According to the Vietnam Banking Association, in the first two weeks of November, deposit interest rates rose across most terms, adjusting by 0.1-0.5 percentage points compared to mid-October. The most significant interest rate gap between bank groups was observed in the 1-month and 6-month terms, with a difference of up to 3 percentage points.

Some offer 7% per annum despite listing 5.5% per annum

State-dominated commercial banks currently offer the lowest savings interest rates in the market, ranging from 1.6-2.4% per annum (1-month term) and 1.9-3% per annum (3-month term).

Notably, last week, several joint-stock commercial banks raised deposit rates for terms under 6 months to 4.7-4.75% per annum, reaching the ceiling set by the State Bank of Vietnam (SBV).

Recently, VIB Bank further increased deposit rates following its last adjustment in late October. The bank added 0.2% per annum for terms of 1-2 months and 6-36 months. After the adjustment, the 2-5 month term rates on the online channel remain at 4.75% per annum—the maximum allowed for deposits under 6 months.

The latest rates for 6-11 month terms at VIB are listed at 5% per annum; 15-18 month terms at 5.5% per annum; and 24-36 month terms at 5.6% per annum.

Additionally, the bank offers an extra 0.5-1% per annum for priority and new customers. Eligible customers can enjoy rates of up to 6% per annum for 6-month terms and 6.5% per annum for 15-month terms.

Meanwhile, without special policies, BacABank leads the market with a 12-13 month term rate of 6.4% per annum.

Deposit interest rates are rising again among private banks, while state-owned banks remain on the sidelines. Photo: T.L |

Ms. Thuy (from Tan Son Nhat Ward, Ho Chi Minh City) shared that while interest rates at private banks have recently increased, the 6-month term rates remain around 5% per annum. However, she noted that by searching social media groups, customers can find significantly higher rates than those listed.

According to Ms. Thuy, some transaction offices in need of capital are willing to offer additional “outside interest” through end-of-term cash bonuses. For instance, one bank lists a 6-month term rate of 5.5% per annum (online), but a transaction office employee offered an effective rate of up to 6.7% per annum. Some even offer 7% per annum for 6-month terms, depending on the deposit amount.

Exchange rate pressure and credit drive interest rates upward

Deposit interest rates have risen significantly since the beginning of Q4-2025, reflecting banks’ capital needs amid accelerating credit growth at year-end.

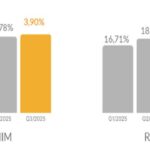

SBV data shows that by the end of October 2025, the banking system’s credit balance had increased by 14.77% compared to the end of last year and by 20.69% year-on-year, indicating a return of capital pressure.

Meanwhile, capital mobilization has only grown by about 10%. The gap between credit growth and mobilization forces banks to raise interest rates to attract idle funds.

Analysts from KB Securities Vietnam (KBSV) note that despite this year’s loose monetary policy, some banks have seen credit growth exceed 20% in just 9 months. This directly pressures input interest rates.

The CEO of a commercial bank observed that the recent rise in savings interest rates also stems from exchange rate pressure. With limited room for exchange rate adjustments (targeting 3-5% annual fluctuation), raising deposit rates is necessary to curb foreign currency hoarding and stabilize the Vietnamese dong.

THUY LINH

– 14:25 20/11/2025

Empowering Financial Growth: Banks Leading the Nation’s Development Journey

Credit recovery is robust and projected to sustain its strong growth trajectory, driven by substantial capital demand from the retail sector and businesses, as well as the ripple effects of public investment. This momentum is poised to significantly contribute to achieving the ambitious GDP growth target of 8% by 2025.

2025 Q3 Banking Overview: Surging Profits, Credit Growth, Shrinking NIMs, and Intensifying Capital Raising Pressures

The banking sector is entering a robust growth phase, yet it faces significant challenges. While credit is accelerating and profitability is improving, the narrowing net interest margin (NIM) is sharply differentiating the competitive capabilities of individual banks.

LDR Ratio Rebounds: Credit Recovery or Liquidity Strain?

The current landscape indicates that systemic liquidity remains stable. However, a cautious approach to management is imperative at this juncture to maintain financial safety margins and, more critically, to uphold the confidence of both the market and depositors.