F88’s inclusion in this prestigious list underscores its long-term commitment to professionalizing governance, enhancing operational efficiency, and promoting transparency in Vietnam’s alternative finance sector.

The “Best Managed Companies” program, conducted by Deloitte across 48 countries and territories, evaluates businesses against rigorous international standards. Candidates must meet stringent criteria in strategy, leadership capabilities, financial performance, risk management, and sustainability. An independent panel of senior management experts and business leaders assesses applicants using a globally unified framework.

According to Deloitte, F88 successfully navigated all evaluation stages, showcasing its robust governance framework and consistent large-scale operational excellence. The company provided comprehensive data on risk control, quality management, operational processes, and technology integration, enabling the panel to thoroughly assess its internal governance capabilities.

Phạm Đình Huỳnh, Director of Private Enterprise Services at Deloitte Private Vietnam, remarked, “Operating in the high-risk alternative finance sector, F88 has established an efficient, transparent operational model with significant social impact by providing legal, safe access to capital. This foundation is crucial for meeting the standards of a well-governed enterprise.” He emphasized that investor confidence and long-term financial partnerships are tangible proofs of the company’s operational integrity.

Phạm Trần Long, Deputy General Director of F88, stated that the award marks a significant milestone in the company’s governance enhancement journey: “Over the years, F88 has focused on building internationally compliant governance, leveraging technology for risk management, standardizing operations, and developing our workforce. We aim to create a transparent, sustainable, and value-driven inclusive finance model for customers, partners, and the market.”

Strong Financial Performance Bolsters Market Confidence

Following its UPCoM listing in August 2025, F88 reported robust growth amidst volatile consumer finance market conditions. Third-quarter 2025 pre-tax profit reached VND 282 billion, doubling year-on-year. Nine-month cumulative profit hit VND 603 billion, approximately 90% of the annual target. Outstanding loans grew 40% to VND 6,413 billion, with nine-month disbursements rising 80% to VND 11,768 billion. In Q3 alone, the company acquired nearly 70,700 new borrowers, totaling 246,700 contracts, with a 68% repeat customer rate—a key indicator of service quality and user satisfaction.

Financially, F88 maintained low non-performing and overdue loan ratios while reducing the cost-to-income ratio (CIR) to 49% in Q3, reflecting operational optimization and technology integration in customer service, credit scoring, and risk monitoring.

Analysts view these results as highly positive for an alternative finance firm operating across hundreds of outlets, requiring stringent risk management and lean operations. Profit growth alongside cost control demonstrates the effectiveness of F88’s operational model.

Expanding and Enhancing the Alternative Finance Model

With over 900 nationwide branches, F88 is among the few firms standardizing pawnshop-secured lending through transparency, data-driven practices, and regulatory compliance. The company aims to develop an inclusive financial ecosystem serving underbanked customers while enhancing data-driven credit scoring and risk management.

The Deloitte “Vietnam Best Managed Companies 2025” award, coupled with strong financial results, is expected to strengthen investor and partner confidence during F88’s upcoming expansion phase. The company plans to invest in technology, governance refinement, and transparency to achieve sustainable growth and contribute to Vietnam’s financial inclusion goals.

F88 Recognized by Deloitte as One of Vietnam’s Best Managed Companies 2025, Validating Excellence in Governance and Growth Performance

On November 19, 2025, F88 was honored by Deloitte—one of the world’s leading audit and consulting firms—at the prestigious “Vietnam Best Managed Companies 2025” program, recognizing Vietnamese enterprises with exceptional governance. F88’s inclusion in this elite list underscores its sustained commitment to professionalizing management, enhancing operational efficiency, and championing transparency within Vietnam’s alternative financial sector.

Vinafood II Deputy General Manager Appointed as Foodcosa Chairman Amid Business Decline

Mr. Nguyen Van Hien has been elected as the Chairman of the Board of Directors of Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) for the term 2021-2026. The decision was finalized following the conclusion of the extraordinary general meeting held on November 18th.

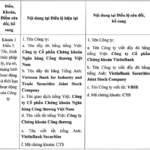

VietinBank Securities Rebrands: New Name, New Identity

The extraordinary shareholders’ meeting of VietinBank Securities will approve the resignation of Ms. Bùi Thị Thanh Thúy from her position as a Board of Directors member and elect a new member to fill the vacancy. Additionally, the company aims to rebrand, including a name change and a refreshed corporate identity.

Viconship Set to Receive Nearly VND 90 Billion in Dividends from Green Port Vip

Green Port Vip is set to distribute over VND 164.4 billion in cash dividends for 2025, offering a 20% payout ratio to its shareholders. Notably, Viconship is expected to receive nearly VND 89.4 billion from this dividend allocation.