HAG Reaches 10-Year Peak

Over the past year, shares of HAG, owned by Hoang Anh Gia Lai Joint Stock Company (HAGL), have surged by 50%, reaching VND 18,850 per share (closing at the upper limit on November 17), marking a 10-year high since August 2015.

| HAG Shares Hit 10-Year High |

This year, HAG shares began their upward trend in April, coinciding with the company’s preparations for its annual general meeting. Prior to this, investors had been abuzz about the debt restructuring of bonds and bank loans that Chairman Doan Nguyen Duc (known as Bau Duc) had been grappling with for nearly a decade.

Through negotiations, Bau Duc successfully sold HAGL Agrico (HNG) to Tran Ba Duong. However, a few years later, he admitted, “HAGL Agrico has no core left to extract, only bones remain.” He swiftly sought new investors to address the billions in bond debt, turning to LPBank (owned by Bau Thuy), TPBank, and most recently, the OCBS group.

Bau Duc confidently assured shareholders on the sidelines that HAG’s debt repayment would undoubtedly succeed before the 2025 Annual General Meeting officially approved the private share issuance plan for debt conversion. Creditors and debtors have found common ground, making the general meeting’s approval a mere formality. True to form, the mountain-based tycoon boldly spoke of new ventures in agricultural exports, expanding the product portfolio to include coffee, avocados, and silk production from mulberry farming.

By the end of the first half of 2025, HAG officially erased its accumulated losses, and its shares exited the warning list after nearly three years.

| Key Financial Metrics of HAG |

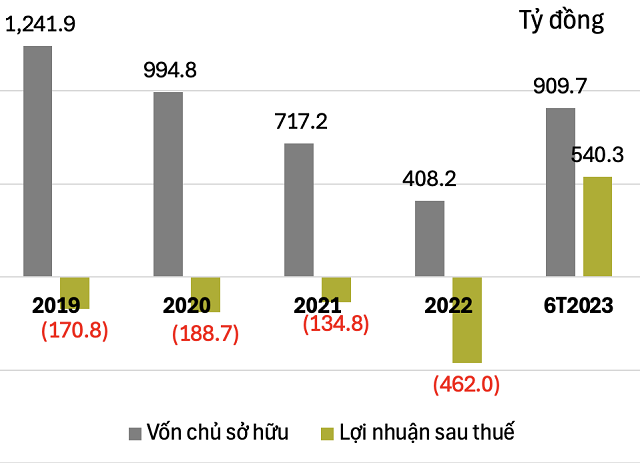

| Equity and Accumulated Profit of HAG |

Aiming to List Subsidiary with Largest Provisions

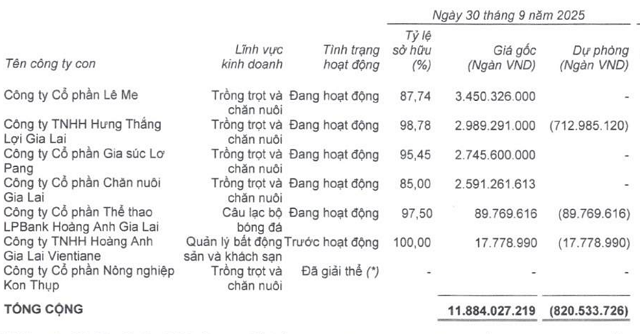

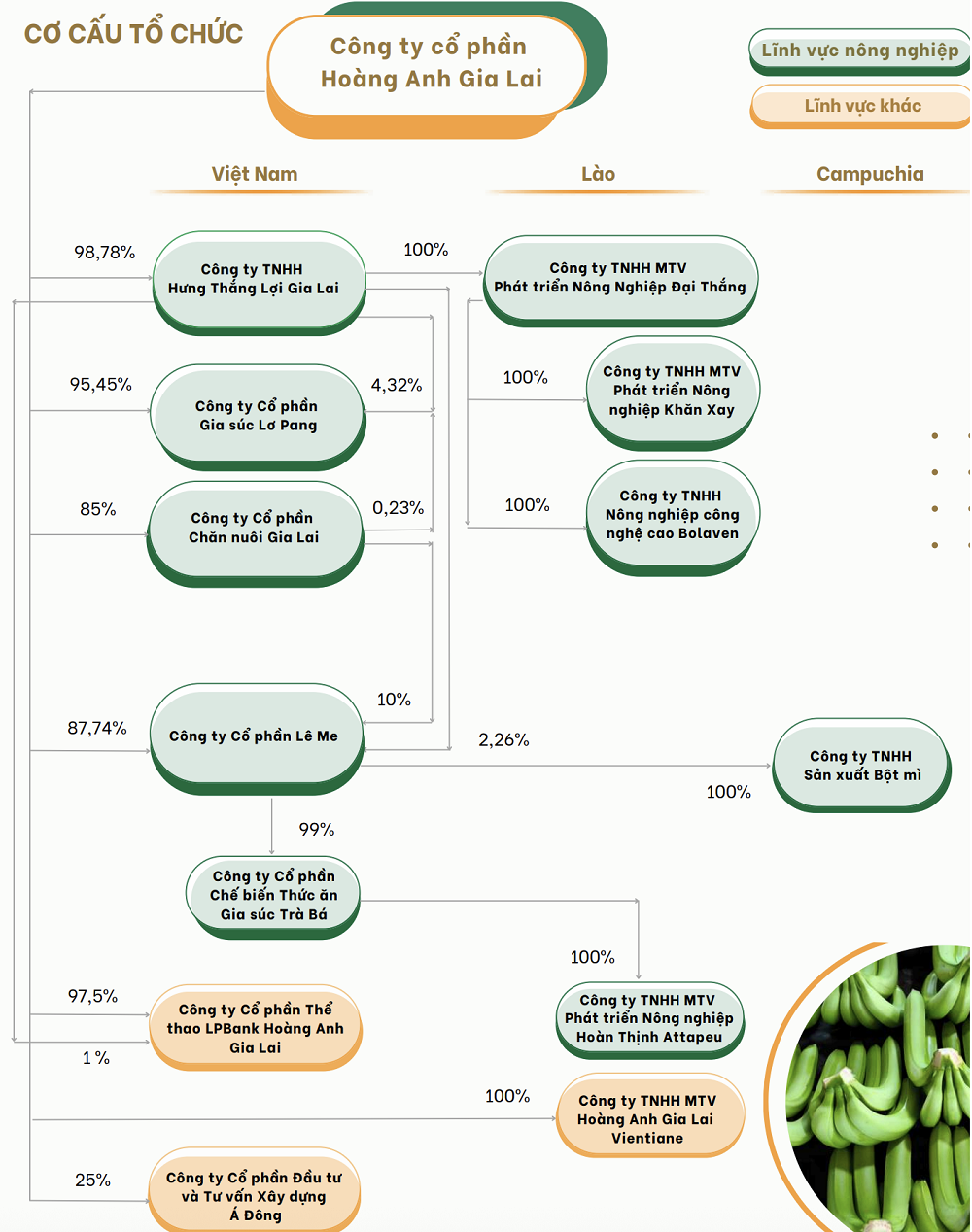

With shares at a decade-high and debt levels reduced, HAG plans to list its subsidiaries, including Hung Thang Loi Gia Lai LLC (HTLGL) in 2026 and Gia Suc Lo Pang JSC (GSLP) in 2027.

Interestingly, HTLGL is the subsidiary for which HAG has made the largest provisions, totaling nearly VND 713 billion out of over VND 820 billion in total provisions as of September 2025.

Source: HAGL’s Q3/2025 Financial Report

|

HTLGL is currently managed by Ms. Vo Thi My Hanh (Board Member and Deputy General Director of HAG), serving as its Director and legal representative. Historically, HAG acquired 98% of HTLGL’s shares from various shareholders for a total of VND 2.477 billion. At that time, in March 2018, HTLGL owned 100% of Dai Thang Agricultural Development Company, which cultivated and managed 1,625 hectares of orchards in Champasak Province, Laos.

HTLGL was initially established with a charter capital of VND 100 billion, with founding shareholders including Mr. Vo Trong Hoang (30%), Mr. Duong Minh Thanh (40%), and Mr. Cao Vinh Tuan (30%). When HAG acquired it, HTLGL’s charter capital was VND 785 billion. Thus, HAG purchased the shares at approximately VND 32,200 per share, more than three times the par value.

Subsequently, HTLGL’s shareholder structure and leadership underwent frequent changes, and it developed a habit of raising funds through bond issuances or loans from its parent company. For instance, a VND 350 billion bond with a 4-year term and a 10% annual interest rate, underwritten by TPBank, matured in October last year. In August, HTLGL issued another VND 1 trillion in bonds with a 3-year term and a fixed interest rate of 10.5% per annum, underwritten by OCBS.

As of September 30, 2025, HTLGL owed HAG over VND 822 billion, including: VND 700 billion in principal, VND 39 billion in interest, and nearly VND 83 billion in borrowed funds and offset receivables.

On October 13, HAG passed a resolution to convert VND 300 billion of debt into equity in HTLGL, reducing the subsidiary’s debt to VND 522 billion. Following this, HTLGL increased its charter capital from VND 1.285 trillion to VND 1.685 trillion, with HAG contributing an additional VND 300 billion, though its ownership stake decreased from 98.778% to 93.14%. Two individuals, Mr. Thuy Ngoc Dung and Ms. Le Thi Lieu, increased their stakes to 3.43% each.

As of November 18, HTLGL was renamed Hoang Anh Gia Lai International Investment JSC.

|

Key Financial Metrics of HTLGL (2019-1H2023)

Source: Author’s compilation

|

What About Gia Suc Lo Pang?

Gia Suc Lo Pang JSC (GSLP) was established in mid-2020 with a charter capital of VND 50 billion. Its founding shareholders included Mr. Nguyen Kim Luan (40%), Mr. Nguyen Van Quy (30%), and Mr. Le Van Thach (30%). By mid-July 2025, the company had increased its charter capital tenfold, with Mr. Luan holding 42%, Mr. Quy 29%, and Mr. Thach 29%. Mr. Nguyen Hung serves as the Director and legal representative.

Meanwhile, HAG’s reports from 2022 to 2025 indicate that it holds nearly absolute ownership of GSLP, with Ms. Ho Thi Kim Chi (Deputy General Director of HAG) serving as Chairwoman. HAG stated that on March 5, 2022, Hung Thang Loi Gia Lai acquired a 10% stake in Gia Suc Lo Pang from individual shareholders. By March 31 of the same year, HAG purchased an additional 90% of the shares from Le Me JSC, increasing its ownership to 99.75% in 2022.

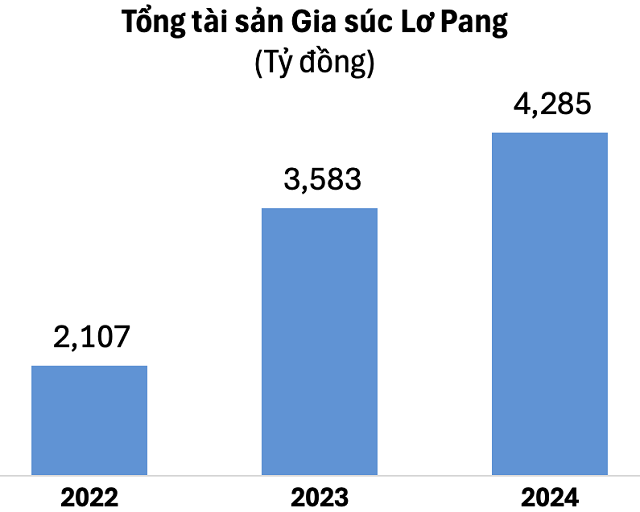

From 2022 to 2024, Gia Suc Lo Pang generated nearly VND 730 billion in after-tax profit. Its total assets as of the end of 2024 were nearly VND 4.3 trillion.

Source: Author’s compilation

|

Interestingly, in March of this year, Mr. Quy—a founding shareholder of Gia Suc Lo Pang—contributed 30% of the capital, alongside Ms. Bach Nguyen Phuong Uyen (40%) and Mr. Nguyen Thuong Trung (30%), to establish Ham Rong Silkworm Investment JSC with a charter capital of VND 20 billion.

Notably, the founding shareholders of these two companies were involved in HAG’s borrowing transactions between 2017 and 2022. Ms. Uyen lent HAG nearly VND 105 billion in Q3/2022. Mr. Quy is a familiar shareholder of HAG, having participated with eight other investors in purchasing nearly 162 million private shares of HAG in April 2022.

Shortly after, the semi-annual report revealed that 14 million HAG shares owned by Mr. Quy and 50 million HAG shares owned by Mr. Doan Nguyen Duc were used as collateral for a VND 102 billion loan from HAG at TPBank, as well as for a VND 300 billion bond issuance by HAG, with TPBank as the bondholder.

Mr. Trung previously received a capital contribution of VND 137 billion from HAG in late 2017.

Mr. Luan borrowed over VND 251 billion from HAG in 2021. For these lending transactions involving shareholders, including Mr. Luan, HAG was administratively penalized by the State Securities Commission.

Mr. Thach founded Le Me JSC in 2018 with a charter capital of VND 10 billion, alongside Ms. Nguyen Ngoc Mai and Mr. Tran Quang Dung. Just one year later, Le Me increased its capital to VND 483 billion. By mid-2023, its capital had surged to VND 3,923 billion. This was the year Le Me issued private shares to convert debt, with HAG acquiring 87.743% of Le Me’s capital and formally consolidating it into HAG; the three founding shareholders retained only 12.257%.

Previously, in 2021, HAG recorded a long-term receivable of VND 440 billion related to a business cooperation contract with Le Me.

Thus, it is evident that from the founding shareholders, these companies have successively transformed through debt conversions and receivables to become subsidiaries of HAG. Now, with these familiar individuals establishing new companies, will Bau Duc continue to use old methods to legitimize debt into equity amidst the unending debt spiral?

Source: HAG

|

– 09:30 21/11/2025

VietinBank Targets 2025 Pre-Tax Profit of VND 32,500 Billion, Poised to Enter Gold Market

At the investor conference held on the afternoon of November 13, 2025, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG) forecasted a stable Net Interest Margin (NIM) with potential improvement by the end of 2026. Additionally, the bank identified emerging business segments, including the National Gold Trading Platform and digital assets, as key strategic focuses.