The global smartphone industry is facing a severe crisis as memory chip prices surge by nearly 50%, forcing major manufacturers like Xiaomi, OPPO, and vivo to halt purchases. According to an exclusive report by Jiemian News on November 14, these companies are running critically low on inventory, with collective stocks lasting less than two months. Some even have less than three weeks’ worth of DRAM chips, leaving them hesitant to accept the skyrocketing prices from Micron, Samsung, and SK hynix.

The situation is further complicated by memory chip manufacturers showing no concern for sales. Jackey, an employee at a chip production facility, candidly stated that if smartphone companies refuse to buy, they can easily redirect their output to server clients facing supply shortages. Notably, server chip prices are 30% higher than those for smartphones, making the choice obvious for manufacturers.

The Dual Storm Driving Memory Chip Prices

AI and shifts in production technology are pushing memory chip prices to unprecedented highs.

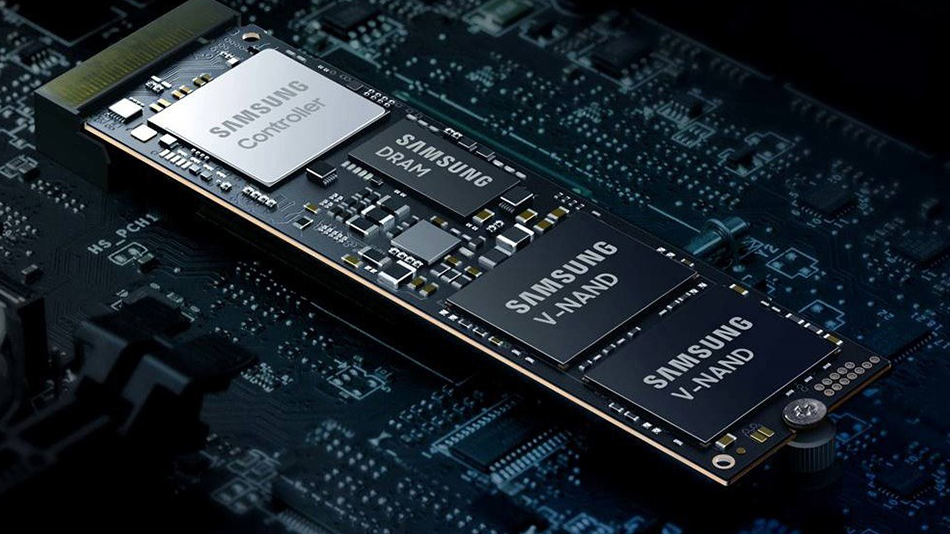

The crisis stems from the AI boom and big data models, which are driving up demand for memory chips in data centers. Server manufacturers are willing to pay premium prices to secure supply, making this market far more attractive than the smartphone sector. The situation worsened when Samsung, SK hynix, Kioxia, and Micron collectively reduced NAND flash supply in the second half of the year to drive prices higher.

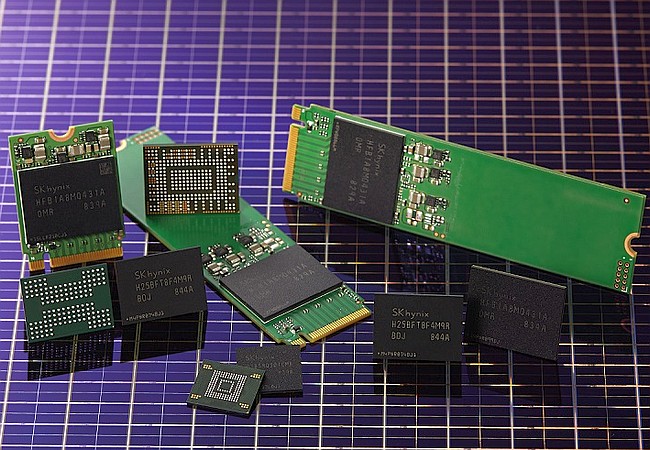

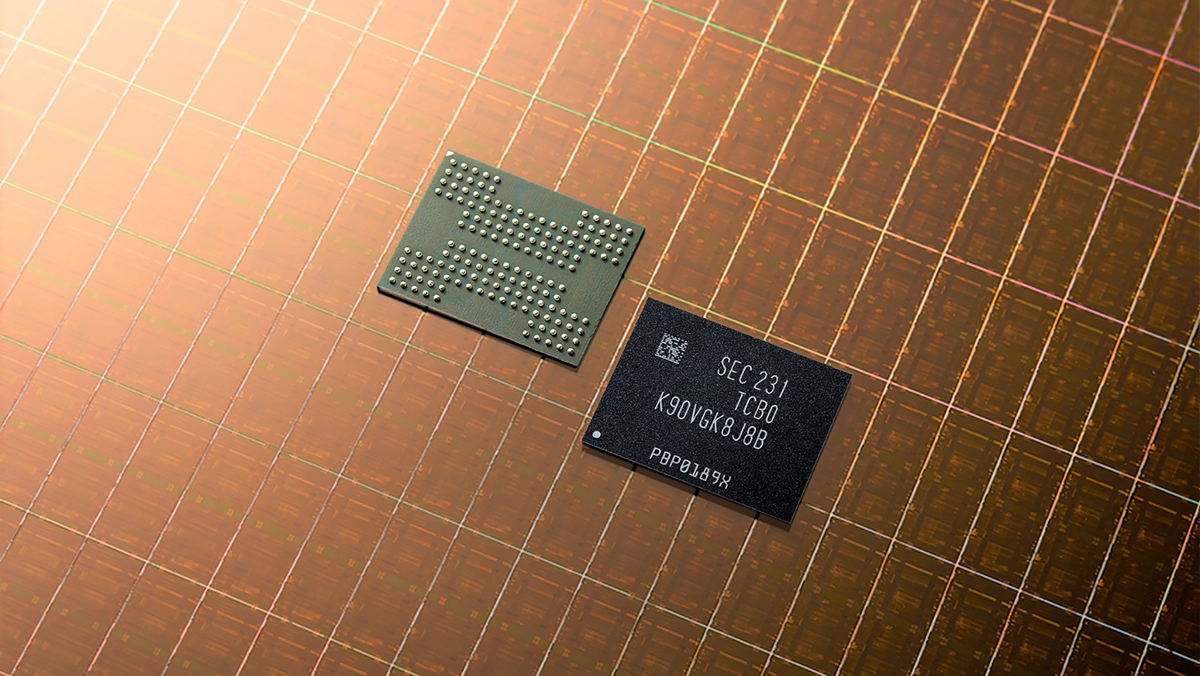

Samsung lowered its NAND wafer production target to 4.72 million units, a 7% drop from last year. Kioxia reduced its target from 4.8 million to 4.69 million wafers, while SK hynix cut production by 10%, from 2.01 million to 1.8 million wafers. Micron maintained its Singapore output at just over 300,000 wafers. The transition to 4-bit-per-cell technology to meet AI demands has further reduced NAND production.

Tensions escalated when Samsung stopped offering contract prices for DDR5 DRAM in October, causing spot prices to jump 25% in a week. A week earlier, SanDisk raised NAND flash contract prices by 50%, prompting giants like Micron to follow suit. North American tech firms, fearing further increases, began panic-buying, and many suppliers have filled orders for the entire next year.

For smartphone manufacturers, this is particularly dire, as memory chips are the second most expensive component after processors. Depending on the model and configuration, memory chips account for 10-30% of total costs, exceeding 20% in high-end models like those with 12GB RAM and 512GB storage. Due to the third-quarter price surge, mid-range and premium smartphones saw price hikes of 100-500 yuan, with the gap between OPPO Find X9 configurations reaching 900 yuan.

The situation worsened when Samsung decided to raise memory chip prices.

Smartphone Manufacturers at a Standstill

The price surge has left the entire industry in strategic limbo. A local brand representative noted that companies are closely monitoring competitors’ 2024 strategies, undecided on whether to reduce specs or raise prices. Many projects have been paused due to soaring costs.

Zhao Haijun, co-CEO of SMIC, confirmed the impact during the Q3 earnings call on November 13. He stated that due to memory chip shortages and price hikes, sectors like smartphones and networking equipment are more cautious with orders. SMIC had to delay some smartphone product deliveries in Q3 to handle urgent memory and analog chip orders.

According to supply chain sources, chip manufacturers typically maintain 6-8 weeks of inventory and adjust contract prices quarterly. With major companies’ stocks depleted, there’s no room for price concessions. Currently, chipmakers are prioritizing smartphone allocations to maintain relationships, while smartphone brands are waiting for someone to set a reference price for negotiations.

However, sources emphasize that only Apple has the clout to lead price negotiations. With its massive order volume and dominance in premium smartphones, the Cupertino giant is the sole entity capable of pressuring chipmakers into offering reasonable prices. Other brands, especially Chinese ones, lack the leverage to compete in this pricing battle.

The outlook remains bleak. Even if manufacturers expand capacity now, it would take one to two years to meet current demand. Insiders warn that today’s AI-driven demand may be partly speculative, with its true scale becoming clear next year. Samsung and SK hynix are unlikely to blindly expand capacity, instead favoring production cuts to maintain high profits. Consequently, memory chip prices are expected to surge again in the first half of next year, further exacerbating smartphone manufacturers’ plight.

The FPT Leader: The Rising Yen Has Minimal Impact on the Corporation, Plans to Establish an AI Factory in Japan

FPT is gearing up to expand its GPU-as-a-Service (GPUaaS) business to Japan, with ambitious revenue targets of $100 million by 2027 and a remarkable pre-tax profit margin of over 20% for this segment.