Concerns Over “Double Taxation”

On the afternoon of November 19th, during the discussion on the draft Law on Personal Income Tax (amended), Delegate Trần Kim Yến (Ho Chi Minh City delegation) raised concerns about the proposal to impose personal income tax on the transfer of gold bars.

In the draft Law, the Government proposes a 0.1% tax on gold bar transfers to enhance market transparency and curb speculation. The Government is also tasked with specifying the taxable value threshold for gold bars, the implementation timeline, and tax rate adjustments in line with market management goals.

Delegate Yến noted that most people view gold as a savings asset accumulated through daily life and hard work. “They might buy it in small amounts, like five grams or one tael, saving for emergencies such as funerals, weddings, or illnesses,” she explained.

Delegate Trần Kim Yến (Ho Chi Minh City delegation)

She further argued that gold is often purchased with already taxed savings. “Is taxing it again upon sale a case of double taxation?” she questioned.

Delegate Yến suggested that taxing citizens’ gold savings might lack social and economic sensitivity. The aim should be to target speculators and market manipulators, but a 0.1% tax may not deter speculation effectively. Instead, focus should be on measures to regulate and stabilize the gold market.

Delegate Phạm Văn Hòa (Đồng Tháp delegation) agreed that profits from gold speculation should be taxed but criticized the 0.1% rate as insignificant. He urged a reevaluation to better curb speculative activities.

Delegate Phạm Văn Hòa (Đồng Tháp delegation)

He advocated exempting families saving gold for future generations or emergencies from transfer taxes, as they are not engaged in business activities.

Supporting Gold Transfer Taxation

Delegate Trịnh Xuân An (Đồng Nai delegation) supported the tax proposal, noting its novelty and suitability for Vietnam’s gold market. He highlighted the difficulty in distinguishing between speculation and savings, especially when buyers engage in early-morning purchases or switch to gold jewelry under pressure.

Delegate Trịnh Xuân An (Đồng Nai delegation)

He suggested setting clear transaction thresholds, such as 200 million VND per transaction or 1 billion VND annually.

Focus on Regulating Gold Transactions

Finance Minister Nguyễn Văn Thắng clarified that the 0.1% tax aims to regulate gold transactions rather than boost revenue. The Government will carefully determine the implementation timeline and report to the National Assembly.

Finance Minister Nguyễn Văn Thắng

He emphasized that the policy seeks to stabilize the gold market and protect citizens from speculative volatility, ensuring no double taxation.

Do You Need to File a Personal Income Tax Return If You’re Below the Taxable Threshold?

Are you unsure whether you need to file a personal income tax return if your earnings fall below the taxable threshold?

Revamping Personal Income Tax Law: Key Amendments Proposed by National Assembly Delegates

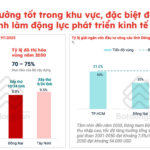

Numerous Members of Parliament have emphasized the necessity of amending the Personal Income Tax Law, offering specific recommendations such as: adjusting the family deduction threshold based on economic regions; carefully considering whether to retain or streamline the progressive tax brackets; and providing clearer regulations on taxes related to the transfer of gold bars and inherited real estate.