VietinBank Announces Public Offering of Saigon Port Shares

On November 18, 2025, VietinBank (Vietnam Joint Stock Commercial Bank for Industry and Trade) announced the public offering of over 19.6 million SGP shares, representing a 9.07% stake in Saigon Port Corporation.

This marks one of the largest divestments by a Vietnamese commercial bank in Q4 2025, aimed at addressing non-performing assets as directed by the government and the State Bank of Vietnam.

The shares will be auctioned on the Hanoi Stock Exchange (HNX) with a starting price of VND 29,208 per share.

With a total of 19,616,627 common shares at a par value of VND 10,000 each, the offering is valued at nearly VND 573 billion. VietinBank Securities (VietinBankSC) will act as the auction advisor and executor.

The auction timeline is as follows: Investors can submit bids and deposits (10% of the registered value at the starting price) from December 19, 2025, to January 15, 2026. The deadline for registration, deposit submission, and auction code receipt at HNX is 4:00 PM on December 18, 2025. The official auction is scheduled for the morning of January 23, 2026. Successful bidders must complete payment within 90 days of receiving the share registration certificate.

VietinBank’s divestment from Saigon Port aligns with its long-term strategy to focus on core banking activities and comply with regulations on asset management and divestment from non-core sectors. The SGP shares were originally acquired as part of the bank’s efforts to resolve bad debts under government decrees and directives from the State Bank of Vietnam.

On the UPCoM market, SGP shares closed at VND 26,700 on November 18, 2025.

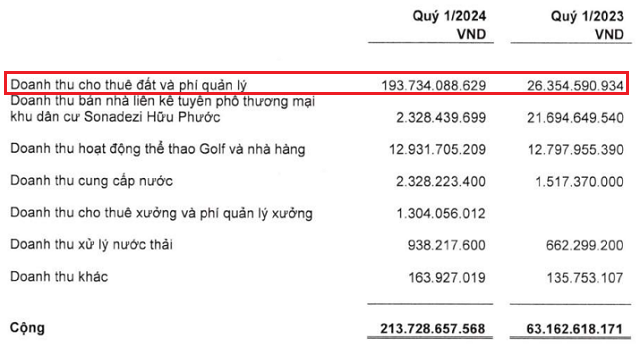

Saigon Port’s Financial Performance Overview

Saigon Port’s Operational Highlights

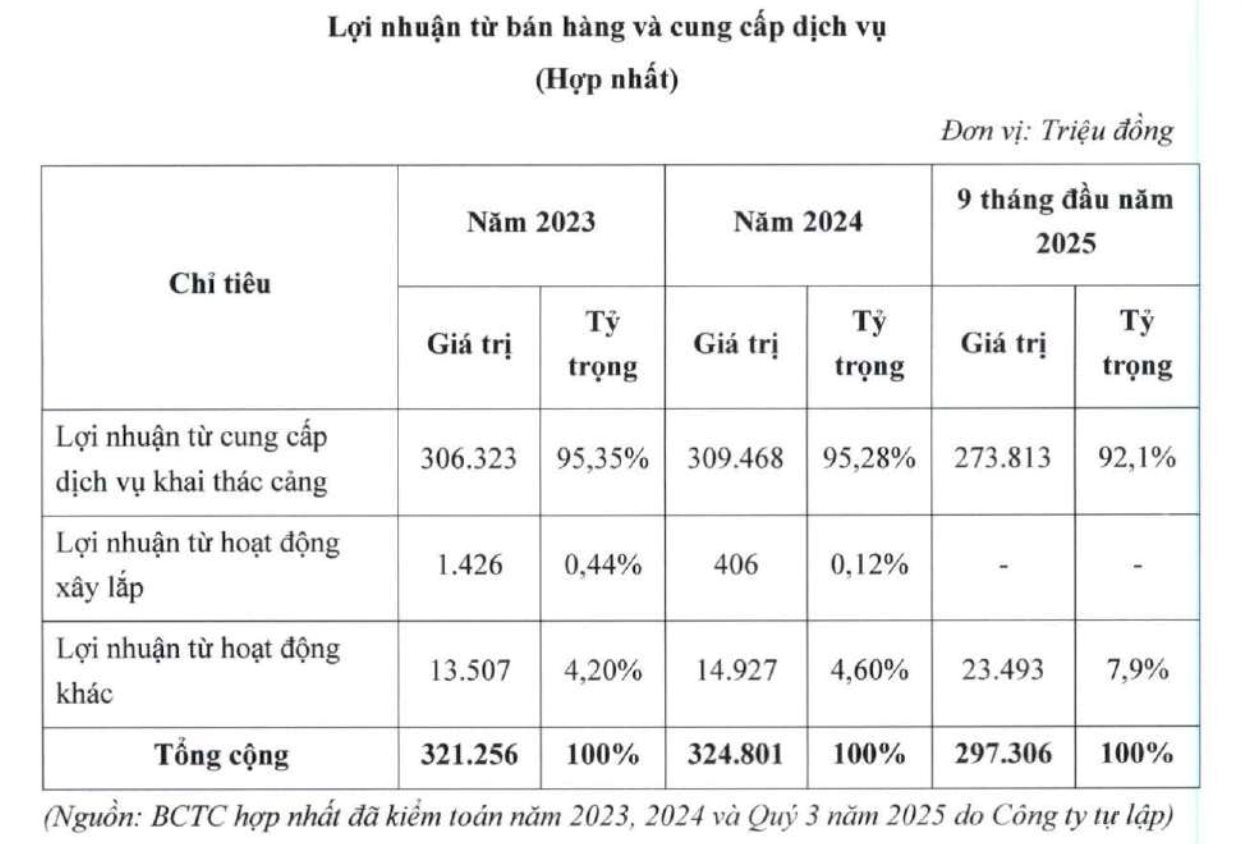

Saigon Port’s core business is port operation services. Despite fluctuations in import-export activities, profits from port services have consistently grown, accounting for the largest share of the company’s revenue.

In 2024, port operation services generated a consolidated profit of VND 309 billion, a 1.03% increase from 2023, representing 95.28% of the company’s total profit.

Saigon Port serves the Southern region, including Ho Chi Minh City, South Central provinces, and the Mekong Delta, with 21 berths totaling 2,969 meters in length, and a buoy system along the Saigon River, Nha Be, Soai Rap, and Thien Liem areas. It is the only port in Ho Chi Minh City handling both general cargo and international cruise ships.

VietinBank Auctions 19.6 Million SGP Shares, Expected to Raise Nearly VND 573 Billion

VietinBank is auctioning over 19.6 million SGP shares of Saigon Port, with a starting price of 29,208 VND per share, aiming to generate a minimum revenue of nearly 573 billion VND.

What Did South Korea’s Chaebol SK Do Before Divesting from Masan?

SK’s Q3/2025 financial report reveals its Masan investment remains classified as “held for sale,” albeit with a subtle distinction.

VietinBank Targets 2025 Pre-Tax Profit of VND 32,500 Billion, Poised to Enter Gold Market

At the investor conference held on the afternoon of November 13, 2025, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG) forecasted a stable Net Interest Margin (NIM) with potential improvement by the end of 2026. Additionally, the bank identified emerging business segments, including the National Gold Trading Platform and digital assets, as key strategic focuses.