The upcoming bond offering comprises nearly 5 million units, priced at 100,000 VND per unit. Existing shareholders are entitled to purchase bonds at a ratio of 35,671:1,000, with transferability limited to one transaction. Once acquired, the bonds can be freely traded.

CEO Lê Viết Liên, holding 3.68% of the company’s capital, is eligible to purchase approximately 184,000 bonds, equivalent to 18.4 billion VND. Chairman Đoàn Hữu Thuận, with a 9.85% stake, plans to acquire over 492,000 bonds, requiring around 49.2 billion VND. The offering period runs from November 24 to December 10.

Chairman Thuận’s family also holds significant shares in HDC. His wife owns 3.37%, son Đoàn Hữu Hà Vinh, Deputy CEO of HDC, holds 2.18%, and son Đoàn Hữu Hà An owns 1.02%. Other relatives hold hundreds of thousands to millions of shares. Collectively, the Chairman’s affiliated group controls approximately 18% of the company’s capital.

From left: Đoàn Hữu Hà Vinh, Đoàn Hữu Thuận, and Lê Viết Liên – Image: Hodeco

|

The convertible bond issuance was approved during the 2025 annual general meeting. HDC aims to raise approximately 500 billion VND. The bonds offer a fixed interest rate of 10% per annum for two years, with semi-annual interest payments. Mandatory conversion into shares occurs in two phases: 40% after one year and the remainder at maturity. The primary objective is to restructure bank debt by year-end.

Recently, HDC has actively raised capital. In Q3, the company issued two private bond tranches totaling 500 billion VND, with interest rates of 10.5-11% per annum and a three-year term. These funds were allocated to repay 200 billion VND in bank debt and acquire the Phước Thắng urban area project in Vũng Tàu (300 billion VND).

Prior to the convertible bond offering, HDC completed a 12% bonus share issuance. Approximately 21.4 million new shares were distributed, increasing the charter capital to nearly 2,000 billion VND, with over 214 billion VND retained for reinvestment.

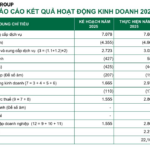

Additionally, HDC’s cash flow improved significantly following the divestment from CTCP Đầu tư Xây dựng Giải trí Đại Dương Vũng Tàu, developer of the 19.6-hectare Antares tourism project (valued at 8.5 trillion VND). In Q3 alone, the company recorded 696 billion VND in divestment profits, resulting in a net profit of over 537 billion VND. Investment cash inflows for the period increased by approximately 740 billion VND.

As of September-end, HDC held 757 billion VND in long-term debt and 868 billion VND in short-term debt, with total assets of around 5.4 trillion VND. Inventory exceeded 1.4 trillion VND, primarily attributed to The Light City complex project (943 billion VND). Long-term work-in-progress costs totaled over 1.6 trillion VND, concentrated in the Long Điền residential project (793 billion VND) and the Cỏ Mây urban area in Phước Thắng (646 billion VND).

| HDC’s Q3/2025 investment cash inflows from associates surged |

After divesting from Đại Dương Vũng Tàu, HDC records a record Q3 profit of nearly 550 billion VND

HDC fully divests from Đại Dương Vũng Tàu: Who is the new owner?

– 10:04 20/11/2025

VietinBank Offers 19.6 Million Saigon Port Shares for Sale at Starting Price of VND 29,208 Each

This marks one of the largest divestment initiatives by Vietnam’s commercial banking system in Q4/2025, addressing legacy assets from non-performing loans as directed by the Government and the State Bank of Vietnam.

Novaland Group Delays Debt Payments

Introducing the NVLH2123011 bond issuance, launched on September 1, 2021, with a total issuance value of 1,000 billion VND and a 2-year maturity. As of now, Novaland remains obligated to repay approximately 816 billion VND in principal and nearly 72 billion VND in interest for this bond tranche.