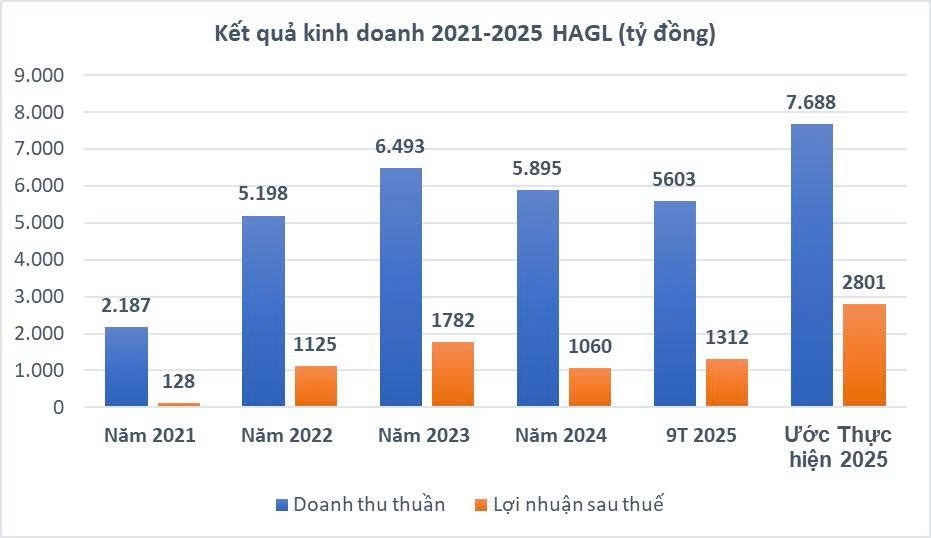

In November 2025, during a survey of banana, durian, and mulberry farms spanning Vietnam, Laos, and Cambodia, Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code: HAG) shared projected financial results for 2025.

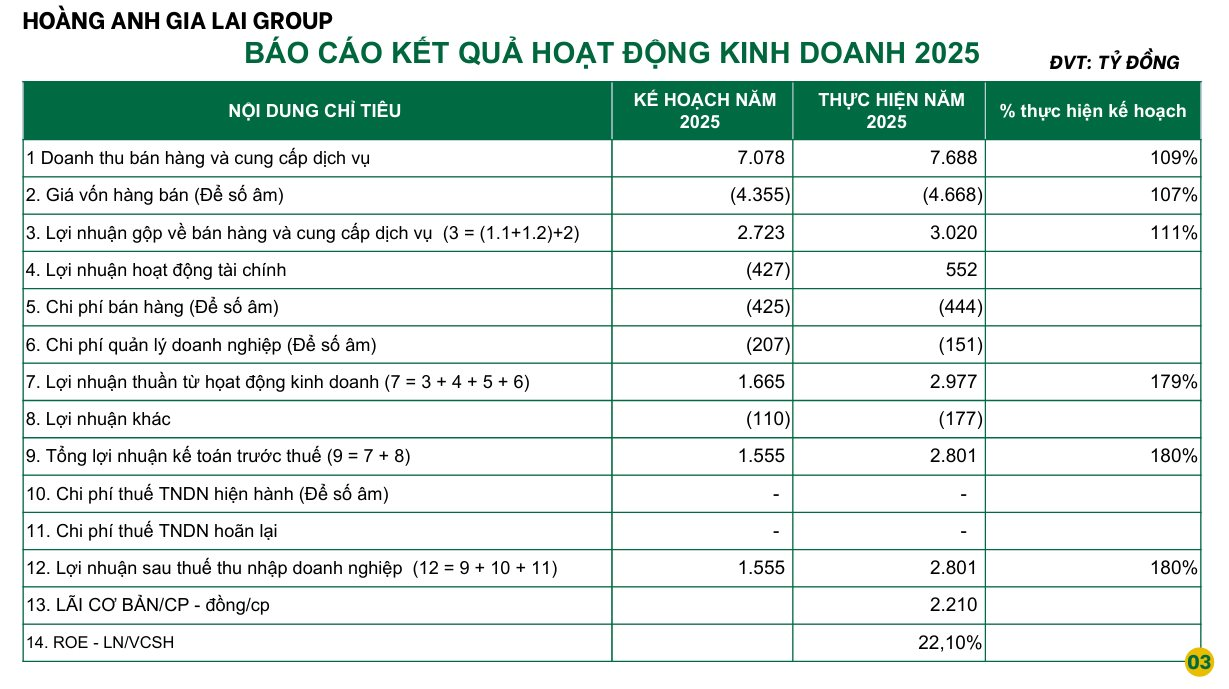

Accordingly, full-year revenue is estimated at VND 7,688 billion, a 30% increase compared to 2024, with post-tax profit projected at VND 2,800 billion, a 164% surge (equivalent to an additional VND 1,246 billion) over the previous year. Basic earnings per share (EPS) stand at VND 2,210.

Source: HAGL

This profit figure also exceeds the initial 2025 target of VND 1,555 billion by 180%. Meanwhile, HAGL’s post-tax profit for the first nine months of 2025 reached just over VND 1,300 billion.

Thus, the company is estimated to earn a post-tax profit of VND 1,500 billion in Q4, surpassing the combined profit of the previous three quarters.

If approved by auditors, the 2025 revenue of VND 7,688 billion and profit of VND 2,800 billion would mark HAGL’s highest historical figures since its financial statements were first published.

Exceptional Financial Income

Estimated gross profit from operations stands at VND 3,020 billion, nearly VND 850 billion higher than 2024 and VND 300 billion above the previous plan, partially explaining the surge in post-tax profit. However, the more significant impact stems from financial activities.

In 2024, HAGL incurred a financial loss of over VND 400 billion. If financial activities yield a profit of VND 552 billion in 2025 as announced, this would boost profits by more than VND 950 billion compared to the previous year.

According to Mr. Doan Nguyen Duc, in the final quarter, HAGL expects to record an extraordinary financial income of approximately VND 1,000 billion due to the reversal of previously accrued interest expenses.

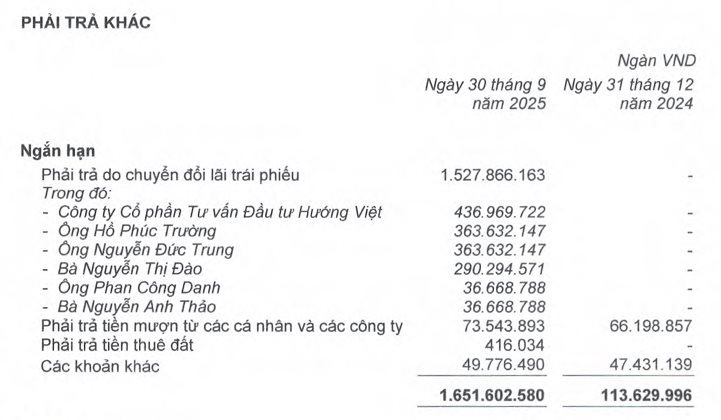

This financial income arises from the partial waiver of bond interest when a group of investors acquired the bond from BIDV Bank and subsequently converted it into HAG shares at the end of Q3.

In the Q3/2025 financial statements, the company reports a “Payable due to bond interest conversion” of VND 1,527 billion.

Also in Q3/2025, HAGL completed the issuance of 210 million shares to convert VND 2,520 billion in debt. Six investors participated, including one institution and five individuals. Huong Viet Investment Consulting JSC received 60.06 million shares as the institutional investor.

Following the transaction, Huong Viet Investment Consulting JSC and related parties hold nearly 75.6 million HAG shares, equivalent to a 5.96% stake, becoming a major shareholder of HAGL.

OCBS Securities, a subsidiary of Huong Viet, holds 15.4 million shares (1.22%).

During HAGL’s financial restructuring, OCBS Securities played a dual role. According to HAGL’s report, OCBS is a bond creditor with a debt of VND 663 billion. Additionally, OCBS served as the advisor and registrar for the VND 1,000 billion bond issued by Hung Thang Loi Gia Lai LLC (a HAGL subsidiary) in August 2025.

7,030 Ha of Bananas and 2,140 Ha of Durian Sustain HAGL

In its core business, the fruit segment (bananas and durian) contributed VND 4,408 billion, accounting for 80% of total revenue in the first nine months. This segment also generated the company’s primary gross profit of VND 2,172 billion.

HAGL operates 7,030 ha of banana farms across three countries: 3,110 ha in Vietnam, 2,070 ha in Laos, and 1,850 ha in Cambodia. Additionally, HAGL cultivates 2,140 ha of durian.

HAGL’s banana farm in Laos

HAGL’s export strategy is twofold. Approximately 60% of banana production is exported to China, generating an estimated revenue of VND 2,460 billion in the first nine months of 2025. The remaining 40% targets premium markets in Japan and South Korea.

At packaging facilities, the processing methods differ significantly between these markets. Bananas exported to China are packed in cartons branded with partner labels such as Xuan Yue and Yongjia.

In contrast, bananas destined for Japan undergo higher standards, including smaller bunches, shrink-wrapping, and branding with labels like Amami and Farmind, emphasizing their highland origins.

PDV Logistics Officially Lists on HOSE

On the morning of November 19th, Phuong Dong Vietnam Transportation and Logistics Joint Stock Company (PDV Logistics, HOSE: PDV) officially listed and began trading over 66 million PDV shares on the Ho Chi Minh City Stock Exchange (HOSE). With an opening price of VND 12,450 per share, PDV’s market capitalization reached VND 823 billion.

Novaland Group Delays Debt Payments

Introducing the NVLH2123011 bond issuance, launched on September 1, 2021, with a total issuance value of 1,000 billion VND and a 2-year maturity. As of now, Novaland remains obligated to repay approximately 816 billion VND in principal and nearly 72 billion VND in interest for this bond tranche.