The VN-Index rebounded towards the end of the session, extending its recovery streak. However, the market remained fragmented, diverging from regional trends. Domestic stocks defied the downward trajectory of regional markets, including the U.S., which saw declines on November 17th, primarily driven by losses in tech shares.

Despite cautious investor sentiment, Vietnam’s market opened in positive territory. The benchmark index fluctuated around the reference point, with liquidity staying low. Support from key stocks was insufficient to propel the index further. Market polarization persisted, with 15 VN30 constituents declining, outpacing 13 gainers.

VN-Index recovered late in the session, marking its third consecutive day of gains.

Leading stocks such as VIC, VHM, VPB, and HVN contributed positively but lacked the momentum for a significant breakthrough. Meanwhile, major players like FPT, VNM, GVR, and GAS faced selling pressure, trimming index gains.

The financial and banking sectors also showed strong divergence. SHB topped banking liquidity but saw a slight 0.6% decline. VCB, LPB, MSB, SSB, and MBB followed suit with losses. Securities stocks rose modestly, around 1%, insufficient to significantly lift the broader market.

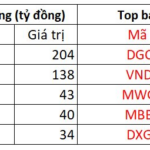

Real estate stocks remained divided, with some blue-chip gains offset by mid-cap corrections in CII, CEO, DXG, DIG, and PDR. NVL stood out with a robust 5% surge to VND 15,850 per share, its fifth consecutive gain, including three ceiling sessions.

The seafood sector performed well, with ANV hitting its ceiling. VHC, IDI, CMX, and MPC also advanced on news that Vietnam’s seafood exports reached USD 9.5 billion in the first 10 months of 2025, up 16% year-on-year. Pangasius exports alone totaled USD 1.8 billion, a 9% increase, driven by October’s USD 217 million, up 8% from 2024.

At the close, the VN-Index gained 5.5 points (0.33%) to 1,659.92. The HNX-Index fell 1.33 points (0.49%) to 267.36, and the UPCoM-Index dropped 0.66 points (0.55%) to 120. Trading value edged up slightly to VND 22,256 billion.

Market Pulse November 19: Red Dominates as VN-Index Reverses, Plunging Over 10 Points

At the close of trading, the VN-Index fell by 10.92 points (-0.66%), settling at 1,649 points, while the HNX-Index dropped 2.33 points (-0.87%), closing at 265.03 points. Market breadth was overwhelmingly negative, with 430 decliners outpacing 270 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 5 advanced, and 2 remained unchanged.

Vietstock Daily 20/11/2025: Is Market Volatility Emerging?

The VN-Index has paused its upward momentum, retesting the middle band of the Bollinger Bands. This level serves as a critical support threshold that the index must hold to sustain its short-term recovery. Meanwhile, both the Stochastic Oscillator and MACD continue to signal buying opportunities, supported by gradually improving liquidity. Should trading volume surpass its 20-day average in upcoming sessions, the index’s outlook would turn increasingly positive.