On November 18, 2025, I.P.A Investment Corporation (HNX: IPA) successfully issued 14,160 bonds with a face value of VND 100 million each, totaling VND 1,416 billion. These are all “triple-zero” bonds (unsecured, non-convertible, and without warrants). The bonds carry a fixed interest rate of 9.5% per annum, with a 5-year term maturing on November 18, 2030.

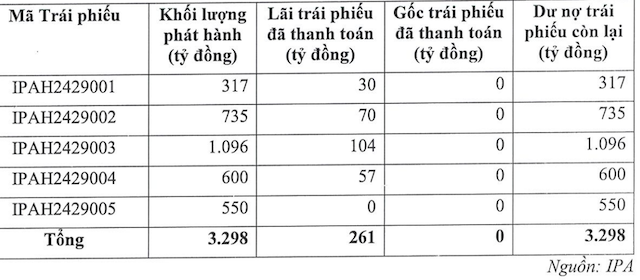

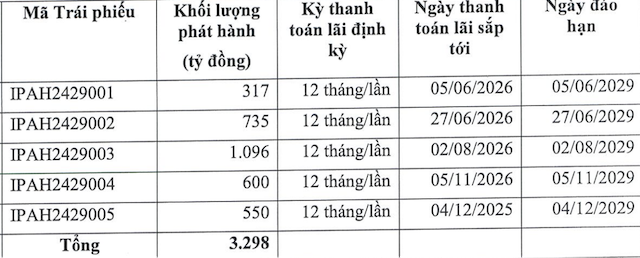

With this latest issuance, I.P.A now has six outstanding bond series listed on the Hanoi Stock Exchange (HNX), totaling VND 4,714 billion. These include the newly issued IPA12501 series and the IPAH2429001 to IPAH2429005 series issued in 2024, all with a 9.5% interest rate and maturing between June and December 2029. Specifically, the IPAH2429001 series, valued at VND 317 billion, is used to restructure existing loan agreements and other liabilities of IPA; the remaining four series are allocated for restructuring the company’s debts, including loans, bonds, and other liabilities.

The company confirmed that from 2022 to 2024, it has fully and punctually repaid both principal and interest on all previously issued bonds.

Overview of IPA’s Bond Issuance and Repayment Status

Source: IPA

|

On November 14, IPA’s Board of Directors approved a private bond issuance for 2025, with a maximum value of VND 1,416 billion. The proceeds will be used to acquire controlling stakes in companies operating in finance, insurance, banking, and securities, thereby indirectly owning listed stocks in these sectors to generate revenue and profits for the company.

Following the issuance, IPA allocated the entire VND 1,416 billion to purchase 141.6 million shares of IPAF Investment Corporation at VND 10,000 per share. This will increase IPAF’s charter capital from VND 101 billion to VND 1,520 billion post-issuance of 141.9 million shares.

IPAF plans to use the raised capital to increase its ownership stakes in several subsidiaries to 99.999%. Specifically, VND 288 billion will be allocated to ICapital Investment Management JSC, VND 284.4 billion to IGrowth Capital JSC, VND 284.4 billion to IValue Investment Management JSC, VND 271.2 billion to IProsper Investment Management JSC, and VND 288 billion to IVision Investment Management JSC.

IPA cautioned that if IPAF and its target companies underperform, it could lead to a decline in enterprise value, negatively impacting IPA’s investment returns. Additionally, significant price fluctuations in the stocks held by these subsidiaries could reduce profitability and affect IPA’s investment activities.

In the interim, IPA will utilize idle funds by depositing them in term accounts, savings accounts, or other legal forms at credit institutions, ensuring the funds remain available for their intended purpose without delay.

In April, IPA was fined VND 60 million by the State Securities Commission for delayed disclosures and an additional VND 65 million for incomplete disclosures, both in violation of regulatory requirements.

Beyond bonds, in September, IPA sought shareholder approval to issue 50 million shares privately at a minimum price of VND 20,000 per share. The proceeds will be used to prepay five bond series (IPAH2429001 to IPAH2429005) issued in 2024. The issuance is planned for 2025 or 2026, pending regulatory approval. If successful, IPA’s charter capital will rise to VND 2,638 billion.

– 07:06 20/11/2025

Coteccons to Distribute Over 100 Billion VND in Dividends

Coteccons Construction JSC (HOSE: CTD) has announced the finalization of its shareholder list for the 2025 fiscal year cash dividend distribution. Shareholders will receive a 10% dividend, equivalent to VND 1,000 per share. The ex-dividend date is set for December 1st.

TNR The LegendSea Da Nang Project Developer Successfully Raises VND 500 Billion in Bond Issuance

Vipico, the esteemed developer behind the TNR The LegendSea project in Da Nang, has successfully raised an impressive 500 billion VND through a bond issuance.