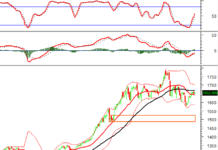

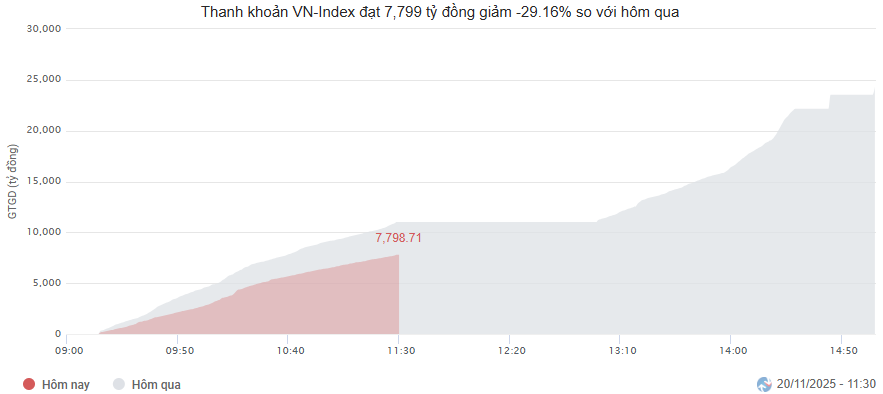

Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 592 million shares, equivalent to a value of more than 16.7 trillion VND; the HNX-Index reached over 47.9 million shares, equivalent to a value of more than 1 trillion VND.

The VN-Index opened the afternoon session with selling pressure resurfacing, narrowing the index’s gains from earlier in the session. However, buyers quickly regained control, helping the index stay above the reference level until the end of the session and closing in the green. In terms of influence, VIC, VJC, VHM, and VPB were the most positively impactful stocks on the VN-Index, contributing over 10.1 points of growth. Conversely, HPG, MWG, TCB, and CTG faced selling pressure, reducing the index by more than 1.6 points.

Source: VietstockFinance

|

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by stocks such as KSF (-0.51%), VIF (-6.29%), HUT (-1.69%), and SHS (-0.9%).

Source: VietstockFinance

|

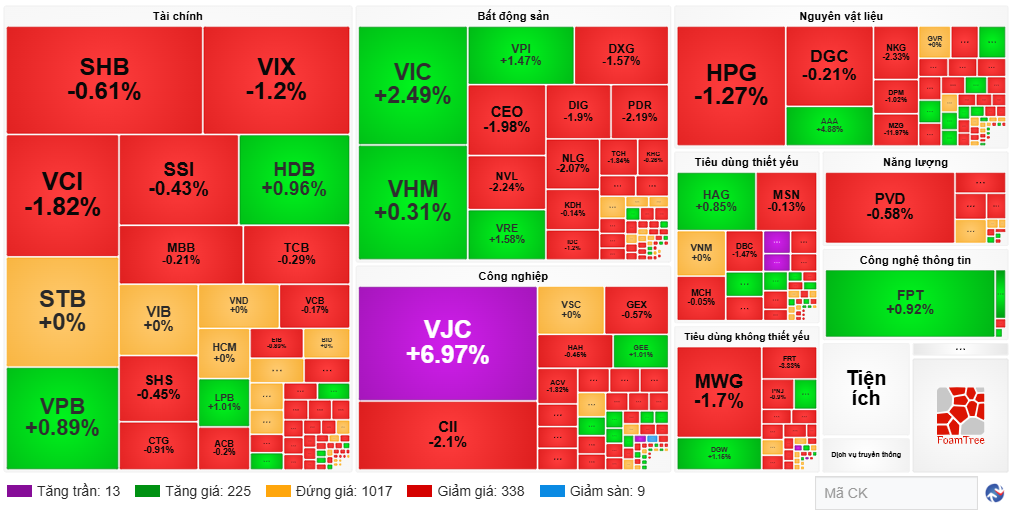

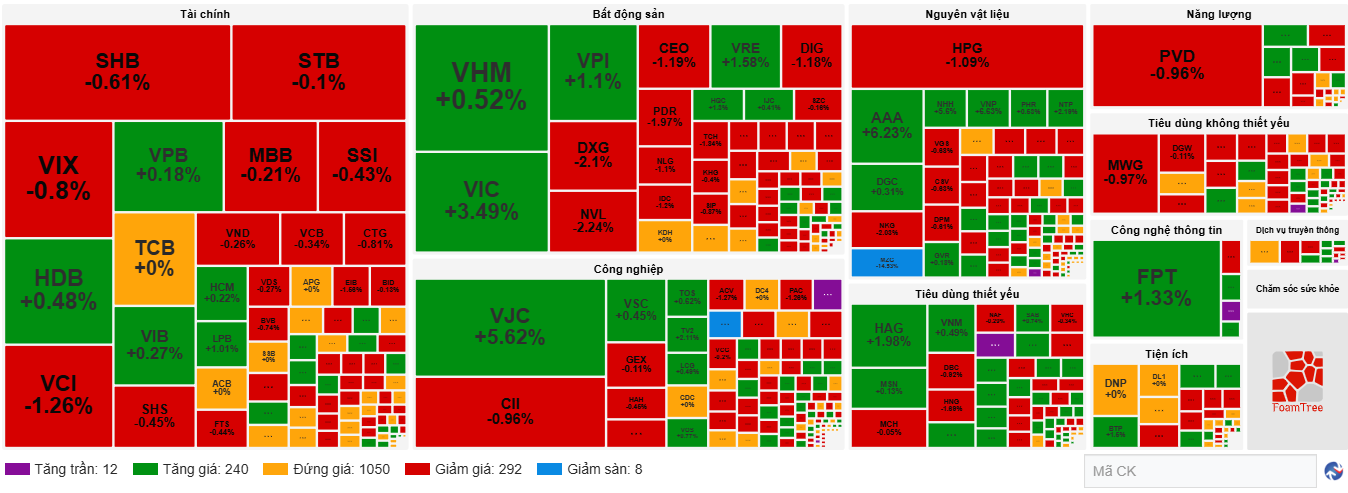

At the close, the market rose by 0.2%, but red dominated most sectors. Specifically, the real estate sector led the market with a 1.7% increase, primarily driven by VIC (+3.4%), VHM (+0.93%), CEO (+1.27%), KDH (+0.14%), and KBC (+2.32%). The information technology and industrial sectors followed with gains of 0.98% and 0.28%, respectively. Conversely, the communication services sector saw the most significant decline, dropping 2.45%, mainly due to VGI (-3.18%), CTR (-1.08%), and FOX (-0.49%).

In terms of foreign trading, foreign investors turned net buyers with over 237 billion VND on the HOSE, focusing on VPB (181.11 billion), SSI (134.86 billion), VIC (123.45 billion), and VIX (81.63 billion). On the HNX, foreign investors were net sellers with over 3.8 billion VND, concentrated in SHS (8.8 billion), VTZ (1.73 billion), VFS (1.64 billion), and PVI (1.13 billion).

Source: VietstockFinance

|

Morning Session: Gains Narrowed

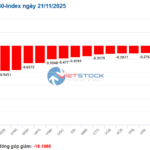

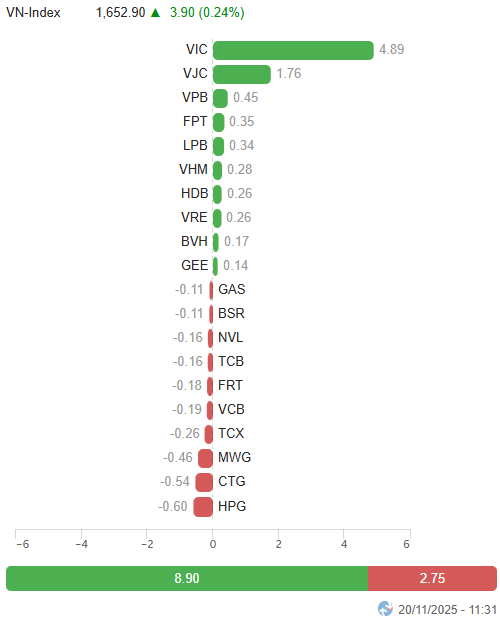

The upward momentum showed signs of cooling toward the end of the morning session. From a peak gain of over 11 points, the VN-Index narrowed its increase to nearly 4 points (+0.24%), closing the mid-session at 1,652.9 points. Meanwhile, the HNX-Index fell by 0.48%, ending at 263.76 points. Market breadth favored sellers, with 347 decliners and 238 advancers.

Investor sentiment remained cautious, with HOSE trading volume reaching only over 264 million units, equivalent to nearly 7.8 trillion VND, down 29.16% from the previous session. The HNX recorded a volume of over 23 million units, equivalent to more than 498 billion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing 4.89 points. VJC followed, adding 1.76 points to the index. Conversely, HPG, CTG, and MWG were the most negatively impactful, reducing the index by 1.6 points.

Source: VietstockFinance

|

Divergence continued to dominate, with sectors fluctuating within narrow ranges. The communication services sector temporarily lagged, falling 2.01%, influenced by VGI (-2.67%) and CTR (-1.84%).

Large-cap sectors like finance and industry exerted significant pressure on the index, with many stocks facing strong adjustments: VIX (-1.2%), VCI (-1.82%), TCX (-1.11%); ACV (-1.82%), CII (-2.1%), VGC (-1.64%), BMP (-3.25%), VCG (-1.02%), and SCS (-1.06%). Meanwhile, green returned to HDB (+0.96%), VPB (+0.89%), LPB (+1.01%); GEE (+1.01%), TV2 (+3.38%), and VJC rising to its upper limit.

Conversely, real estate temporarily led the market with a 1.04% increase, thanks to positive contributions from VIC (+2.49%), VRE (+1.58%), SJS (+1.16%), and VPI (+1.47%). The rest of the sector remained in the red, including NVL (-1.92%), PDR (-2.41%), DXG (-1.57%), TAL (-1.69%), TCH (-1.84%), and NLG (-2.07%).

Source: VietstockFinance

|

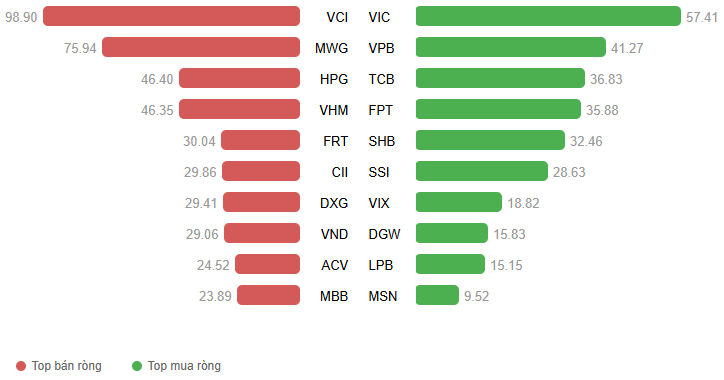

Foreign investors continued to be net sellers, with a value of over 400 billion VND across all three exchanges. Selling pressure concentrated on VCI and MWG, with values of 98.9 billion and 75.94 billion, respectively. Meanwhile, VIC led the net buying with a value of 57.41 billion VND.

Source: VietstockFinance

|

10:30 AM: Hesitant Trading, Mixed Index Movements

Investors remained hesitant, with trading volume showing no significant improvement, and major indices oscillating around the reference level. As of 10:30 AM, the VN-Index rose by 6.9 points, trading around 1,655.9 points. The HNX-Index fell by 1.04 points, trading around 263.99 points.

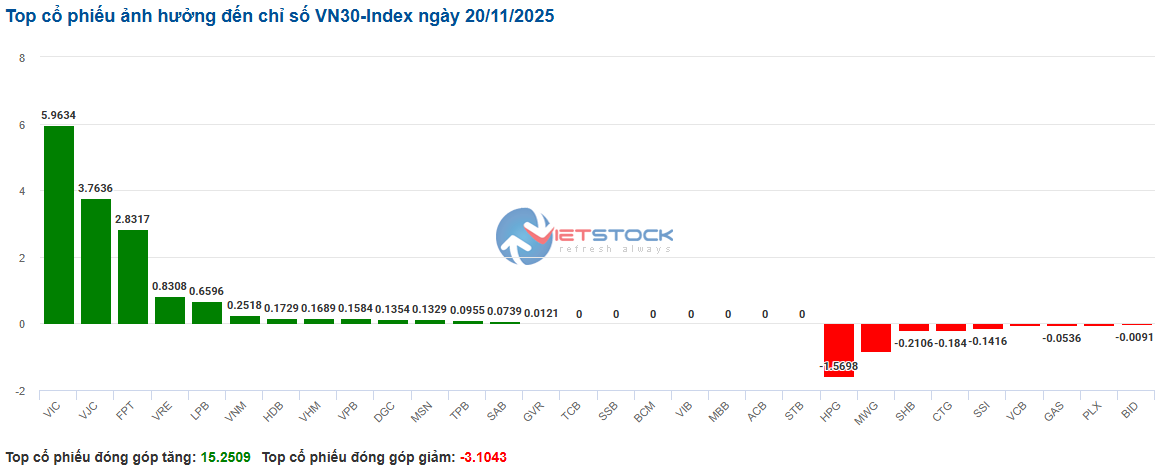

Stocks in the VN30 basket saw mixed movements, but buying pressure slightly dominated. Specifically, VIC, VJC, FPT, and VRE contributed 5.96 points, 3.76 points, 2.83 points, and 0.83 points, respectively, to the index. Conversely, HPG, MWG, and SHB faced strong selling pressure, reducing the VN30-Index by over 3 points.

Source: VietstockFinance

|

Sector-wide, red and green alternated. In the energy sector, divergence prevailed, with red dominating. Notable decliners included BSR (-0.62%), PLX (-0.58%), PVD (-0.96%), and PVS (-0.29%). Only a few stocks like PVT, VTO, and HLC maintained green, but with insignificant gains.

The materials sector also saw a slight decline, with selling pressure concentrated on large-cap stocks. Specifically, HPG fell by 1.09%, DCM by 1.13%, DPM by 0.41%, HSG by 0.58%, and NKG by 2.03%.

Conversely, the information technology sector continued its positive trend, with buying pressure focused on FPT (+1.33%), DLG rising to its upper limit, and ELC (+0.24%).

Additionally, the real estate sector showed a good recovery, with green concentrated mainly in Vingroup-related stocks: VHM (+0.52%), VIC (+3.4%), and VRE (+1.58%). Most other stocks remained in the red, including KDH (-0.43%), KBC (-0.44%), NVL (-2.24%), and PDR (-1.54%).

Compared to the opening, sellers gradually gained the upper hand, with 292 decliners and 240 advancers.

Source: VietstockFinance

|

Opening: Early Divergence

At the start of the session on November 20, as of 9:30 AM, the VN-Index rose slightly by over 1 point, reaching 1,650 points. Similarly, the HNX-Index increased slightly, trading around 265 points.

Green and red alternated across most sectors. Notably, the finance and industrial sectors experienced strong early divergence. On the buying side were stocks like HDB, MBB, VCI, VJC, and GEE, with modest gains of less than 1%. Conversely, red appeared in SHB, VIX, STB, CTG, VSC, and ACV.

The information technology sector was among the early gainers, with FPT rising 1.22%, DLG hitting its upper limit, and ELC gaining 0.49%.

Large-cap stocks like VHM, HPG, and MWG weighed on the market, collectively pulling it down by over 1.2 points. Conversely, VCB, FPT, and VJC led the upward pull, but their combined impact was also nearly 1.2 points.

– 15:23 20/11/2025

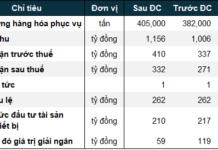

Vietstock Daily 21/11/2025: Cautious Sentiment Prevails?

The VN-Index remains in a tug-of-war along the middle line of the Bollinger Bands, with trading volume below the 20-day average, signaling investor caution. Despite this, both the Stochastic Oscillator and MACD continue to hold bullish signals, painting a positive short-term outlook. For the recovery to solidify, the index must break above the 50-day SMA, supported by improved liquidity in upcoming sessions.

Proprietary Trading Firms Reverse Course, Offloading Hundreds of Billions in Vietnamese Stocks on November 18th: Which Stock Takes Center Stage?

Proprietary trading firms reversed their stance, shifting to net sellers with a total of VND 365 billion on the Ho Chi Minh Stock Exchange (HOSE).