Prior to the transaction, Mr. Binh held over 10.7 million shares, equivalent to 1.98% of the company’s capital. Upon completion, his ownership ratio is expected to slightly decrease to approximately 1.9%.

With the current market price at around VND 69,000 per share, the transaction could yield Mr. Binh more than VND 27 billion. According to the announcement, the purpose of the sale is to meet personal financial needs, and it will be executed through order matching and/or negotiated transactions.

Born in 1982, Mr. Binh graduated from the University of Virginia and the University of Hawaii in the United States. Before joining REE, he worked at HSBC Vietnam. From 2009 to 2020, he served as the Financial Director and was later appointed as Deputy General Director, while also holding a seat on the Board of Directors since 2007.

His ownership ratio has remained relatively stable over the years, with additional shares primarily acquired through stock dividend distributions.

Mr. Nguyễn Ngọc Thái Bình – Image: REE

|

Mr. Binh is one of two children of Mrs. Nguyễn Thị Mai Thanh, Chairwoman of REE, who holds 12.8% of the company’s shares. The ownership structure at REE is heavily influenced by Mrs. Thanh’s family, with her husband, Mr. Nguyễn Ngọc Hải, owning 5.5%, and their daughter, Mrs. Nguyễn Ngọc Nhất Hạnh, holding 1.3%. Additionally, the largest controlling shareholder remains Platinum Victory Pte. Ltd., with over 41.6%, which recently slightly increased its stake.

The price of REE has maintained a positive trend and is currently at its highest level since its listing 25 years ago. Compared to the beginning of 2025, the increase is over 20%. Since early 2024, the rise exceeds 60%. Over the past five years, the stock has more than quadrupled in value.

The price surge closely follows improvements in business operations. In Q3/2025, REE reported a net profit of VND 674 billion, the highest in two years and second only to Q4/2024. Revenue surpassed VND 2.5 trillion, ranking second historically and continuing its upward trend since Q3/2023.

Revenue from central hydropower plants such as Vĩnh Sơn Sông Hinh and Sông Ba Hạ remained the primary driver during the period. The electromechanical refrigeration segment also showed a strong recovery.

In the first nine months, REE achieved a net profit of over VND 1.9 trillion, a 45% increase year-on-year, and fulfilled more than 98% of its annual target with one quarter still to go.

| REE market price has been rising consistently over the years |

– 10:47 21/11/2025

Capital Outflows Hit Insurance, Real Estate, and Securities Sectors

In the past week of trading, cash flow weakened significantly, with no sector standing out as a notable magnet for investment. Conversely, numerous sectors experienced substantial outflows, highlighting a broader trend of capital withdrawal.

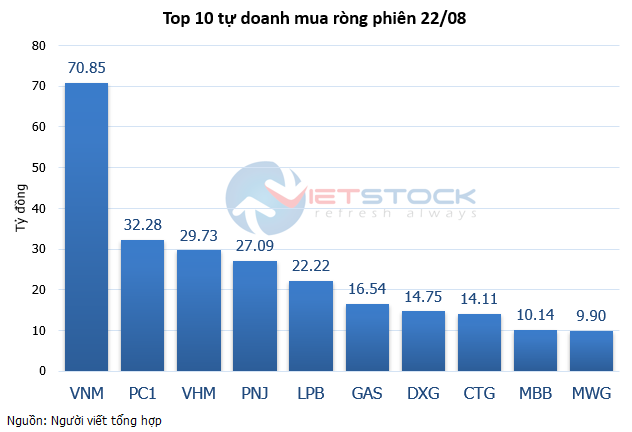

Investment Fund Trading: Buying Momentum Returns

In the final week of October (24–31/10/2025), investment funds resumed their net buying trend, despite the broader market facing significant downward pressure. After peaking around 1,800 points, the VN-Index declined for three consecutive weeks, shedding a total of 108 points, and closed the session on 31/10 at 1,639.65 points.

HAH Surpasses 9-Month Profit Targets, Achieves Record-High Receivables, and Prepares to Adjust Annual Goals in Upcoming Meeting

Hai An Transport and Loading Joint Stock Company (HOSE: HAH) has announced an extraordinary general meeting in December to adjust its 2025 business plan, following a 20% profit surge in the first nine months, surpassing its annual target.