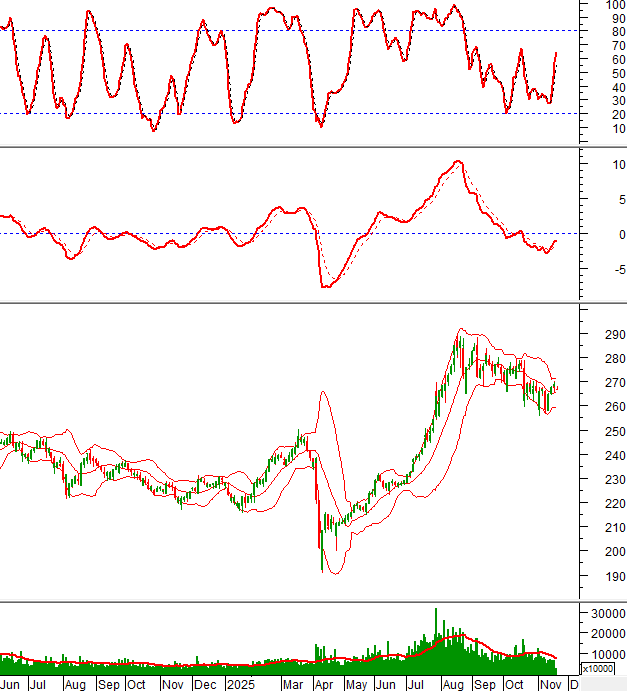

Technical Signals of VN-Index

During the morning trading session on November 19, 2025, the VN-Index paused its upward momentum as it approached the 50-day SMA.

However, the index successfully broke above the Middle line of the Bollinger Bands, and both the Stochastic Oscillator and MACD are signaling a buy, indicating a positive short-term outlook.

Technical Signals of HNX-Index

In the morning session on November 19, 2025, the HNX-Index corrected, forming a Long Upper Shadow candlestick pattern.

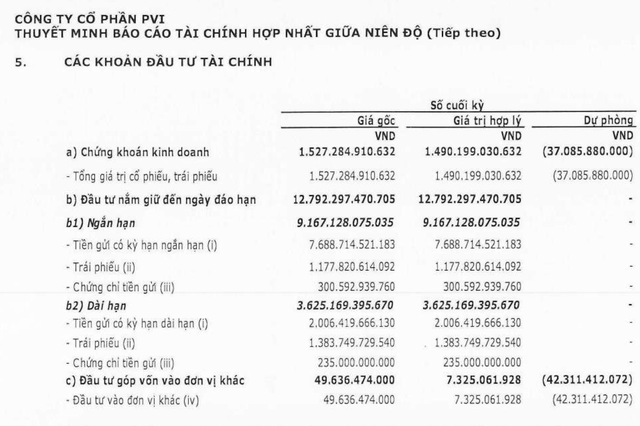

Trading volume has remained below the 20-day average since November 5, 2025, suggesting limited potential for significant moves. The Middle line of the Bollinger Bands is providing short-term support.

DPM – Petrovietnam Fertilizer and Chemicals Corporation (DPM)

In the morning session on November 19, 2025, DPM shares rose, remaining above the Middle line of the Bollinger Bands. Trading volume exceeded the 20-session average, indicating increased investor activity.

Currently, DPM is testing the 50-day SMA, while the MACD continues to rise, approaching the zero line after generating a buy signal. If the MACD maintains its upward trend, the recovery momentum is likely to strengthen.

VIX – VIX Securities Corporation (VIX)

In the morning session on November 19, 2025, VIX shares dipped slightly, forming a small-bodied candlestick with erratic trading volume, reflecting investor uncertainty.

Currently, VIX remains below the 100-day SMA and the Middle line of the Bollinger Bands. The Stochastic Oscillator is recovering after signaling a buy in the oversold region.

This suggests that VIX’s short-term recovery prospects face challenges unless the indicator moves above this region in the near future.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 11:59 AM, November 19, 2025

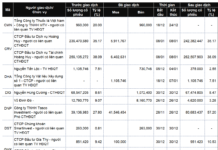

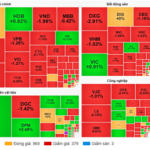

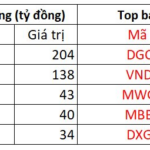

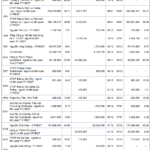

Market Pulse November 19: Red Dominates as VN-Index Reverses, Plunging Over 10 Points

At the close of trading, the VN-Index fell by 10.92 points (-0.66%), settling at 1,649 points, while the HNX-Index dropped 2.33 points (-0.87%), closing at 265.03 points. Market breadth was overwhelmingly negative, with 430 decliners outpacing 270 advancers. Similarly, the VN30 basket saw red dominate, as 23 stocks declined, 5 advanced, and 2 remained unchanged.

Vietstock Daily 20/11/2025: Is Market Volatility Emerging?

The VN-Index has paused its upward momentum, retesting the middle band of the Bollinger Bands. This level serves as a critical support threshold that the index must hold to sustain its short-term recovery. Meanwhile, both the Stochastic Oscillator and MACD continue to signal buying opportunities, supported by gradually improving liquidity. Should trading volume surpass its 20-day average in upcoming sessions, the index’s outlook would turn increasingly positive.

Derivatives Market on November 20, 2025: Market Liquidity Declines Ahead of Expiry Session

On November 19, 2025, futures contracts for the VN30 and VN100 indices predominantly closed in negative territory. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern after retesting the 50-day SMA, accompanied by increased trading volume compared to the previous session. This suggests a cautious sentiment among investors.