Billions in Hand, Yet Hesitant to Buy a Home

Amid soaring property prices in Hanoi, prospective homebuyers face mounting challenges in realizing their dream of homeownership. Even those with substantial savings find themselves struggling to secure a suitable property.

Mr. Hoang Thanh, an engineer from Ninh Binh working in Hanoi, shares his predicament. With a combined monthly income of VND 40 million, his family saves approximately VND 15 million after expenses. Currently, they have VND 2 billion in savings, supplemented by support from both families.

Despite their financial readiness, Mr. Thanh and his wife have spent months searching for an affordable home. Two-bedroom apartments in Tay Mo, Tu Liem, and Ha Dong districts start at VND 5 billion. Purchasing one would require a VND 3 billion bank loan, with monthly repayments exceeding VND 30 million—an unsustainable burden alongside living expenses.

“Property prices have surged in recent years and remain prohibitively high. If prices persist, my family cannot afford a home. Borrowing more feels risky due to potential interest rate hikes,” he explains.

Similarly, Mr. Tuan Anh, an office worker in Hanoi, faces challenges finding a home within his budget. With a monthly income of VND 30 million, his family saves around VND 12 million after expenses.

“We have VND 1.5 billion in savings and could secure an additional VND 1 billion from both families. However, two-bedroom apartments in Hanoi range from VND 4.5 to 5 billion. I fear rising interest rates will make loan repayments unmanageable,” he says.

Mr. Tuan Anh notes that some deep-alley homes in Hanoi, priced around VND 2.5 billion for 20m², lack legal documentation. Due to legal uncertainties and cramped spaces, his family hesitates to invest. They continue to monitor the market for better opportunities.

High Income, Yet Homeownership Remains Elusive

Ms. Do Thu Hang, Senior Director of Consulting and Research at Savills Hanoi, highlights the persistently high prices of primary market apartments. Even affordable housing, once priced at VND 30-40 million/m², now averages VND 50 million/m². Lower-priced options are scarce, significantly impacting the purchasing power of genuine homebuyers.

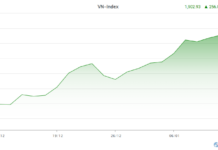

According to Ms. Hang, with an average annual household income of VND 250 million in Hanoi, buying a VND 4 billion apartment would require 18 years of saving without spending. While average incomes grow at 6% annually, secondary market property prices have risen by 17-20%, exacerbating affordability issues.

Dr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association (VARS), notes that the minimum income required to purchase an average-priced home in Hanoi is 2.3 to 10 times higher than the average household income.

Data from the General Statistics Office reveals that the average monthly income in Hanoi during Q3/2024 is VND 10.7 million. For a family of four with two working members, the total monthly income is approximately VND 21.4 million.

Skyrocketing property prices have pushed homeownership out of reach for many Hanoians, including middle- to high-income earners. Even young professionals earning VND 40-50 million monthly hesitate to buy without family support. The psychological burden of substantial loan repayments, especially with rising floating interest rates post-promotion, remains a significant deterrent.

Vietnam’s TOD Urban Revolution: Unlocking the Potential of Next-Gen Megacities

The Transit-Oriented Development (TOD) model is an essential strategy for creating modern, sustainable living spaces and addressing land scarcity in major urban areas, particularly in Ho Chi Minh City. By integrating urban development with public transportation, TOD fosters efficient land use, reduces congestion, and enhances quality of life, making it a cornerstone for future-proof cities.