On November 17, Masan Consumer Corporation (Masan Consumer – Stock Code: MCH) announced a shareholder consultation document via written consent. The proposal outlines the use of treasury shares for distribution to existing shareholders and a share issuance plan to increase equity capital from retained earnings.

MCH plans to allocate nearly 10.9 million treasury shares to existing shareholders. The issuance ratio is 10,000:103, meaning shareholders holding 1 share will receive 1 entitlement to treasury shares, and every 10,000 entitlements will yield an additional 103 shares.

Additionally, Masan intends to issue approximately 226.9 million bonus shares to existing shareholders. The issuance ratio is 10,000:2,147, whereby shareholders holding 1 share will receive 1 entitlement to additional shares, and every 10,000 entitlements will result in 2,147 additional shares. Treasury shares are not eligible for additional share entitlements.

The capital for both the treasury share distribution and bonus share issuance will be sourced from retained earnings based on the latest audited financial report. Both the distributed treasury shares and newly issued shares will be unrestricted for transfer. The implementation is scheduled for 2026, with the exact timing determined by the Board of Directors. Shareholders must submit their written consent forms by 5:00 PM on November 27, 2025.

If approved and successfully executed, MCH’s chartered capital will increase from VND 10,676 billion to VND 12,945 billion.

Previously, on November 12, Masan approved a written shareholder consultation resolution for a share issuance plan from retained earnings, equivalent to a 22.5% ratio. This means shareholders holding 1,000 shares will receive an additional 225 new shares.

Masan Consumer is pursuing this share issuance to increase capital as part of its ongoing initial listing on the Ho Chi Minh City Stock Exchange (HoSE).

On November 5, HoSE officially accepted Masan Consumer’s initial listing application. The company registered 1.067 billion shares for listing, equivalent to a chartered capital of VND 10,676 billion. Vietcap Securities Corporation is the advisory firm for the listing.

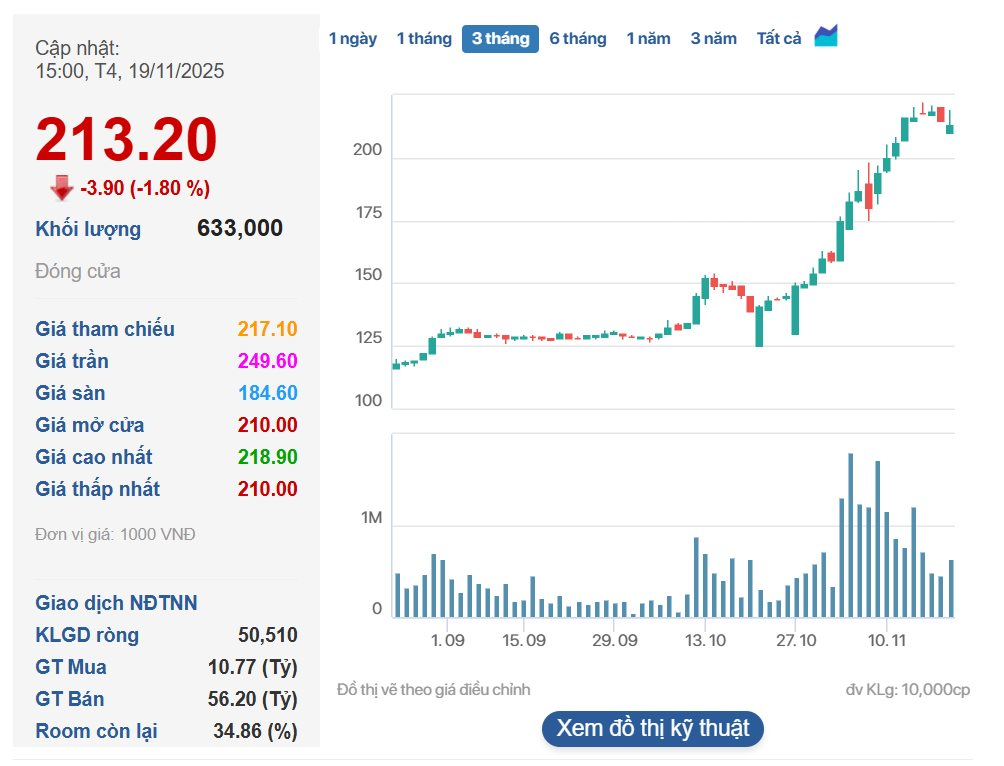

According to regulations, the reference price on the first trading day on HoSE will be based on the average price of the last 30 sessions on UPCoM.

In terms of business performance, MCH reported net revenue of VND 7,516 billion in Q3/2025, a slight 6% decrease year-on-year. Net profit after tax also declined by 19% to VND 1,698 billion.

For the first nine months of the year, Masan Consumer recorded net revenue of VND 21,281 billion, a 3% decrease compared to the same period last year. Consequently, net profit after tax fell to VND 4,660 billion, a 16% year-on-year decline.

On the stock market, MCH shares closed at VND 213,200 per share on November 19, corresponding to a market capitalization of over VND 225,000 billion.

PVT Subsidiary Prepares 20% Dividend Payout Shortly After HOSE Listing

On the morning of November 19th, over 66 million PDV shares of PVT Logistics (PVT Logistics Joint Stock Company) officially commenced trading on the Ho Chi Minh City Stock Exchange (HOSE).

Masan Consumer: Surging Growth Hand in Hand with Sustainable Development

In the fiercely competitive fast-moving consumer goods (FMCG) sector, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) stands out as a rare gem in Vietnam’s market. The company not only sustains profitability at the highest levels in the region but has also been recognized by S&P Global as one of the world’s leading sustainable FMCG enterprises.

What Enables Masan Consumer to Sustain Superior Profitability Across Economic Cycles?

In a volatile global economy, Masan Consumer (UPCoM: MCH) consistently delivers exceptional profitability, ranking among the top FMCG companies in the region with the highest profit margins. In 2025, the company was recognized by S&P Global as one of the world’s leading sustainable consumer goods enterprises.