Recently, JVC held an extraordinary shareholders’ meeting to approve several key initiatives, including a company name change, business sector diversification, and the continuation of a private placement offering.

In response to shareholder inquiries about the pharmaceutical sector’s direction, the company’s leadership highlighted the increasing saturation and fierce price competition in the medical equipment market, particularly in diagnostic imaging. This has necessitated a shift toward sectors with higher profit margins and long-term growth potential. JVC has chosen the pharmaceutical industry due to Vietnam’s significant and urgent demand for medicines, substantial market opportunities, high growth potential, and government incentives to boost domestic production and reduce import dependency.

Additionally, JVC leverages its established expertise, strong relationships with hospitals, clinics, and a nationwide healthcare partner network, providing a strategic advantage in expanding into pharmaceuticals. This diversification mitigates risks associated with over-reliance on a single sector. The transition aims to broaden the company’s healthcare ecosystem, integrating medical equipment and pharmaceuticals to deliver comprehensive healthcare solutions to the public.

For the 2026-2031 period, the leadership outlined the following strategy: JVC will focus on importing, registering, and distributing essential specialty pharmaceuticals in Vietnam. The company will utilize its existing healthcare partner network (hospitals, clinics) to optimize product distribution. Simultaneously, JVC will collaborate with reputable domestic and international pharmaceutical companies to facilitate technology transfer and achieve self-sufficiency in production.

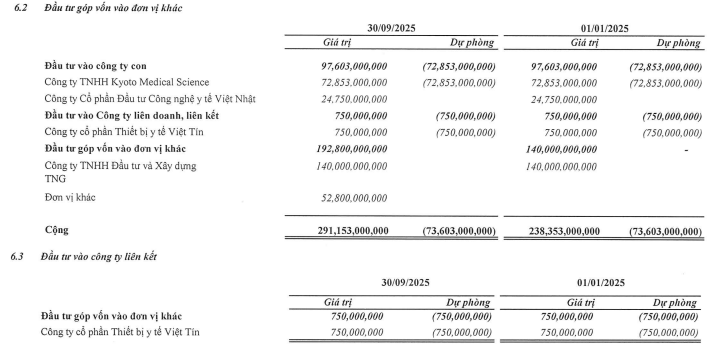

As of September 30, JVC holds investments in two subsidiaries: Kyoto Medical Science LLC (100% ownership) and Vietnam-Japan Medical Technology Investment JSC (99% ownership). Additionally, the company holds a 25% stake in Vietnam-Japan Medical Equipment JSC and has invested nearly VND 53 billion in other entities.

JVC’s total investment in subsidiaries and associates exceeds VND 291 billion. Notably, the company has set aside nearly VND 73 billion in provisions related to its investment in Kyoto Medical Science.

|

JVC’s Capital Contributions as of September 30, 2025 (Unit: VND)

Source: JVC Parent Company Financial Statements

|

Regarding business performance, JVC’s leadership reported that according to the Q3/2025 financial statements, the company achieved consolidated revenue of approximately VND 478 billion and consolidated net profit of around VND 40 billion in the first nine months of the year. This represents a 13% increase in revenue and a 66% rise in net profit compared to the same period in 2024 (VND 424 billion and VND 23.9 billion, respectively).

| JVC’s Business Performance |

The leadership expressed confidence that, under any circumstances, 2025’s business results will outperform those of 2024.

Moving forward, JVC plans to execute a private placement of 25 million shares, a plan approved by shareholders in 2024 but not yet completed. The sole investor, VII Holding JSC, is expected to hold an 18.2% stake in JVC post-offering. VII Holding has a close association with JVC, as Mr. Vu Dinh Do, Chairman of VII Holding’s Board of Directors, is married to Ms. Nguyen Thi Hanh, a member of JVC’s Board of Directors.

At the anticipated offering price of VND 10,000 per share, JVC aims to raise VND 250 billion. Of this amount, VND 150 billion will be invested in Vietnam-Japan Medical Technology Investment JSC, a 2021-established entity specializing in multi-specialty clinics, dental services, and headquartered in Hanoi.

The remaining VND 100 billion will be allocated to purchasing medical equipment and supplies.

– 16:28 19/11/2025

VCI Sets Private Placement Price at VND 31,000, Attracting Foreign Institutions Willing to Invest Hundreds of Billions

The Board of Directors of Vietcap Securities Corporation (HOSE: VCI) has recently passed a resolution to issue 127.5 million private placement shares, aiming to increase its charter capital to VND 8,501 billion. The offering has attracted significant interest, with 69 investors, including both institutions and individuals, expressing their intent to purchase tens of millions of shares.

Traphaco (TRA) Appoints New Female CEO from Sales & Marketing Amid 79% Profit Surge

Traphaco (TRA) has appointed Ms. Dao Thuy Ha, Deputy General Director in charge of Sales & Marketing, as the new General Director. This decision follows the company’s impressive 79% profit growth in Q3 2025.

VCI Approves Private Placement of Up to 127.5 Million Shares, Anticipating 10-20% Profit Surge in Annual Plan

On the afternoon of November 7thOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE:On the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in theOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in the company’s business prospects and changes in executive leadership.