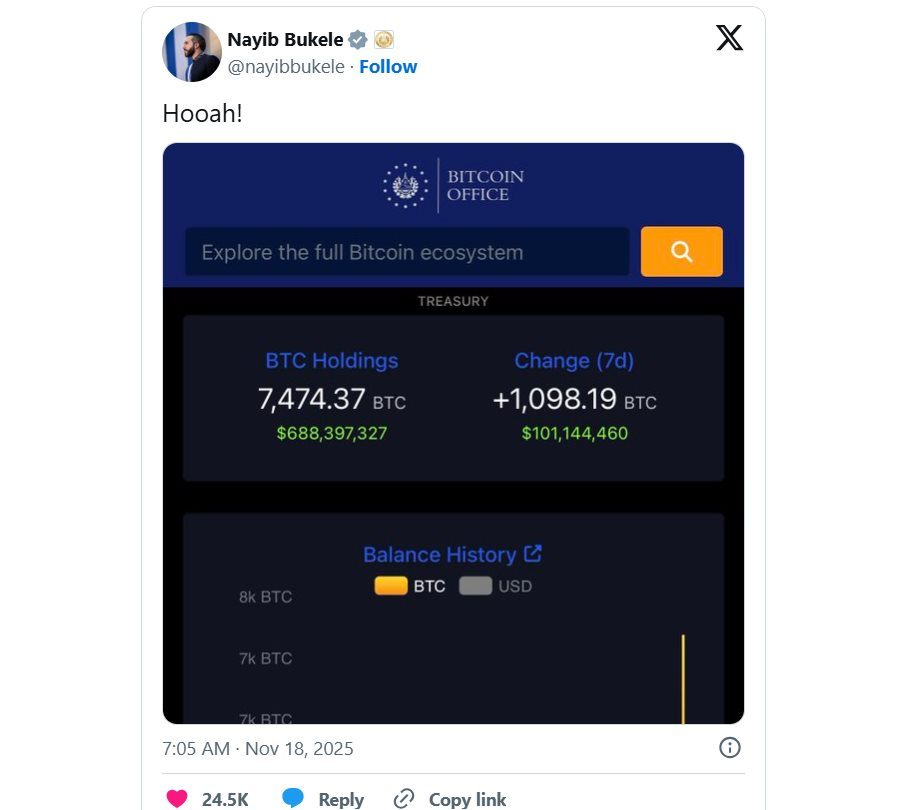

According to Invest, El Salvador has just completed one of the largest Bitcoin purchases ever made by a sovereign nation. In just 7 days, the Central American country added 1,098 BTC to its strategic reserves, capitalizing on the recent market correction to accumulate on a large scale.

President Nayib Bukele personally announced these transactions on social media, celebrating a new milestone in the country’s digital currency policy. With 7,474 BTC in its “digital treasury,” El Salvador solidifies its position as a pioneer in the wave of institutional Bitcoin adoption.

This latest purchase occurred during a period of high volatility, as BTC prices corrected after reaching an all-time high. Bukele’s strategy remains consistent: buying on dips to optimize the average cost basis—a classic approach of long-term investors. This underscores the Salvadoran government’s unwavering faith in Bitcoin’s potential as a store of value. On-chain data confirms the transactions, with funds flowing into state-managed wallets.

In the week ending November 14, BTC prices dropped over 9%; by Monday, the cryptocurrency traded below $92,000, even briefly dipping under $90,000.

An Accumulation Strategy Defying International Pressure

President Bukele appears to be betting that the future economic benefits of his Bitcoin strategy will justify the risks.

Since 2021, El Salvador has been the first country to legalize Bitcoin. Bukele views the cryptocurrency not just as a financial tool, but as a declaration of independence from international institutions like the International Monetary Fund (IMF) and the World Bank. He asserts that Bitcoin will help the nation break free from traditional financing systems, attract tech investments, and usher in a new era of “Bitcoin City”—a clean energy economic hub where digital currency transactions drive development.

For Bukele, Bitcoin is more than an investment asset; it’s a symbol of national sovereignty, a statement that El Salvador can defy the global financial order and thrive. However, observers caution that this gamble isn’t over. If Bitcoin crashes, gains could vanish in days, while El Salvador’s economy remains heavily reliant on remittances and foreign debt.

El Salvador has requested a $1.3 billion loan from the IMF to service its debt, but an agreement is unlikely as the country refuses to abandon Bitcoin.

“This is a nation searching for a silver bullet to cure all its ills,” remarked Jaime Reusche, Vice President of Risk Management at Moody’s. “Typically, such a silver bullet doesn’t exist.”

Bukele announced the country’s shift to Bitcoin at a conference in June 2021. Days later, he presented a three-page bill to Congress, drafted by a 27-year-old American cryptocurrency company owner. The legislation was approved by lawmakers in less time than a football match and took effect in September 2021.

Jose Garcia, a 52-year-old phone charger vendor in a bustling San Salvador square, sees no impact from the digital currency.

He downloaded the Chivo app, where the government deposited $30 into every user’s account to encourage adoption. He went to an ATM to convert it to USD and never opened the app again.

“Most people withdrew the $30 and that was it,” he said.

Byron Sandoval, a 23-year-old tattoo artist, sees Bitcoin’s potential and believes El Salvador could eventually profit from its early adoption. “In 10 to 15 years, the whole world will use it.”

However, in daily life, he finds Bitcoin too risky. He primarily uses cash, but when a client wants to pay with Bitcoin via Chivo, he asks them to convert it to USD first. Sandoval keeps all his funds in USD on the app for stability. “If they pay me in Bitcoin, I could lose money.”

Source: Invest, BI

Asia’s Crypto Derivatives Race: Singapore Bets on Futures, Hong Kong Opts for ETFs

Amidst the volatile digital asset market, SGX Derivatives, the derivatives arm of the Singapore Exchange (SGX), has adopted a cautious approach by exclusively opening its doors to institutional investors. This strategic move by SGX Derivatives reflects a dual strategy: actively engaging in the cryptocurrency market while safeguarding retail investors from the steep declines in digital assets by restricting product access to institutional players.

Silent Power Unloads Nearly $1.7 Billion in Bitcoin Just Before $90,000 Milestone

Bitcoin ETF inflows have witnessed a consistent net outflow trend over the past four consecutive sessions, spanning from November 12th to 17th.