CTX Holdings (Stock Code: CTX), a leading Vietnamese investment, construction, and trading conglomerate, has recently announced an addendum to the agenda of its 2025 Extraordinary Shareholders’ Meeting.

The company’s Board of Directors is proposing to transition CTX Holdings from a public company to a non-public entity, in compliance with current Vietnamese securities regulations.

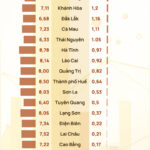

Following this announcement, CTX shares plummeted to their floor price of VND 12,600 per share on November 21st. This marks a nearly 40% decline from its peak of VND 20,800 per share just three months prior.

Established in 1982 under the Ministry of Construction, CTX Holdings underwent privatization in 2005 and listed on the HNX stock exchange in 2012. However, in late 2023, the company’s shares were delisted to the UPCoM market and placed under trading restrictions due to delayed financial reporting.

In Q3 2025, CTX Holdings reported a staggering 15,500% year-on-year surge in net revenue to VND 5,873 billion, primarily driven by real estate sales of VND 5,851 billion. Net profit after tax reached VND 216 billion, a remarkable 97-fold increase compared to the same period last year (VND 2.2 billion).

For the first nine months of 2025, the company’s net profit after tax stood at VND 216.6 billion, a significant improvement from VND 3.7 billion in the corresponding period of 2024.

This extraordinary performance is attributed to the successful transfer of the A1-2 Commercial and Residential Complex project to Viet Minh Hoang Real Estate Investment JSC (a subsidiary of Sun Group) in late July 2025. Now rebranded as Sun Feliza Suites, this transaction resulted in a 17-fold increase in CTX Holdings’ gross profit to VND 297 billion.

3D rendering of the Sun Feliza Suites luxury apartment complex. Image: Sun Group.

During this period, several major shareholders divested their stakes, including Ms. Nguyen Thi Kim Xuan, Vietnam Modern Commercial Joint Stock Bank, and Ms. Chu Thi Hong Hanh. Conversely, new investors emerged, such as FTM Investment JSC (14.53%), PENS Construction JSC (8.38%), and AMAI Investment LLC (14.95%).

All three new entities were established in the same year and share the same registered address as CTX Holdings: 2nd Floor, HH2 Building, Duong Dinh Nghe Street, Cau Giay District, Hanoi. These companies are affiliated with Mr. Phan Minh Tuan, Chairman of the Board, and Mr. Ly Quoc Hung, Board Member and Deputy General Director.

Additionally, entities related to Mr. Phan Minh Tuan maintain a combined 35.65% stake in the company. This includes Mr. Tuan’s personal holding of 1.46%, Thang Long Fundings JSC’s 19.16%, and Hoa Binh Fundings JSC’s 15%.

EVS Securities Board Member Resigns

EVS Securities announces the resignation of Mr. Nguyen Dinh Tuan from his position as a member of the Board of Directors.

FLC Shares Expected to Resume Trading in Q1 2026 Following Leadership Overhaul

The extraordinary 2025 Shareholders’ Meeting (2nd session) of FLC Group Joint Stock Company (UPCoM: FLC), held on the morning of November 11th, commenced with a remarkable shareholder attendance rate of 35.682%.

Cumulative Loss Exceeds 3 Trillion, Negative Equity: Former Steel Industry Leader Unveils Restructuring Plan

Pomina’s Q3 2025 financial report reveals a net revenue of VND 203 billion, marking a 58% decline compared to the same period last year. The company incurred an after-tax loss of nearly VND 183 billion, an improvement from the VND 286 billion loss recorded in the corresponding quarter of the previous year. This marks Pomina’s 14th consecutive quarter of losses.