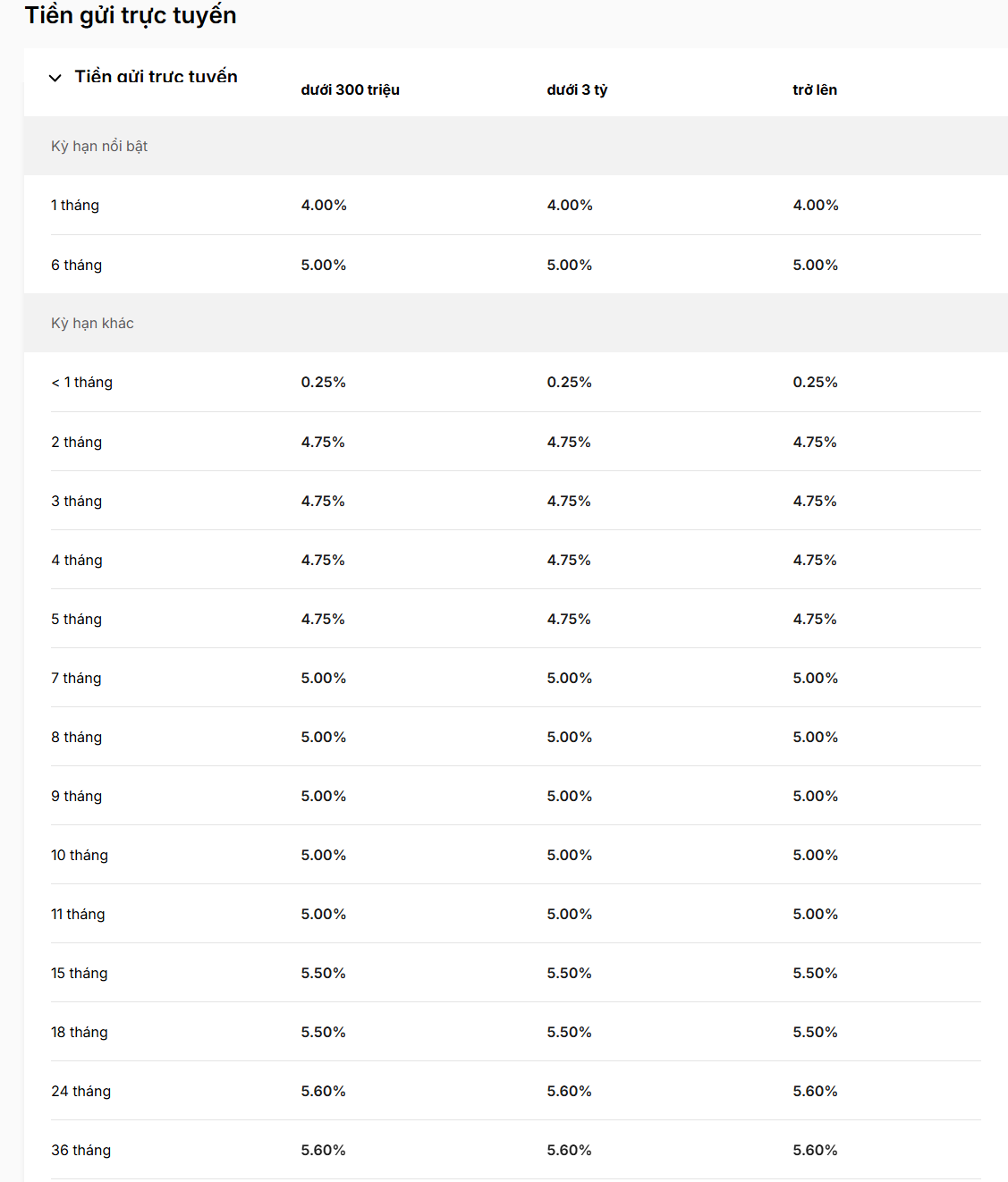

Following the update, VIB’s online savings interest rates for individual customers receiving interest at maturity have been significantly enhanced: the 1-month term is now at 4%/year; the 2-month term reaches 4.1%/year; and the 3–5 month term has hit the ceiling rate of 4.75%/year as per regulations for deposits under 6 months.

For longer-term deposits, interest rates have also improved markedly: 6–11 months are at 5%/year; 12–18 months have risen to 5.5%/year; and the highest rate currently stands at 5.6%/year for terms of 24–36 months.

Source: VIB

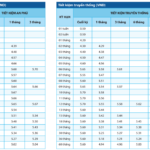

Since the beginning of November, approximately 20 banks have increased savings interest rates, including major banks such as Sacombank, VPBank, MB, HDBank, and Techcombank. Among these, some banks have raised interest rates for terms under 6 months to the regulatory ceiling (MBV, Nam A Bank, Bac A Bank, VIB).

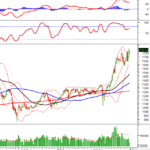

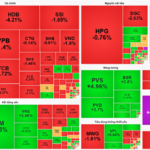

According to industry experts, the widespread increase in interest rates indicates that the capital mobilization race has intensified in the fourth quarter of 2025, particularly among joint-stock commercial banks. This is in anticipation of heightened capital demand at year-end and to narrow the gap between deposit and lending growth.

In a recently published macroeconomic report, Vietcombank Securities (VCBS) forecasts that deposit interest rates will trend upward toward the end of the year, especially among joint-stock commercial banks, driven primarily by two factors.

First, liquidity pressure within the banking system is increasing as credit is expected to accelerate strongly in the final months of the year, with full-year growth estimated at 18-20%. As of late October, credit had grown by 13.37% compared to the end of 2025, reflecting robust capital demand within the economy.

Second, the risk of USD/VND exchange rate fluctuations remains present, given the increased demand for foreign currency during the peak import season at year-end.

Consequently, VCBS predicts that deposit interest rates may rise again at some joint-stock commercial banks toward the end of the year to meet capital needs and manage systemic risks. However, rates are expected to remain at a low level in line with the policy of supporting economic growth.

Skyrocketing Savings Rates: New Bank Disrupts the Market

Interest rates for terms ranging from 2 to 5 months at this bank have been increased to 4.75% per annum, the maximum rate permitted by the State Bank of Vietnam for deposits under 6 months.

Banks Hike Deposit Interest Rates to Stabilize Exchange Rates and Balance Capital Flows

Interest rates on bank deposits have rebounded as a strategic move to stabilize exchange rates and balance capital flows, reflecting the mounting pressures from the foreign exchange market as 2025 draws to a close.