I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON NOVEMBER 20, 2025

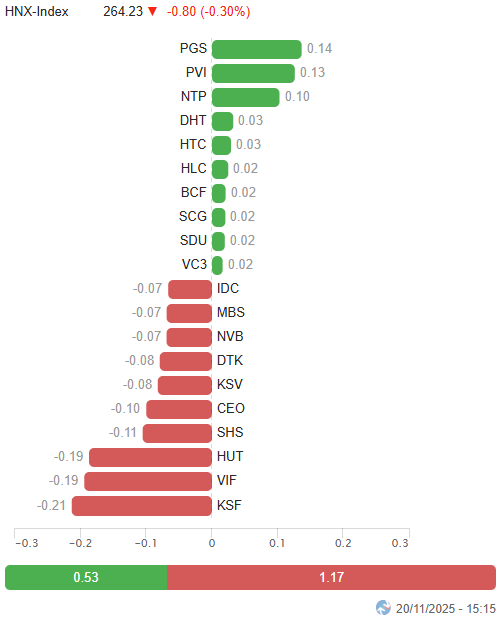

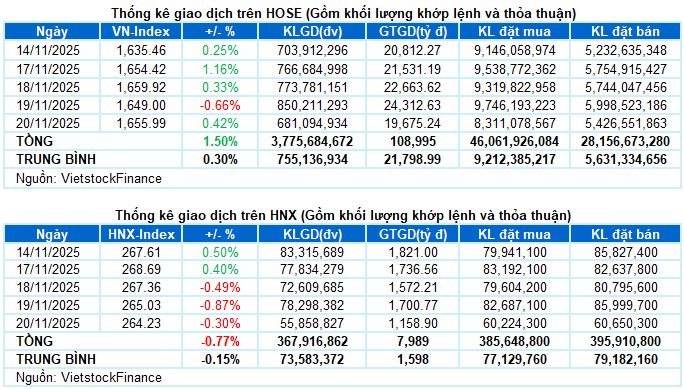

– Key indices showed mixed movements during the November 20 trading session. Specifically, the VN-Index rose by 0.42%, reaching 1,655.99 points, while the HNX-Index hovered near the reference level, closing at 264.23 points.

– Trading volume on the HOSE floor decreased by 20.1%, totaling over 592 million units. Similarly, the HNX floor recorded nearly 48 million matched units, a 32.4% decline compared to the previous session.

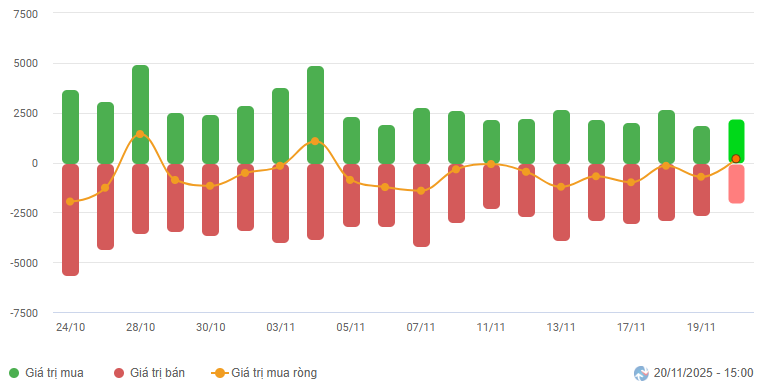

– Foreign investors turned net buyers with a value of over 237 billion VND on the HOSE floor and net sellers with 3.8 billion VND on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

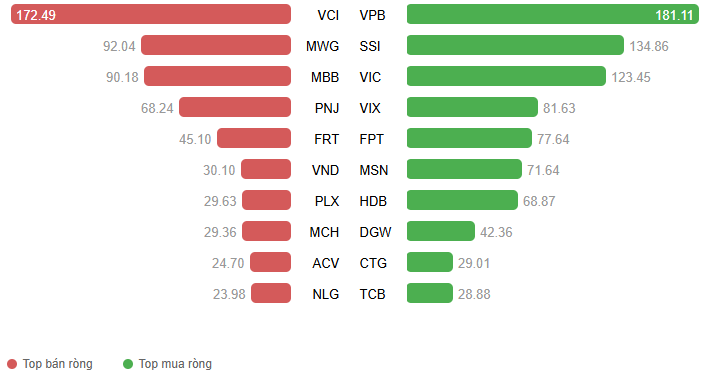

Net Trading Value by Stock Code. Unit: Billion VND

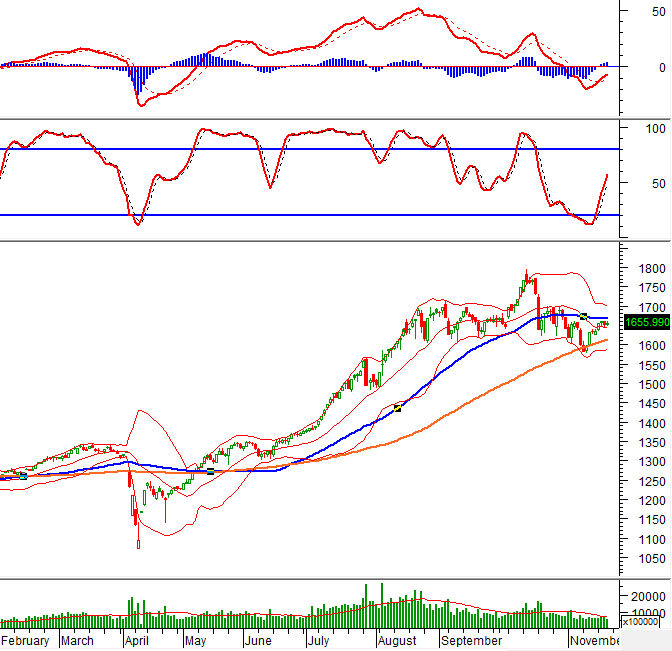

– During the November 20, 2025 session, after a slight decline at the beginning and briefly touching the reference level, buying demand quickly returned, helping the VN-Index maintain balance for most of the morning. In the afternoon session, the market experienced a strong correction, pulling the index below the reference level. However, bottom-fishing capital reacted promptly, supporting the index’s recovery. Thanks to support from some blue-chip stocks at the end of the session, the VN-Index regained its green and closed at 1,655.99 points, up nearly 7 points from the previous session.

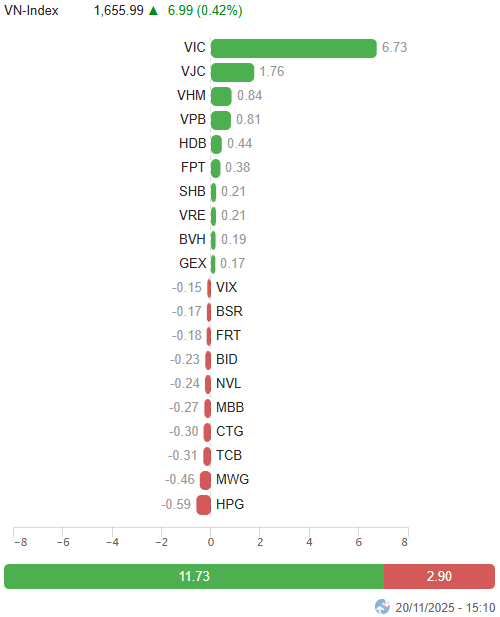

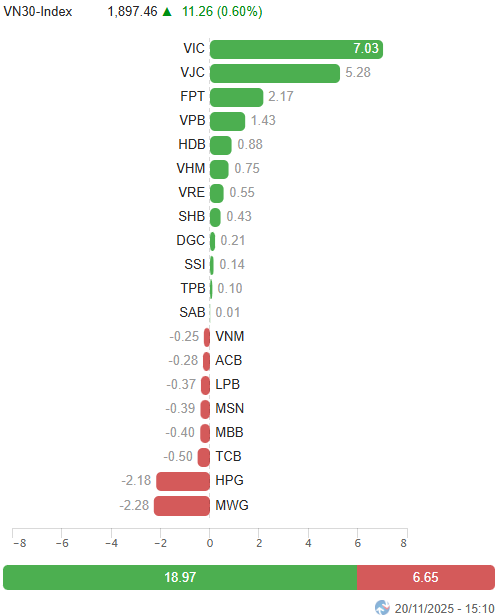

– Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing 6.73 points. Following were VJC, VHM, and VPB, adding a combined 3.4 points to the index. Conversely, HPG, MWG, and TCB were the most negative, subtracting a total of 1.36 points from the index.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index closed up over 11 points (+0.6%), reaching 1,897.46 points. The basket’s breadth was relatively balanced, with 12 gainers, 13 losers, and 5 unchanged stocks. On the upside, VJC was the standout performer, closing at the upper limit. VIC also shone brightly with a 3.4% increase. On the downside, MWG, HPG, and SSB were the laggards, adjusting over 1%.

Divergence dominated sector performance. The real estate sector led the overall gain, with notable names such as VIC (+3.4%), VHM (+0.93%), VRE (+1.27%), KBC (+2.32%), DXG (+1.57%), VPI (+1.84%), and TAL (+1.47%). However, several stocks in this sector faced strong selling pressure, including NVL (-3.51%), TCH (-1.38%), CEO (-1.19%), and NLG (-2.62%).

The financial and industrial sector indices fluctuated within a narrow range, with mixed green and red. While many stocks maintained good demand, such as SHB (+1.22%), HDB (+1.6%), VPB (+1.6%), ABB (+2.07%), BVH (+2.03%), GEX (+1.94%), GEE (+1.12%), TV2 (+3.66%), and VJC hitting the upper limit, several others declined over 1%, including VIX, VCI, SSB, CII, VCG, BMP, VTP, ACV, and CDC.

Meanwhile, the communication services sector was the laggard, adjusting 2.45%, primarily due to pressure from leading stocks such as VGI (-3.18%), FOX (-0.49%), and CTR (-1.08%).

The VN-Index continued to hover around the Middle line of the Bollinger Bands with trading volume below the 20-day average, reflecting investors’ cautious sentiment. The Stochastic Oscillator and MACD indicators maintained buy signals, indicating a positive short-term outlook. However, the index needs to break above the SMA 50 line accompanied by improved liquidity in the coming sessions to solidify the recovery.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Trading Volume Remains Below 20-Day Average

The VN-Index continued to hover around the Middle line of the Bollinger Bands with trading volume below the 20-day average, reflecting investors’ cautious sentiment.

The Stochastic Oscillator and MACD indicators maintained buy signals, indicating a positive short-term outlook. However, the index needs to break above the SMA 50 line accompanied by improved liquidity in the coming sessions to solidify the recovery.

HNX-Index – Third Consecutive Session of Adjustment

The HNX-Index adjusted for the third consecutive session, falling below the Middle line of the Bollinger Bands.

The MACD indicator is narrowing its gap with the Signal line. If a sell signal reappears in the coming sessions, the short-term outlook will be more pessimistic.

Capital Flow Analysis

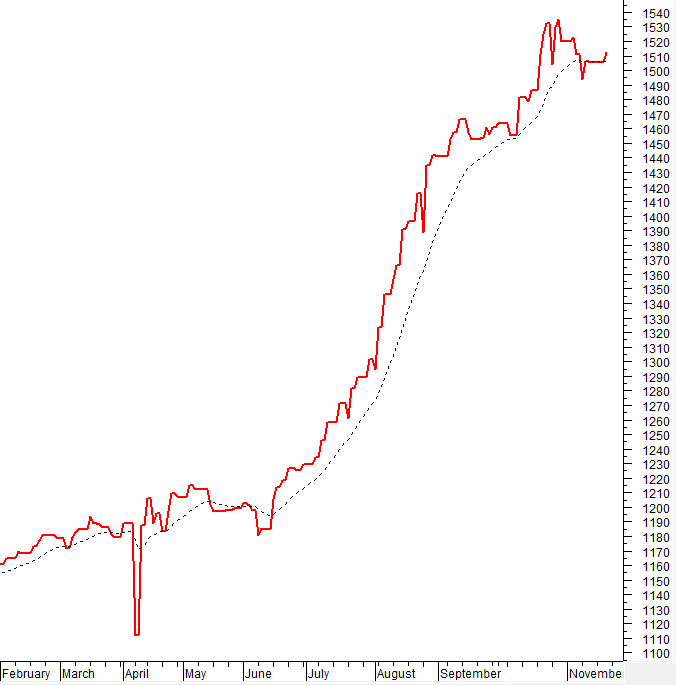

Smart Money Movement: The Negative Volume Index of the VN-Index crossed above the EMA 20 line. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Capital Movement: Foreign investors turned net buyers in the November 20, 2025 session. If foreign investors maintain this action in the coming sessions, the outlook will be more optimistic.

III. MARKET STATISTICS ON NOVEMBER 20, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:08 November 20, 2025

Foreign Investors Ease Sell-Off Pace, Counter-Trend with Nearly VND 400 Billion Buy-In on Blue-Chip Stock

Foreign investors narrowed their net selling streak, with a modest net sell of approximately VND 84 billion across the entire market today.

Stock Market Rallies for Three Consecutive Sessions, Yet Investor Caution Persists

The VN-Index rebounded towards the end of today’s session (November 18), extending its winning streak to three consecutive days. While investor sentiment remained cautious and the market showed signs of divergence, a notable development emerged within the seafood stock group.