EVS Securities Joint Stock Company (stock code: EVS, listed on HNX) has announced the materials for its 2025 Extraordinary General Meeting of Shareholders, scheduled for the afternoon of December 11, 2025, via an online format.

The meeting will address several critical agenda items, including amendments to the Company’s Charter, revisions to its Internal Governance Regulations, and the removal of Board of Directors members.

Notably, the meeting will deliberate on the handling of collateral assets tied to repeatedly extended receivables, continued execution of asset purchases, sales, or investments, and approval of transactions under the authority of the General Meeting of Shareholders, as outlined in Report No. 10/2025/TT-HĐQT dated April 1, 2025, previously approved during the 2025 Annual General Meeting.

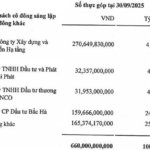

Specifically, the EVS Board of Directors will propose the recovery and sale of collateral assets for two repeatedly extended debts. The first is a debt owed by Vietmedia Joint Stock Company (Vietmedia), totaling VND 328.55 billion (principal: VND 306.68 billion, interest as of September 30, 2025: VND 21.87 billion, with interest to be settled at the time of receivable finalization). The collateral for this debt is 35.3 million NVB shares of National Citizens Commercial Joint Stock Bank.

The second debt, amounting to VND 189.16 billion (principal: VND 169.55 billion, interest as of September 30, 2025: VND 19.61 billion, with interest to be settled at the time of receivable finalization), is owed by Toan Xuan Thinh Trading Investment Joint Stock Company. The collateral for this debt is 19.49 million NVB shares.

EVS will proceed with the recovery and sale of the NVB shares held as collateral on the securities accounts of the guarantors, either through order matching, negotiated transactions, or off-exchange ownership transfers to EVS’s proprietary trading account, in compliance with legal regulations. The recovery price of the NVB shares will be based on market agreement and adhere to legal provisions.

For the debt owed by Tien Thanh Consulting Service LLC (Tien Thanh), EVS will require Tien Thanh to provide additional collateral. EVS will then sell or recover the collateral and other assets, or execute other related actions, to offset Tien Thanh’s payment obligations, ensuring full recovery of the receivable.

The debt from Tien Thanh amounts to VND 737.5 billion in bonds. Originally due on December 22, 2025, the payment has been extended to January 22, 2026.

Additionally, the meeting will approve the resignation of two Board of Directors members due to personal reasons. Mr. Nguyen Dinh Tuan (born 1980) submitted his resignation effective November 17, 2025, and Mr. Ngo Thanh Tung (born 1982) resigned effective November 19, 2025.

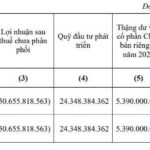

In terms of business performance, EVS reported operating revenue of VND 209 billion for the first nine months of 2025, a 41% increase year-on-year. Consequently, pre-tax profit reached over VND 11 billion, 2.3 times higher than the same period last year.

As of September 30, 2025, EVS’s total assets stood at VND 2,323 billion, a 5.8% decrease year-on-year.

Within this, the FVTPL financial asset portfolio had an original value of over VND 723 billion, comprising VND 433 billion in listed shares and VND 251 billion in unlisted shares. Outstanding loans totaled more than VND 140 billion.

Notably, receivables accounted for half of the total assets, amounting to VND 1,255 billion. These receivables likely include the unrecoverable bond debts mentioned earlier.

These include VND 328.5 billion owed by Vietmedia, VND 737.5 billion in bonds from Tien Thanh Consulting Service LLC, and VND 189 billion from Toan Xuan Thinh Trading Investment Joint Stock Company.

F88 Recognized by Deloitte as “Vietnam Best Managed Companies 2025”

On November 19, 2025, F88 Company was honored by Deloitte, one of the world’s leading audit and consulting firms, at the prestigious “Vietnam Best Managed Companies 2025 – Best-Managed Vietnamese Enterprises” program.

F88 Recognized by Deloitte as One of Vietnam’s Best Managed Companies 2025, Validating Excellence in Governance and Growth Performance

On November 19, 2025, F88 was honored by Deloitte—one of the world’s leading audit and consulting firms—at the prestigious “Vietnam Best Managed Companies 2025” program, recognizing Vietnamese enterprises with exceptional governance. F88’s inclusion in this elite list underscores its sustained commitment to professionalizing management, enhancing operational efficiency, and championing transparency within Vietnam’s alternative financial sector.