As of the closing session on November 20, domestic gold prices experienced a widespread decline, dropping by 300,000 to 700,000 VND compared to the previous day’s closing levels.

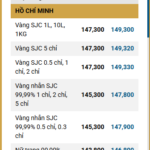

Specifically, the price of gold bars across major gold retailers saw a uniform decrease of 700,000 VND per tael. SJC, PNJ, and DOJI all listed the buying and selling prices of SJC gold bars at 148.3 – 150.3 million VND per tael. Bao Tin Minh Chau traded at 148.8 – 150.3 million VND per tael.

For gold rings, SJC listed the buying and selling prices at 145.9 – 148.4 million VND per tael, a decrease of 600,000 VND per tael from the previous day’s close.

DOJI and PNJ set their buying and selling prices at 146.2 – 149.2 million VND per tael, a drop of 300,000 VND from the previous session’s end.

Gold rings at Bao Tin Minh Chau also saw a 500,000 VND decrease in both buying and selling prices, trading at 148.3 – 151.3 million VND per tael.

Source: SJC

—————————————————–

In the latest update from the early afternoon of November 20, gold bar prices across major retailers uniformly decreased by 700,000 VND per tael.

SJC, PNJ, and DOJI all listed the buying and selling prices of SJC gold bars at 148.3 – 150.3 million VND per tael. Bao Tin Minh Chau traded at 148.8 – 150.3 million VND per tael.

For gold rings, SJC listed the buying and selling prices at 145.9 – 148.4 million VND per tael, a decrease of 600,000 VND per tael from the previous day’s close. Gold rings at Bao Tin Minh Chau also saw a 500,000 VND decrease in both buying and selling prices, trading at 148.3 – 151.3 million VND per tael.

DOJI set their buying and selling prices at 146.2 – 149.2 million VND per tael, a drop of 300,000 VND from the previous session’s end. Meanwhile, PNJ maintained its prices at 146.5 – 149.5 million VND per tael.

In the global market, spot gold prices fell by 0.4% to $4,060 per ounce. U.S. gold futures for December delivery dropped by 0.5% to $4,064 per ounce.

Global gold prices declined as the U.S. dollar strengthened, and the market reduced expectations of a Federal Reserve rate cut in December.

The DXY dollar index rose to its highest level in over two weeks, making gold more expensive for USD holders.

The minutes of the Fed’s October meeting, released on Wednesday, indicated that the central bank had cut rates even as policymakers warned that doing so could risk rising inflation and erode public trust in the central bank.

CME Group’s FedWatch tool showed that traders now see a nearly 33% chance of a Fed rate cut at the December 9-10 meeting, down from 49% on Wednesday.

—————————————————–

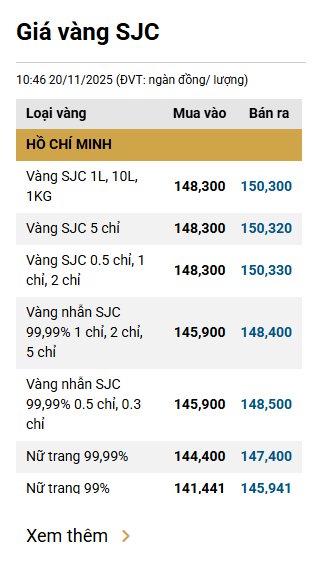

In the latest morning update, gold bar prices remained unchanged from the previous day’s close. SJC, PNJ, and DOJI all listed the buying and selling prices of SJC gold bars at 149 – 151 million VND per tael. Bao Tin Minh Chau traded at 149.5 – 151 million VND per tael.

For gold rings, SJC listed the buying and selling prices at 145.9 – 148.4 million VND per tael, a decrease of 600,000 VND per tael from the previous day’s close.

PNJ and DOJI maintained their buying and selling prices at 146.5 – 149.5 million VND per tael. Gold rings at Bao Tin Minh Chau also held steady at 148.3 – 151.3 million VND per tael.

Source: SJC

———————————————————

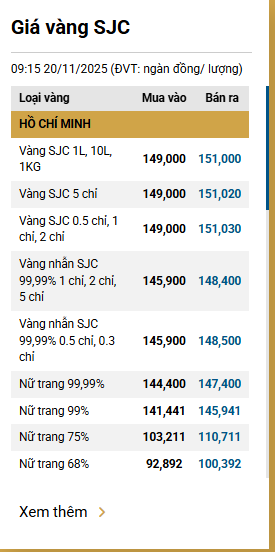

As of 7 a.m. today (November 20), domestic gold prices remained unchanged from the previous day’s close.

SJC, PNJ, and DOJI all listed the buying and selling prices of SJC gold bars at 149 – 151 million VND per tael. Bao Tin Minh Chau traded at 149.5 – 151 million VND per tael.

For gold rings, SJC listed the buying and selling prices at 146.5 – 149 million VND per tael.

PNJ and DOJI traded at 146.5 – 149.5 million VND per tael. Gold rings at Bao Tin Minh Chau were bought and sold at 148.3 – 151.3 million VND per tael.

Source: SJC

In the international market, gold prices entered their third consecutive session of gains amid the release of the Fed’s October meeting minutes.

As of 7:00 a.m., spot gold prices stood at $4,102 per ounce, up 0.6% from the previous day’s close. Earlier, gold prices had risen by 0.53% and 0.26% in the trading sessions on November 18 and 19, respectively.

According to the Fed’s October meeting minutes, the Federal Open Market Committee (FOMC) once again acknowledged the weakening labor market but expressed significant concerns about the impact of rate cuts on inflation.

The minutes also revealed that Fed officials were divided over rate cuts. Internal disagreements persisted over whether a sluggish labor market or persistent inflation posed a greater economic threat.

Although the FOMC approved a 25 basis point rate cut at the meeting, the path forward remains uncertain. Ongoing internal divisions continue to influence the outlook for a December rate cut. The minutes indicated that “many” Fed officials are skeptical about the need for additional rate cuts this year.

“Some members judged that the Committee could lower the target range for the federal funds rate at the December meeting if the economy evolved as they anticipated during the intermeeting period,” the minutes stated.

“Many members noted that, in light of their economic outlooks, holding the target range for the federal funds rate steady for the remainder of the year could be appropriate,” the minutes continued.

Earlier, data released on Tuesday showed that the number of Americans receiving unemployment benefits reached a two-month high in mid-October, with unemployment claims continuing to rise to 1.9 million in the week ending October 18.

“(The data) is boosting market expectations of a rate cut in December. This is supporting gold and silver, which are attempting to end a three-day losing streak,” said Tai Wong, an independent metal trader.

Gold, as a safe-haven asset, tends to rise in a low-interest-rate environment since it is a non-yielding asset. Gold prices fell by 0.56% on Thursday, over 2% on the previous Friday, and nearly 1% on Monday as investors scaled back expectations of another Fed rate cut this year.

Gold Shops in Ho Chi Minh City Suddenly… Deserted

In recent days, numerous gold shops in Ho Chi Minh City have seen a noticeable decline in foot traffic. Observers suggest that the narrowing gap between official gold prices and those on the black market has diminished the appeal for buyers and sellers looking to profit from price differences.

Gold Prices Plummet by 1.7 Million VND per Tael on the Afternoon of November 18th

Global gold prices experienced a significant decline during Monday’s trading session (November 17) and continued to drop today (November 18). Domestically, the prices of gold rings and gold bars have both fallen, with reductions ranging from 0.2 to 1.7 million VND per tael compared to the end of yesterday.

Gold Prices Hit Record Highs: Opportunity or Trap?

As a safe-haven asset, gold prices have consistently shattered historical records, driving domestic prices to unprecedented highs. The question remains: will this trend persist, and what strategies should investors adopt?

Which Investment Channel Will Shine Next: Gold, Real Estate, or Stocks?

The three major investment channels are entering distinct phases. Gold is forecasted to continue its upward trajectory in the medium to long term, while real estate maintains short-term vibrancy but carries potential risks from 2027 onward. Meanwhile, the stock market is showing signs of bottoming out, paving the way for a more unified upward trend.