According to the Hanoi Stock Exchange (HNX), Gia Duc Real Estate Co., Ltd. (a subsidiary of Novaland Investment Group Corporation, stock code: NVL) has announced the approval from bondholders to supplement the collateral assets for its bonds.

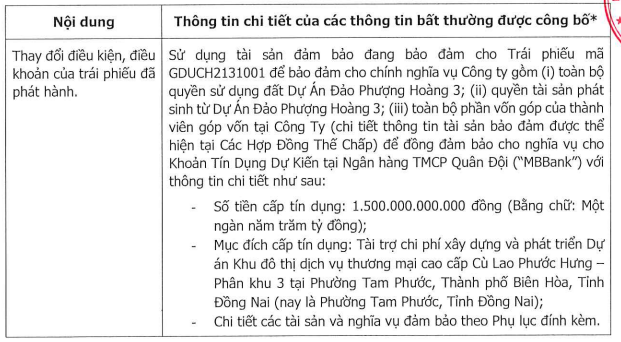

Specifically, Gia Duc Real Estate will use the collateral assets of the GDUCH2131001 bond series to jointly secure a credit facility of VND 1,500 billion at MB Bank.

This loan is intended to finance the construction and development of the high-end commercial service urban area Cu Lao Phuoc Hung (also known as Aqua City) – Subzone 3 (referred to as Phoenix Island 3 or Island 3) in Tam Phuoc Ward, Bien Hoa City, Dong Nai Province.

The assets used for joint collateral include land use rights and assets generated from Island 3, along with the entire capital contribution of members at the company.

Source: HNX

Regarding the GDUCH2131001 bond, it is the only bond currently issued by Gia Duc Real Estate. It is a non-convertible, non-warrant bond with collateral and is not a subordinated debt.

The bond was issued in 2021 and will mature in 2031, with an annual interest rate of 10%. The current issuance and outstanding value is VND 1,300 billion.

In connection with the aforementioned credit facility, on November 3, 2025, Novaland announced Resolution No. 65/2025-NQ.HĐQT-NVLG, which includes a provision approving the use of the entire capital contribution of over VND 2,019.4 billion, equivalent to 53.996% of the charter capital at Gia Duc Real Estate, to secure the loan obligation of up to VND 1,500 billion at MB Bank.

Additionally, the resolution approves the use of assets totaling VND 5,470.7 billion, equivalent to 98.087% of the charter capital at Novaland Investment Corporation (NVL JSC), to secure a loan obligation of up to VND 2,000 billion at MB Bank – North Saigon Branch.

The aforementioned collateral assets are currently securing the obligations of bonds issued by NVL JSC in 2020, with a total outstanding value of VND 1,405 billion.

The purpose of the two loans from NVL JSC and Gia Duc Real Estate is to finance the construction and development of Subzone 2 and Subzone 3 of the high-end commercial service urban area Cu Lao Phuoc Hung.

Regarding the business performance of Gia Duc Real Estate, in the first six months of 2025, the company recorded a post-tax loss of nearly VND 46 billion, compared to a profit of over VND 57 billion in the same period last year.

As of June 30, 2025, the owner’s equity was recorded at VND 3,431.5 billion. Total liabilities increased by nearly 8%, reaching nearly VND 8,752 billion, primarily due to a significant increase in bank loans from VND 120 billion to over VND 1,992 billion.

Securing Digital Financial Security for Millions of Vietnamese: MB’s Commitment

“Financial security is the cornerstone of successful digital transformation,” MB emphasizes, highlighting the critical importance of robust cybersecurity in an era where cyber threats are increasingly sophisticated.

MB Wins Four Prestigious Awards from Visa

Not only does this award recognize the success of MB Bank’s card services, but it also stands as a testament to the bank’s relentless efforts in implementing cashless payment solutions. By leveraging cutting-edge technology, MB Bank is committed to delivering a seamless and secure experience for its customers.

CEO MB Phạm Như Ánh: The Extraordinary Journey Fueled by Discipline and Breakthroughs

The journey to propel MB into the top 5 financial institutions is guided by a leadership philosophy that blends ‘iron discipline’ with an unwavering spirit of innovation and breakthrough. This ethos has been the compass for CEO Phạm Như Ánh through every challenge, fostering MB’s sustained growth and resilience.

MB Wins Vietnam Digital Transformation Award 2025 for Pioneering Technology Solutions

Building on its previous successes, Military Commercial Joint Stock Bank (MB) has once again been honored with the “Outstanding Digital Transformation Enterprise” award at the Vietnam Digital Awards 2025. This recognition highlights MB’s comprehensive technology solutions, leveraging artificial intelligence and automation to enhance customer service.