Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 74 million shares, equivalent to a value of more than 20.6 trillion VND; the HNX-Index reached over 71 million shares, equivalent to a value of more than 1.5 trillion VND.

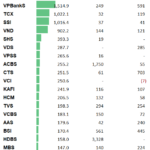

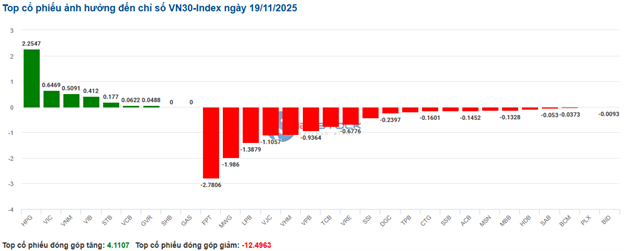

The VN-Index opened the afternoon session with buying interest resurfacing, helping the index recover slightly. However, sellers unexpectedly increased pressure, causing the VN-Index to plummet and close in pessimistic red. In terms of impact, VPB, VCB, TCB, and FPT were the most negatively influential stocks on the VN-Index, contributing to a decline of over 3.7 points. Conversely, HDB, VIC, HPG, and VNM maintained their green status, adding more than 1.4 points to the index.

| Top 10 Stocks Most Impacting the VN-Index on November 19, 2025 (in points) |

Similarly, the HNX-Index experienced a rather pessimistic trend, with negative impacts from stocks such as SHS (-3.06%), MBS (-2.62%), CEO (-2.69%), and KSV (-1.1%)…

| Top 10 Stocks Most Impacting the HNX-Index on November 19, 2025 (in points) |

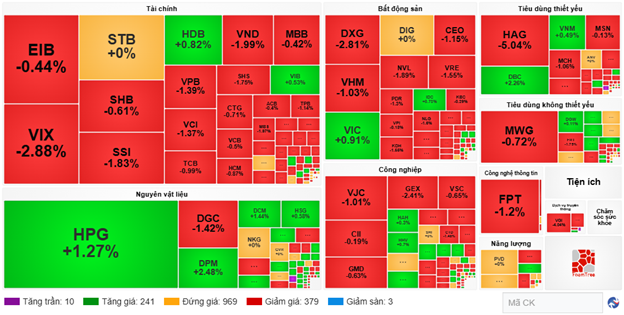

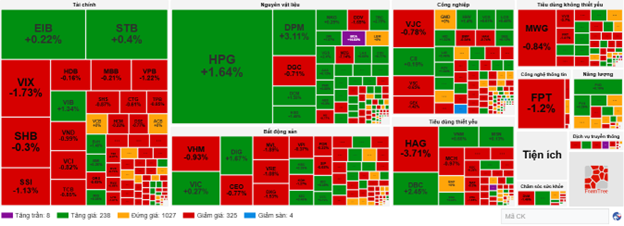

At the close, the market declined with red dominating all sectors. The communication services sector saw the most significant decline, at 3.6%, primarily due to stocks like VGI (-4.66%), FOX (-0.16%), CTR (-0.54%), and YEG (-1.64%). The technology and finance sectors followed with declines of 1.9% and 0.86%, respectively. Notable selling pressure was observed in stocks such as FPT (-2%), CMG (-0.52%), ELC (-0.73%), DLG (-0.36%), VIX (-3.85%), SSI (-2.53%), VND (-3.72%), VPB (-2.43%), TCB (-1.56%), and MBB (-0.84%). The real estate sector also ended in the red, with a decline of 0.27%.

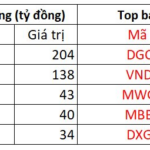

In terms of foreign trading, foreign investors continued to net sell over 651 billion VND on the HOSE, focusing on stocks like DGC (188.98 billion), VND (143.63 billion), MWG (104.61 billion), and MBB (88.33 billion). On the HNX, foreign investors net sold over 8.2 billion VND, concentrating on SHS (15.32 billion), NTP (4.3 billion), DTD (3.83 billion), and PVI (2.84 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Red Dominates

No significant recovery efforts were seen by the end of the morning session. At the midday break, the VN-Index fell by more than 6 points (-0.39%), to 1,653.51 points; the HNX-Index dropped to 266.56 points, a decline of 0.3%. Market breadth favored sellers, with 382 stocks declining, 251 advancing, and 969 unchanged.

Among the top 10 stocks influencing the VN-Index, VHM had the most negative impact, reducing the index by 0.92 points. TCB and CTG followed, pulling the index down by an additional 1.82 points. On the positive side, VIC stood out with a contribution of 1.77 points.

| Top 10 Stocks Most Impacting the VN-Index in the Morning Session of November 19, 2025 (in points) |

Most sectors were engulfed in red. The communication services sector temporarily led the decline with a 3.12% drop due to negative performances from leading stocks like VGI (-4.04%), FOX (-0.16%), CTR (-1.08%), and ICT (-3.88%).

Large-cap sectors such as finance, industry, and real estate also weighed heavily on the index, with numerous stocks declining by over 1%, including VIX, SSI, VPB, VCI, SHS, VND, MBS, TPB; VJC, GEX, CTD, PC1, VGC, VTP; DXG, VHM, NVL, VRE, CEO, PDR, KDH, and NLG.

On the positive side, the materials sector temporarily led the market, thanks to strong contributions from stocks like HPG (+1.27%), DPM (+2.48%), DCM (+1.44%), and VGS (+1.71%). However, many stocks remained in the red, including DGC (-1.42%), KSV (-1.04%), MSR (-0.44%), and DDV (-2.37%).

Source: VietstockFinance

|

Foreign investors net sold 848.51 billion VND across all three exchanges. Selling pressure was concentrated on two stocks: DGC and MWG, with values of 164.53 billion and 149.29 billion, respectively. Leading the net buying list was HPG, with a value of 201.44 billion VND, far ahead of other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling on November 19, 2025 |

10:30 AM: Intense Tug-of-War

Investor hesitation led to major indices fluctuating around the reference point. As of 10:30 AM, the VN-Index fell by over 4 points, trading around 1,655 points. The HNX-Index saw a slight decline, trading around 266 points.

Stocks in the VN30 basket showed mixed movements, but selling pressure remained dominant. Specifically, FPT, MWG, LPB, and VJC collectively reduced the index by 2.78 points, 1.98 points, 1.38 points, and 1.1 points, respectively. Conversely, HPG, VIC, VNM, and VIB maintained their green status, contributing over 3.8 points to the VN30-Index.

Source: VietstockFinance

|

Red dominated most sectors. Notably, the materials sector showed a positive reverse trend with the strongest market increase. Specifically, HPG rose by 1.45%, NTP by 2.22%, GVR by 0.88%, and DPM by 3.11%. However, red persisted in stocks like DGC (-0.71%), MSR (-1.31%), and DDV (-2.03%).

The banking sector saw a slight decline, with mixed performances among top banks. SHB fell by 0.3%, HDB by 0.16%, and VPB by 1.04%. On the positive side, STB, VIB, and VCB remained in the green, though with modest gains.

Similarly, the real estate sector showed mixed movements. On the positive side, VIC rose by 0.45%, KBC by 0.43%, and DIG by 1.67%. Meanwhile, VHM fell by 1.03%, CEO by 0.77%, and NVL by 1.89%, remaining in the red.

Compared to the opening, strong polarization continued, with sellers maintaining the upper hand. The number of declining stocks was 325, while advancing stocks numbered 238.

Source: VietstockFinance

|

Opening: Continued Tug-of-War in Early Trading, Strong Financial Sector Polarization

As of 9:30 AM, major indices moved in opposite directions and fluctuated around the reference point.

The early session highlighted red dominating most financial sector stocks. Selling pressure concentrated on stocks like SHB, VIX, HDB, and SSI, with declines of less than 1%. A few stocks maintained green, including VIB, VCI, BSI, and CTS, with gains of less than 1%.

Large-cap stocks like VHM, FPT, and CTG weighed on the market, collectively pulling the index down by over 1.5 points. Conversely, VIC, HPG, and GVR led the upward trend, contributing nearly 4.5 points.

VN30 stocks faced selling pressure, with most in the red. Declining stocks included MWG (-0.12%), FPT (-1.1%), VJC (-1.23%), and MSN (-0.25%). A few maintained green, such as HPG (+0.55%), VIB (+1.07%), and DGC (+0.51%).

– 15:20 19/11/2025

Vietstock Daily 20/11/2025: Is Market Volatility Emerging?

The VN-Index has paused its upward momentum, retesting the middle band of the Bollinger Bands. This level serves as a critical support threshold that the index must hold to sustain its short-term recovery. Meanwhile, both the Stochastic Oscillator and MACD continue to signal buying opportunities, supported by gradually improving liquidity. Should trading volume surpass its 20-day average in upcoming sessions, the index’s outlook would turn increasingly positive.

Market Sell-Off Intensifies as Profit-Taking Pressure Mounts

Vietnam’s stock market took a sharp downturn on November 19th, with the VN-Index plunging below the 1,650-point mark.

How Record-Breaking Stock Markets Have Fueled Bank Performance

The third quarter of 2025 marks a historic milestone as the VN-Index surpasses its peak, with the banking sector playing an irreplaceable leading role. Interestingly, the vibrant stock market has also delivered a powerful boost to the business operations of banks, particularly those owning securities companies.