Illustrative image

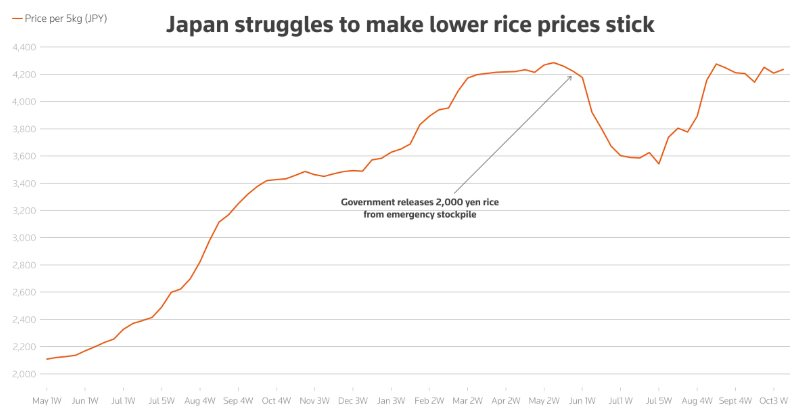

Rice prices in Japan continue to soar, reaching a new all-time high and placing additional strain on consumers as the nation considers adjustments to its agricultural support and distribution policies. The latest data from Japan’s Ministry of Agriculture reveals that the average retail price of rice has hit a record high since the survey began in 2022.

During the week ending November 14, the average price of 5 kg rice sold across approximately 1,000 supermarkets nationwide climbed to 4,316 yen, an increase of 81 yen from the previous week. This surpasses the previous record of 4,285 yen set in May, despite the market welcoming newly harvested rice, which typically helps cool prices in the short term.

Record surge in rice prices in Japan.

The average price of branded rice varieties, including new rice, also rose by 33 yen to 4,573 yen per 5 kg, marking the fourth consecutive week of price increases and setting yet another record. Meanwhile, blended rice, including government reserve releases, saw a more significant jump—rising by 176 yen to 3,732 yen.

A separate survey of approximately 6,000 retailers recorded an average rice price of 4,444 yen, up 116 yen from the previous report. These figures underscore the persistent upward trend in the price of this essential staple over recent months.

Amid domestic prices hitting record highs, Japan maintains a hefty 341 yen/kg tariff on rice imports by private enterprises. However, even with the tax included, imported rice remains significantly cheaper than domestic rice, generating considerable consumer interest and intensifying competitive pressure on the local market.

In response to these developments, many experts suggest that Japan’s new government is repositioning its rice policy to prioritize income stability for farmers and support distributors. This marks a shift from previous policies that focused more on keeping retail prices affordable for consumers.

This change is most evident in the adjustment of production targets. After proposing to increase rice output to 7.48 million tons this year, the new administration has announced a lower target of 7.11 million tons for 2026. This aims to balance supply and demand and prevent excess production that could lead to sharp price declines.

Takahide Kiuchi, executive economist at the Nomura Research Institute and former Bank of Japan (BOJ) board member, commented: “Policies are shifting toward supporting producers and distributors. There’s no indication that rice prices will drop from around 4,000 yen, which may disappoint consumers.”

Conversely, many farmers argue that the current high prices, though unusual, are still insufficient to offset soaring costs. Yasuji Oshima, a farmer in Ibaraki Prefecture, stated: “Rice prices are too high—this is market-driven inflation. But if prices revert to pre-2024 levels while labor, fertilizer, and equipment costs remain elevated, farmers’ profits will be squeezed.”

Oshima warned that declining profits would further discourage young people from entering rice farming, risking long-term production shortages. “I hope the government will implement policies ensuring sustainable agricultural development for the next 10 to 50 years.”

With both retail prices and production costs on the rise, Japan’s rice market faces ongoing challenges. Policy adjustments related to output and import tariffs are expected to help stabilize supply, but price pressures on consumers are unlikely to ease in the near term.

Source: Reuters

Trương Gia Bình: Losing $1 Million in the U.S. and India, FPT Software’s Revival Thanks to Japan

“With a $1 million budget for global expansion, we faced setbacks in Silicon Valley and Bangalore, where investments yielded no contracts. As funds dwindled, Japan emerged as our turning point, offering the first deal that revitalized FPT Software’s journey.”

Vietnamese Rice Prices Hit Two-Month Low

This week, Vietnamese rice prices plummeted to their lowest point in over two months, driven by lackluster demand and subpar quality of the newly harvested crop.