As the global economy shifts towards green growth, sustainable development has become a core focus for many financial institutions worldwide. In Vietnam, Sacombank stands out as a pioneer in implementing this strategy. Recently, the bank launched its Green Finance Package (Sacombank Eco), a comprehensive financial solution that allows customers to optimize their benefits while contributing to environmental protection efforts alongside the bank.

From Personal Finance to Sustainable Development

Designed for individual customers, particularly the environmentally conscious Gen Y and Gen Z, the Green Finance Package offers a fresh approach. It transforms everyday financial activities into tangible actions for the environment through four key product groups: Green Savings, Visa O₂ Credit Card, Green Sector Loans, Health Insurance, and the Green Living Fund.

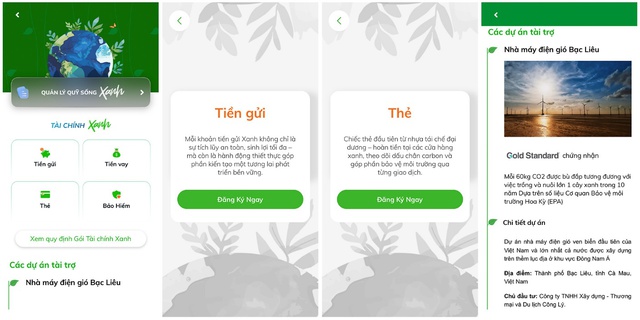

A standout feature is the Green Living Fund, which accumulates all rewards earned by customers when using products within the package. These funds can be converted into carbon credits or contributed to environmental projects such as reforestation, renewable energy, and energy conservation. Periodically, 70% of the fund is automatically converted, while customers can choose specific projects to support via Sacombank Pay with the remaining amount.

After conversion, customers receive an electronic certificate from Gold Standard, an international organization evaluating greenhouse gas reduction projects. This certificate confirms the amount of CO₂ offset, equivalent to the number of trees planted and nurtured over 10 years. Through Sacombank Pay, all transactions, CO₂ emissions, rewards, and contribution certificates are transparently displayed, enabling customers to easily track their carbon footprint and environmental impact.

With Green Savings, customers can join the green journey by simply depositing savings for terms ranging from 1 to 6 months. Monthly, Sacombank rewards 5% of the total interest earned into the customer’s Green Living Fund. Thus, each savings account not only generates profit but also contributes to offsetting emissions, creating a positive community impact.

The Visa O₂ Credit Card promotes smart and responsible spending. Each transaction displays the corresponding CO₂ emissions on Sacombank Pay, helping customers identify their carbon footprint. If emissions are lower than the market average, customers earn 20,000 VND for each positive deviation point, further contributing to the Green Living Fund—turning daily expenses into meaningful environmental actions.

For green sector loans, the bank offers preferential interest rates for customers purchasing VinFast electric vehicles or investing in eco-friendly sectors like renewable energy, clean agriculture, and energy efficiency. This initiative aims to promote green consumption and drive sustainable economic transformation.

Health insurance is also integrated into the Sacombank Eco ecosystem, completing the green and healthy living journey. When customers purchase K-Care Insurance or 24/7 Global Health Care, Sacombank contributes 1,000 VND for every 1 million VND of the first-year premium to the Green Living Fund. This product not only safeguards personal health but also promotes the message of “living healthy to live green,” as a healthy community is the foundation for sustainable development.

Join the Green Finance Package now on Sacombank Pay

Green Finance: An Essential Trend in ESG Strategy

According to Sacombank representatives, the Green Finance Package is a concrete step in the bank’s ESG strategy. Beyond governance and social responsibility, ESG serves as the guiding principle for all Sacombank activities—from internal operations and credit management to product development and customer experience.

“Sustainable development is no longer a slogan but a measure of a financial institution’s capability. With the Green Finance Package, we aim to inspire a ‘green living’ spirit among our customers, ensuring every financial action—whether saving, using a card, borrowing, or insuring—contributes meaningfully to environmental projects. This is how Sacombank fulfills its ESG commitment while building a greener future for Vietnam alongside our customers,” shared Ms. Nguyễn Phương Huyền, Director of Individual Customer Division at Sacombank.

For more details, please contact the 24/7 toll-free Hotline at 1800 5858 88 or visit HERE.

Masan Consumer: Surging Growth Hand in Hand with Sustainable Development

In the fiercely competitive fast-moving consumer goods (FMCG) sector, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) stands out as a rare gem in Vietnam’s market. The company not only sustains profitability at the highest levels in the region but has also been recognized by S&P Global as one of the world’s leading sustainable FMCG enterprises.

Da Nang Considers Urban Expansion to the South

Da Nang City will explore adjustments to its urban planning, aiming to expand the urban space and alleviate infrastructure pressures in the central area.

Sacombank Launches Green Finance Package: Realizing ESG Sustainability Commitments

Sacombank is steadfastly advancing its sustainable development agenda with the launch of the Green Finance Package—a pioneering product that seamlessly integrates environmental considerations into personal financial services. This strategic initiative underscores the bank’s commitment to its ESG roadmap, marking a significant milestone in aligning financial growth with ecological responsibility.