In the transformative journey of HAGL, OCBS emerges as the Comprehensive Strategic Consulting Partner, acting as the silent “architect” that standardizes information and strengthens communication with the investor community.

The X Tour – “Unveiling a New Era of Sustainability”

The pinnacle of HAGL’s resurgence is “The X Tour – Unveiling a New Era of Sustainability,” held from November 12 to November 15, 2025. This tour, orchestrated by HAGL and OCBS, takes investors across three countries—Vietnam, Laos, and Cambodia—to experience HAGL’s circular agricultural ecosystem firsthand. With over 50 representatives from leading investment funds, securities firms, and financial institutions, The X Tour has captured the attention of media and investors alike. Its success lies not only in its impressive scale and structured model but also in how HAGL and OCBS transformed it into a “living field report,” narrating HAGL’s new era through real data, operations, and experiences.

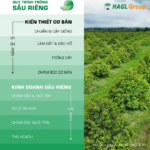

Throughout the tour, investors gain comprehensive insights into HAGL’s evolving ecosystem. In Vietnam, they visit the Ham Rong Silk Factory, aimed at international markets; the durian garden at HAGL Academy; and the circular agriculture model of bananas, durians, coffee, and silkworms in Gia Lai Livestock Project (Mang Yang). In Laos, banana, coffee, and durian farms in Attapeu and Paksong offer a panoramic view of operational scale, efficiency, and economic value. Meanwhile, banana and silkworm projects in Stung Treng, Cambodia, further demonstrate HAGL’s growth potential in this new phase.

The X Tour takes investors on a direct tour of facilities in Vietnam, Laos, and Cambodia.

OCBS – HAGL’s Strategic “Architect” in the New Era

As the Comprehensive Strategic Consulting Partner, OCBS not only co-organized The X Tour but also played a pivotal role in strategic direction, investor connections, and standardizing messaging, materials, and publications. OCBS redesigned HAGL’s information architecture, enabling the company to communicate with the market consistently, clearly, transparently, and data-driven. This has been instrumental in building trust and amplifying HAGL’s value.

The X Tour exemplifies how companies can proactively share their stories and potential in a practical, vivid manner. Few organizations are confident enough to invite external scrutiny, but HAGL has always welcomed investors to visit any of its projects. OCBS’s partnership has elevated this practice to new heights, making it more professional and effective. It’s no surprise that many investors liken the program to an “open audit,” allowing the market to witness HAGL’s achievements firsthand.

The collaboration between OCBS and HAGL’s relentless efforts has yielded early successes. HAGL’s capital structure improved after converting over VND 2,520 billion of debt into equity; a HAGL subsidiary successfully issued VND 1,000 billion in bonds; and HAGL eliminated its accumulated losses of over VND 7,500 billion after years of restructuring and operational efficiency, achieving a consolidated after-tax profit of VND 1,312 billion in the first nine months of 2025 (up 54% year-on-year and 85% of the target).

A new HAGL is emerging, with OCBS as the strategic architect shaping its coherent, compelling, and consistent narrative.

Mr. Nguyễn Đức Quân Tùng, CEO of OCBS (in black, left), alongside Bầu Đức, Chairman of HAGL, during The X Tour.

OCBS – A Dynamic and Ambitious Securities Company

Beyond its role as HAGL’s “architect,” OCBS is demonstrating its own formidable momentum. Established in 2006, OCBS has evolved over nearly 20 years into a strategic partner for major corporations like OCB Bank, FiinGroup, and FPT. It is positioning itself as a professional Investment Banking & Asset Management securities company, offering comprehensive financial solutions to individual and institutional investors.

2025 marks OCBS’s remarkable breakthrough. After six months of comprehensive restructuring, the company’s Q3 2025 profit surged 72 times year-on-year, making it the fastest-growing securities firm in the first nine months of 2025. Its product and service ecosystem has expanded to cover all target customer segments, from trading and financial advisory to investment banking and asset management.

OCBS aims to become a pioneering institution combining the strengths of commercial banking, investment banking, data analytics, and credit rating, offering comprehensive advisory services to companies restructuring or entering new growth cycles. HAGL’s sustainable new era, supported by OCBS, is a clear testament to this vision.

Following a fourfold increase in its charter capital to VND 1,200 billion in July 2025, OCBS is set to propose a further increase to VND 3,200 billion at an extraordinary shareholders’ meeting on November 27, 2025. This rapid capital expansion underscores investor confidence in OCBS’s future and highlights its ambition to achieve significant growth in the coming period.

OCBS is headquartered at The Hallmark – Ho Chi Minh City International Financial Center.

Masan Consumer: Surging Growth Hand in Hand with Sustainable Development

In the fiercely competitive fast-moving consumer goods (FMCG) sector, Masan Consumer Corporation (Masan Consumer, UPCoM: MCH) stands out as a rare gem in Vietnam’s market. The company not only sustains profitability at the highest levels in the region but has also been recognized by S&P Global as one of the world’s leading sustainable FMCG enterprises.

Stocks Linked to Bầu Đức Deliver a Surprising Turn

Amidst positive developments on the afternoon of November 14th, the VN-Index closed the week’s final session with a modest gain of over 4 points. However, liquidity remained subdued, continuing its downward trend. Notably, stocks associated with Bầu Đức emerged as a surprising highlight.