Illustrative image

According to preliminary statistics from the General Department of Customs, Vietnam’s coal imports in October reached over 4.8 million tons, valued at more than $497 million, marking a significant increase of 22% in volume and 8.8% in value compared to the previous month.

In the first 10 months of the year, Vietnam imported over 55 million tons of coal, worth more than $5.6 billion, reflecting a 2.3% increase in volume but a 14.6% decrease in value compared to the same period in 2024.

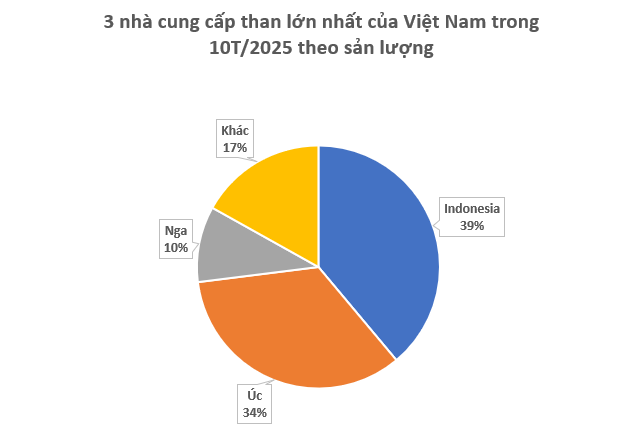

In terms of market share, Indonesia remains Vietnam’s largest coal supplier, providing over 21 million tons valued at more than $1.7 billion, a 2.5% decrease in volume and 14% in value compared to the same period in 2024. The average import price stands at $81 per ton, a 12% reduction.

Australia follows closely as the second-largest supplier, with over 18 million tons valued at more than $2.2 billion, showing a robust 27% increase in volume and 2% in value compared to the same period in 2024. The average import price is $120 per ton, a 22% decrease.

Notably, Russia is significantly increasing its coal exports to Vietnam amid sanctions-induced supply surpluses. Specifically, Vietnam imported over 5.6 million tons of coal from Russia, valued at more than $716 million, a 17% increase in volume but a 14% decrease in value. The average price dropped by 26%, to $127 per ton.

Currently, imported coal into Vietnam is subject to the Most-Favored Nation (MFN) tariff rate of approximately 3-5%. The specific MFN rate depends on the type of coal and its corresponding code.

Russia’s coal industry is facing challenges due to Western sanctions, reduced coal import demand from China, and intense competition from Indonesia in other Asian markets. With limited growth potential in export markets, Russian coal producers face a difficult choice: accept lower prices and negative profit margins or reduce production, according to Firat Ergene, Senior Analyst at Kpler.

According to this energy flow analysis firm, China is unlikely to witness a strong coal import surge like the 2023-2024 period in the coming years. The decline in China’s coal imports has intensified competition from Indonesia, putting pressure on Russian coal due to higher transportation costs from Russia’s Far Eastern ports to China compared to Indonesia.

Amid oversupply, China has reduced imports and increased coal exports in most months this year. Although coal imports rebounded in September due to reduced domestic production and increased electricity demand during a heatwave, the overall trend remains lower than the previous year. In 2024, China’s coal imports surged as Beijing capitalized on plummeting international coal prices.

China is Russia’s largest coal buyer, but limited import demand growth is restraining Moscow’s key export market. In reality, Russia has shifted its focus to China, India, and Turkey after the European Union and other Western countries banned Russian coal imports in 2022 following the Ukraine conflict.

The Great Russian Retail Rush: Vietnam’s 5% Import Tax Advantage Makes it the 5th Largest ‘Shark’ in the World.

“Russia’s National Treasures: A Russian Extravaganza in Vietnam.

Throughout this year, Vietnam has witnessed an influx of Russia’s national treasures at incredibly attractive prices. A veritable feast of Russian culture and history has been on offer, captivating and intriguing locals and tourists alike.”