Buying a car through installment payments is a popular option where the buyer only needs to pay a deposit, typically around 20% of the car’s value, while the remaining amount is financed by a bank. The loan is then repaid in monthly installments, including both principal and interest.

Prospective buyers should carefully review all related terms and conditions before committing to an installment plan. Image: Tiền Phong.

When taking out a car loan, buyers typically encounter two main types of interest rates. The first is the Promotional Rate, a fixed rate lower than market average, applied for an initial period, such as 6 or 12 months.

The second is the Floating Rate, which takes effect after the promotional period ends. This rate fluctuates with market conditions and is calculated as: “Bank’s Base Rate + a fixed margin, e.g., 3.5%.”

Regarding loan limits, banks usually finance between 70% to 85% of the car’s value. However, this ratio may decrease for longer loan terms or used vehicles.

Repayment periods can extend up to 7-8 years, or 84-96 months, giving buyers flexibility in managing their finances.

Before taking possession of the car, buyers must prepare three main payments:

First, the Down Payment, ranging from 15% to 30% of the car’s value, depending on the bank’s policy.

Second, On-Road Costs, including mandatory fees like registration tax, license fees, and civil liability insurance.

Third, Comprehensive Insurance, required by the bank for the loan duration, typically costing 1.3% to 1.5% of the car’s value.

Illustrative image.

Banks commonly use the Reducing Balance Method to calculate interest, where monthly interest decreases as it’s based on the remaining principal, not the original loan amount.

Monthly payments consist of two parts: Principal Repayment and Interest. The principal is the total loan divided by the loan term, while interest is the remaining principal multiplied by the monthly interest rate (annual rate divided by 12).

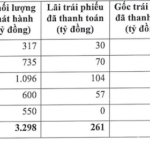

For example, a 500 million VND loan over 5 years (60 months) with an 8.0% promotional rate for the first year and an 11.0% floating rate thereafter:

Month 1: Principal = 8,333,333 VND (500,000,000 / 60). Interest = 3,333,333 VND (500,000,000 * 8% / 12). Total = 11,666,666 VND.

Month 13: Remaining principal ≈ 416,600,000 VND. Interest ≈ 3,820,000 VND (416,600,000 * 11% / 12). Total ≈ 12,153,333 VND.

Illustrative image.

When choosing a loan, focus on key factors for the best financial decision:

Post-Promotional Interest Rate: The most critical factor, affecting costs for 4-7 years. Opt for banks with lower margins, e.g., base rate + 3.0%.

Disbursement Time: Choose banks with quick processing and direct dealer ties, especially during year-end promotions.

Prepayment Penalties: Prefer banks waiving fees after 3 years or charging less than 1.5%.

Application Process: Ensure income verification isn’t overly complex and that you meet credit history (CIC) and income requirements.

State-Owned Banks (Big 4: Vietcombank, VietinBank, BIDV, Agribank) offer stable rates but stricter processes. Private Banks (Techcombank, VPBank, ACB, MBBank) provide more flexible terms and faster approvals.

For a smooth loan process, prepare:

Personal Documents: ID, Household Registration, Marriage Certificate/Single Status Confirmation.

Income Proof: Employment Contract, 3-6 months’ bank statements, or business documents.

Car Purchase Documents: Sales Agreement with the dealer.

Installment car purchases are significant financial commitments. Look beyond promotional rates, ensure monthly affordability, and thoroughly review contracts before signing.

Silver Prices Surge 4% Consecutively, Breaking the 56 Million VND/kg Barrier

Silver prices today have surged both domestically and globally, marking a significant uptick in value across markets.

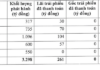

Customer Deposits Decline Across Multiple Banks

By the end of September 2025, total customer deposits across 27 listed banks reached over 12.26 quadrillion VND, reflecting a modest increase of nearly 207 trillion VND compared to June 2025. This marks the slowest quarterly growth rate observed in the past six quarters.