Mr. Ho Si Thuan, Chairman of the Board of Directors of PDV, emphasized that the official listing on the HOSE exchange marks a significant milestone in the company’s comprehensive fleet restructuring efforts.

“With our existing strengths and development momentum, the HOSE listing will provide PDV with additional opportunities to enhance its business scale, management capabilities, and transparency. This will ensure sustainable growth, increase shareholder value, and maximize benefits for our investors,” added Mr. Thuan.

PDV leadership rings the bell at the listing ceremony

|

Prior to joining HOSE, PDV had traded on the UPCoM market for over 8 years. The HOSE listing was executed in accordance with the Board Resolution dated October 21, 2024, following the roadmap approved by shareholders during the Annual General Meetings of 2022, 2023, and 2024. The company aims to complete the listing process between 2024 and 2025 to improve liquidity and expand access to capital.

Established in 2007, PDV is a subsidiary of PV Trans (HOSE: PVT), which holds nearly 52% of its shares.

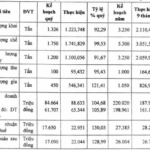

In 2024, PDV achieved record-breaking financial results with revenue exceeding VND 1.362 trillion and net profit surpassing VND 224 billion. In the first nine months of 2025, PDV Logistics reported a net profit of nearly VND 49 billion, equivalent to 55% of its annual target.

– 10:04 19/11/2025

VOS to Soon Sell Vosco Unity, Expanding Maritime Shipbuilding and Repair Sector

On the morning of November 7th, the 2025 Extraordinary General Meeting of Shareholders of Vietnam Ocean Shipping Joint Stock Company (Vosco, HOSE: VOS) approved the sale of the Vosco Unity vessel. Additionally, the meeting also endorsed the expansion of the company’s business activities to include shipbuilding and ship repair services.