The market faced heightened correction pressure during the November 19th session, with the VN-Index retreating to the support level around 1,650 points amid increased trading volume. Selling pressure intensified in the afternoon session, closing the VN-Index down 10.92 points (-0.66%) at 1,649.00 points. Foreign trading activity remained a negative factor, with net selling reaching 716 billion VND.

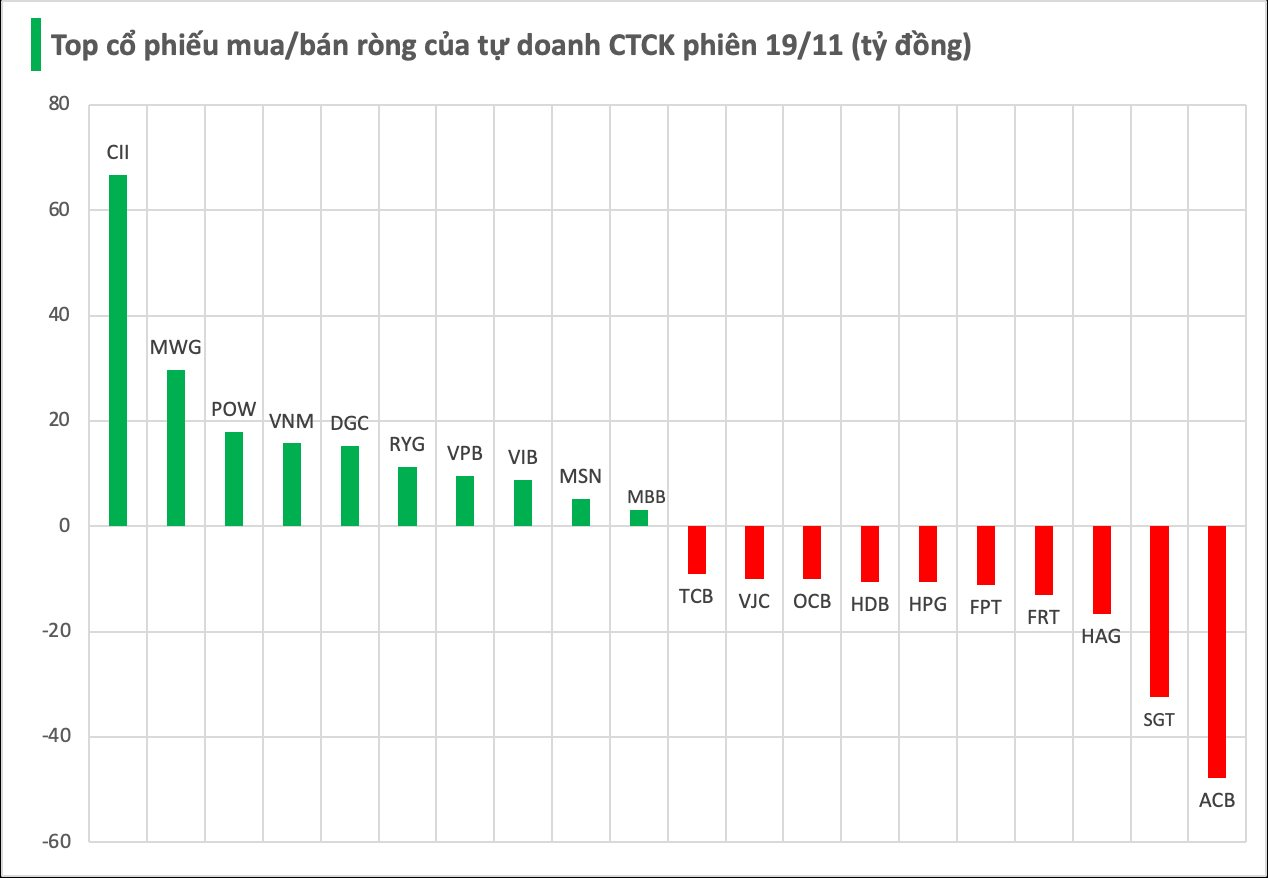

Securities firms’ proprietary trading desks net sold 19 billion VND on HOSE.

Specifically, ACB saw the highest net selling by securities firms’ proprietary trading desks at -48 billion VND, followed by SGT (-32 billion), HAG (-17 billion), FRT (-13 billion), and HDB (-11 billion VND). Other stocks with notable net selling included HPG (-11 billion), FPT (-11 billion), OCB (-10 billion), VJC (-10 billion), and TCB (-9 billion VND).

Conversely, CII led in net buying with 67 billion VND. Other top net buys were MWG (30 billion), POW (18 billion), VNM (16 billion), DGC (15 billion), RYG (11 billion), VPB (9 billion), VIB (9 billion), MSN (5 billion), and MBB (3 billion VND).

Market Pulse November 19: Red Dominates as VN-Index Reverses, Plunging Over 10 Points

At the close of trading, the VN-Index fell by 10.92 points (-0.66%), settling at 1,649 points, while the HNX-Index dropped 2.33 points (-0.87%), closing at 265.03 points. Market breadth was overwhelmingly negative, with 430 decliners outpacing 270 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 5 advanced, and 2 remained unchanged.

Vietstock Daily 20/11/2025: Is Market Volatility Emerging?

The VN-Index has paused its upward momentum, retesting the middle band of the Bollinger Bands. This level serves as a critical support threshold that the index must hold to sustain its short-term recovery. Meanwhile, both the Stochastic Oscillator and MACD continue to signal buying opportunities, supported by gradually improving liquidity. Should trading volume surpass its 20-day average in upcoming sessions, the index’s outlook would turn increasingly positive.