With its stable political and economic environment, and growing international stature, Vietnam has become a crucial link in the global innovation network. Image: TL |

Accelerated Moves by Major Corporations

In recent years, there has been a clear shift in capital and technology flows toward Vietnam. The latest example is Panjit International’s acquisition of 95% of Torex Vietnam Semiconductor, a subsidiary of Japan’s Torex Semiconductor, located in the VSIP II Industrial Park.

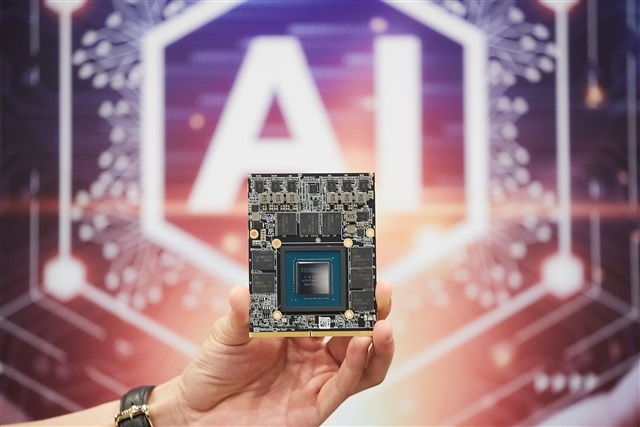

Torex Vietnam excels in packaging and testing using USP (ultra small package) technology. This facility is a strategic piece for Panjit to expand its OSAT capabilities in Southeast Asia, integrating operations with MetaWells to serve AI, automotive, and green energy sectors.

The decision to invest in Vietnam reflects the urgent need for international corporations to diversify production locations and enhance supply chain resilience.

Similarly, Intel, a major investor in Vietnam’s semiconductor industry, is preparing to expand by hiring more technicians and production staff by the end of 2025.

Kenneth Tse, General Director of Intel Products Vietnam, shared that the corporation is relocating some assembly, packaging, and testing operations from Costa Rica to Vietnam. Intel also seeks support from Ho Chi Minh City authorities to expedite machinery operation procedures and ensure aviation security during equipment imports. Once completed, Vietnam will become a critical production hub in Intel’s global network, enhancing its strategic position in the semiconductor industry.

These developments come as Vietnam hosts over 170 FDI semiconductor projects with a total investment of nearly $11.6 billion, primarily focused on design, packaging, and testing (OSAT). The outlook is brightening as many corporations view Vietnam as a safe and efficient “anchor,” elevating its role in the global semiconductor supply chain.

Marvell Vietnam’s rise is a vivid example: from a team of engineers involved in design validation over a decade ago, they now lead high-speed DSP projects like Marvell® Alaska® A 800G and Nova 1.6 Tbps PAM4 DSP, which underpin global AI data infrastructure.

According to Le Quang Dam, General Director of Marvell Vietnam, Vietnam has surpassed Israel to become Marvell’s third-largest R&D center, after the U.S. and India, with over 500 engineers. This achievement not only affirms Vietnamese engineers’ capabilities but also opens up prospects for FDI in semiconductors to shift Vietnam into higher-value segments.

Le Quang Dam noted that Vietnamese engineers are now involved in the most advanced and complex technology projects. For instance, the ODSP optical connection chip with a speed of 1.6 TB per second, used in Marvell’s data centers, was almost entirely designed by Vietnamese engineers.

|

The R&D wave is expanding. In June 2025, Qualcomm launched its first Southeast Asian AI R&D center in Vietnam. Samsung is building its largest regional R&D center in Hanoi; SAP is investing €150 million in R&D development; NVIDIA is advancing its AI center; and Fujikin and Injungbo are also launching projects in Hanoi and Da Nang. With its stable political and economic environment, and growing international stature, Vietnam has become a crucial link in the global innovation network.

Challenges in the Regional Race

However, behind this growth are strategic challenges that could limit Vietnam’s ability to break through in the semiconductor map. Returning from an FDI attraction seminar in Malaysia, Tran Thi Hai Yen, Director of the Southern Investment Promotion Center, noted that competition among ASEAN nations is at its most intense.

In the eyes of international experts, Vietnam stands out for its political stability and well-directed high-tech attraction policies. However, other countries are also aggressively adjusting their strategies.

Malaysia, with Penang as the “Silicon Valley of Southeast Asia,” boasts the region’s largest OSAT ecosystem and a complete supporting supply chain, from material suppliers to equipment. The Malaysian government offers high tax incentives and specialized infrastructure support for semiconductor factories.

Singapore leverages its high-quality workforce, top-tier intellectual property protection standards, and ability to attract fabless companies and advanced manufacturing plants (e.g., GlobalFoundries).

Thailand and the Philippines are intensifying direct tax incentives for the OSAT sector, introducing R&D and engineer training support packages. Meanwhile, Indonesia is pursuing a “chip-linked electric vehicle industry” strategy, aiming to attract semiconductor supply chains for electric vehicles based on its nickel resource advantages.

Compared to these competitors, Vietnam enters the race with significant barriers. Most current FDI enterprises are only involved in two stages: design and packaging-testing. High-value stages like wafer fabrication (fab) are almost non-existent. Building an advanced fab plant can cost $5-20 billion, requiring a stable policy environment, uninterrupted ultra-clean utilities, and international logistics standards.

The workforce capable of meeting the growing investment in semiconductors is also a challenge for Vietnam. Image: LH |

Deloitte’s 2024 report shows Vietnam has only over 40 enterprises in the semiconductor value chain, concentrated in three major cities. To advance to higher stages like advanced packaging or wafer fabrication, Vietnam needs a workforce that is not only large in quantity but also deep in skills, which remains a significant challenge despite the rapid increase in semiconductor engineers.

Infrastructure remains a bottleneck. The semiconductor industry demands 24/7 stable power, ultra-pure water, clean air, and specialized logistics. Even a few minutes of power outage can damage a production line worth hundreds of millions of dollars, forcing Vietnam to compete directly with Singapore and Malaysia, which have the region’s best utility and logistics infrastructure.

On the policy front, the draft amended High-Tech Law presents opportunities but also sparks debate. The high-tech enterprise certification currently lasts only five years, making it difficult for investors to plan long-term projects of 10-20 years. Proposals to replace certification with self-assessment could reduce procedures but risk inconsistent post-inspection standards.

Dr. Bui Xuan Minh, Head of the Semiconductor Design and Industry 4.0 Research Group at RMIT University Vietnam, emphasizes that Vietnam needs to strengthen three pillars: competitive tax incentives, international-standard technical infrastructure, and a robust intellectual property legal system. Investing in a national semiconductor fabrication plant could create an “anchor effect,” attracting a supporting ecosystem of material and equipment suppliers. Simultaneously, collaborating with Synopsys, TSMC, Samsung, and Marvell for technology transfer and standardized training will enhance the local workforce’s quality.

Dr. Minh stated, “We need to integrate subjects like integrated circuit design, microelectronics, and semiconductor physics into training programs. More importantly, we must build strong links between academia and industry to produce a workforce ready for real-world challenges.”

A recent report shows Vietnam has completed 10 out of 38 tasks in the Semiconductor Industry Development Strategy and 9 out of 34 tasks in the Human Resource Development Program. Government leaders are continuously engaging with NVIDIA, Samsung, and Intel to promote semiconductor cooperation during high-level diplomatic visits.

These are positive signs, but faster progress is needed to keep up with regional competition. By addressing bottlenecks in human resources, infrastructure, and institutions, Vietnam can move toward “endogenous capacity building,” developing its own high-tech enterprises and securing a place in the global value chain. The golden window is open, but time is running out.

With a synchronized strategy, Vietnam can not only “attract” FDI but also generate endogenous momentum, turning opportunities into long-term strengths and realizing its dream of becoming Southeast Asia’s strategic semiconductor hub, contributing to the sustainable development of its digital economy.

Le Hoang

– 10:00 20/11/2025

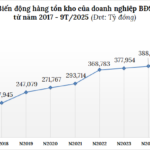

Record-High Inventory Squeeze Hits Real Estate Firms

The inventory landscape for real estate businesses reached unprecedented heights by the end of Q3 2025. Several firms saw their stockpiles surge by tens of trillions of Vietnamese dong.

Nationwide Distribution of New Gasoline Variant Set to Begin June 1, 2026, Sealing the Fate of RON92

Unleash the power of E10 fuel. This innovative blend, a harmonious fusion of 10% ethanol and 90% gasoline, is revolutionizing the way we drive. E10 fuel offers a cleaner, more sustainable alternative, reducing emissions and contributing to a greener future. Experience enhanced engine performance and efficiency with every fill-up, as E10 fuel optimizes combustion and maximizes power output. Make the switch to E10 and join the movement towards a more environmentally conscious and high-performing driving experience.