I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts rallied during the trading session on November 20, 2025. Specifically, 41I1FB000 (I1FB000) rose by 0.65% to 1,898.1 points; VN30F2512 (F2512) increased by 0.4% to 1,889.5 points; 41I1G3000 (G3000) gained 0.03% to 1,883.9 points; and 41I1G6000 (I1G6000) climbed 0.35% to 1,880.3 points. The underlying index, VN30-Index, closed at 1,897.46 points.

Additionally, VN100 futures contracts also saw unanimous gains on November 20, 2025. Notably, 41I2FB000 (I2FB000) advanced 0.36% to 1,804.7 points; 41I2FC000 (I2FC000) rose 0.41% to 1,802.7 points; 41I2G3000 (I2G3000) increased 0.36% to 1,791.3 points; and 41I2G6000 (I2G6000) surged 0.59% to 1,788.5 points. The VN100-Index closed at 1,804.39 points.

During the November 20, 2025 session, 41I1FB000 quickly rallied from the ATO session, with Long positions dominating early, propelling the contract upward. It then traded sideways for most of the morning. In the afternoon, selling pressure reemerged, narrowing gains, but buyers maintained control, closing I1FB000 in positive territory with a 12.3-point increase.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

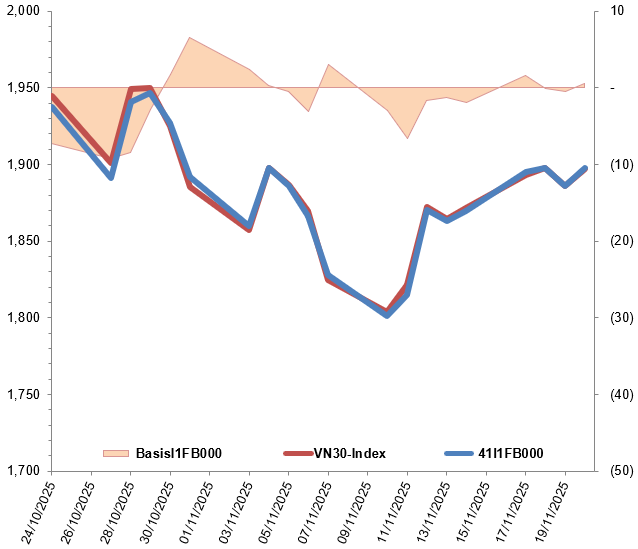

At the close, the basis of 41I1FB000 reversed from the previous session, reaching 0.64 points, indicating renewed investor optimism.

Movements of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

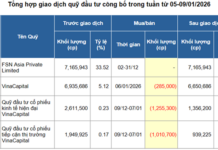

Trading volume and value in the derivatives market increased by 12.24% and 13.45%, respectively, compared to November 19, 2025. Specifically, I1FB000 volume rose 4.54% to 200,571 contracts, while I2FB000 volume doubled to 74 contracts.

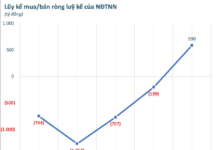

Foreign investors returned to net buying, with a total net purchase of 1,132 contracts on November 20, 2025.

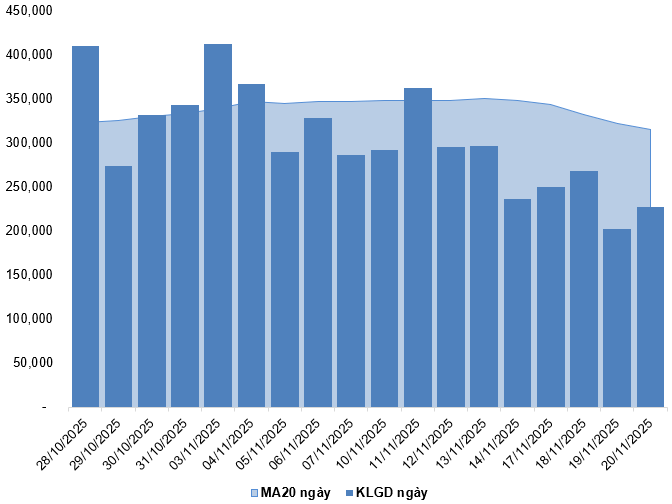

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Futures Contract Valuation

Based on the fair pricing method as of November 21, 2025, the reasonable price range for actively traded futures contracts is as follows:

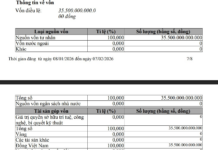

Valuation Summary Table for VN30-Index and VN100-Index Derivatives

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for contract maturity.

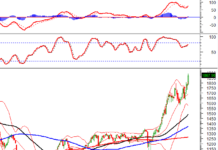

I.3. Technical Analysis of VN30-Index

On November 20, 2025, the VN30-Index continued to trade sideways, with small-bodied candles in recent sessions and below-average 20-day volume, reflecting investor hesitation. However, the index remains above the Bollinger Bands’ Middle line, while the MACD indicator continues to rise toward the zero line after a buy signal, suggesting ongoing recovery efforts.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURE CONTRACTS OF THE BOND MARKET

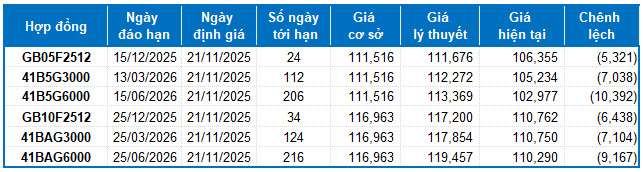

Based on the fair pricing method as of November 21, 2025, the reasonable price range for actively traded bond futures contracts is as follows:

Valuation Summary Table for Government Bond Futures

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for contract maturity.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer significant value in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:28 20/11/2025

Derivatives Market on November 20, 2025: Market Liquidity Declines Ahead of Expiry Session

On November 19, 2025, futures contracts for the VN30 and VN100 indices predominantly closed in negative territory. The VN30-Index reversed its trend, forming a small-bodied candlestick pattern after retesting the 50-day SMA, accompanied by increased trading volume compared to the previous session. This suggests a cautious sentiment among investors.

November 2025 Crypto Report (Part 2): Returning to Critical Support Levels?

Uncover the latest insights and trends shaping the world of major cryptocurrencies, meticulously analyzed for both short-term and long-term investment strategies. These expert evaluations are designed to empower informed decision-making, catering to the interests of discerning investors.